Whilst it may not be a huge deal, we thought it was good to see that the Powerhouse Ventures Limited (ASX:PVL) Non- Executive Director, Doron Eldar, recently bought AU$74k worth of stock, for AU$0.055 per share. Nevertheless, it only increased their shareholding by a minuscule percentage, and it wasn't a massive purchase by absolute value, either.

See our latest analysis for Powerhouse Ventures

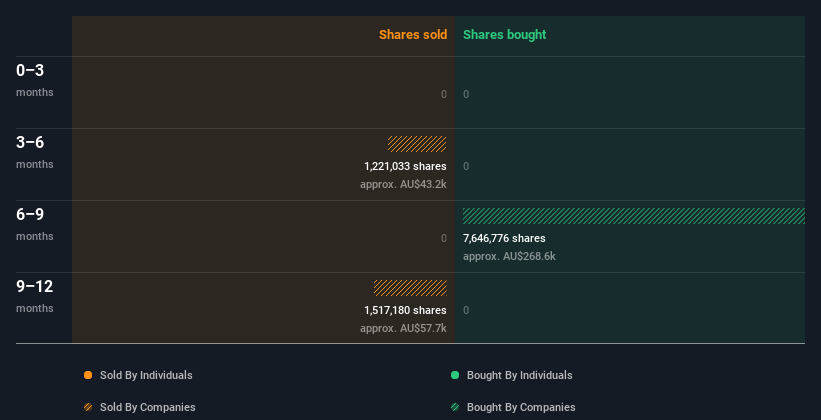

The Last 12 Months Of Insider Transactions At Powerhouse Ventures

Notably, that recent purchase by Doron Eldar is the biggest insider purchase of Powerhouse Ventures shares that we've seen in the last year. Although we like to see insider buying, we note that this large purchase was at significantly below the recent price of AU$0.083. Because it occurred at a lower valuation, it doesn't tell us much about whether insiders might find today's price attractive.

Powerhouse Ventures insiders may have bought shares in the last year, but they didn't sell any. The chart below shows insider transactions (by companies and individuals) over the last year. By clicking on the graph below, you can see the precise details of each insider transaction!

There are always plenty of stocks that insiders are buying. If investing in lesser known companies is your style, you could take a look at this free list of companies. (Hint: insiders have been buying them).

Insider Ownership Of Powerhouse Ventures

I like to look at how many shares insiders own in a company, to help inform my view of how aligned they are with insiders. A high insider ownership often makes company leadership more mindful of shareholder interests. Insiders own 23% of Powerhouse Ventures shares, worth about AU$2.4m. While this is a strong but not outstanding level of insider ownership, it's enough to indicate some alignment between management and smaller shareholders.

So What Does This Data Suggest About Powerhouse Ventures Insiders?

The recent insider purchases are heartening. We also take confidence from the longer term picture of insider transactions. Given that insiders also own a fair bit of Powerhouse Ventures we think they are probably pretty confident of a bright future. While it's good to be aware of what's going on with the insider's ownership and transactions, we make sure to also consider what risks are facing a stock before making any investment decision. Case in point: We've spotted 5 warning signs for Powerhouse Ventures you should be aware of, and 3 of these are potentially serious.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of interesting companies, that have HIGH return on equity and low debt.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions of direct interests only, but not derivative transactions or indirect interests.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:PVL

Powerhouse Ventures

A venture capital firm specializing in seed/startup, early venture, incubation in growth capital companies.

Flawless balance sheet low.

Market Insights

Community Narratives