The Australian market has been navigating uncertainty, with tariff concerns impacting performance and the ASX closing down 0.7%. Despite this, certain sectors like Utilities have shown resilience, highlighting the potential for strategic investment opportunities. Penny stocks, though an older term, continue to offer intriguing possibilities by representing smaller or newer companies that may provide growth at lower price points. By focusing on those with strong financials and solid fundamentals, investors can uncover hidden value in quality companies.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| GTN (ASX:GTN) | A$0.55 | A$108.01M | ★★★★★★ |

| Regal Partners (ASX:RPL) | A$3.10 | A$1.04B | ★★★★★★ |

| EZZ Life Science Holdings (ASX:EZZ) | A$1.715 | A$80.9M | ★★★★★★ |

| IVE Group (ASX:IGL) | A$2.33 | A$360.89M | ★★★★★☆ |

| Bisalloy Steel Group (ASX:BIS) | A$3.16 | A$151.38M | ★★★★★★ |

| SHAPE Australia (ASX:SHA) | A$2.93 | A$242.43M | ★★★★★★ |

| GR Engineering Services (ASX:GNG) | A$2.81 | A$469.8M | ★★★★★★ |

| MotorCycle Holdings (ASX:MTO) | A$1.99 | A$146.87M | ★★★★★★ |

| CTI Logistics (ASX:CLX) | A$1.755 | A$136.91M | ★★★★☆☆ |

| Accent Group (ASX:AX1) | A$1.895 | A$1.07B | ★★★★☆☆ |

Click here to see the full list of 1,011 stocks from our ASX Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Helios Energy (ASX:HE8)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Helios Energy Limited is an onshore oil and gas exploration company operating in the United States, with a market cap of A$44.27 million.

Operations: The company generates revenue from its oil and gas exploration activities, amounting to A$0.14 million.

Market Cap: A$44.27M

Helios Energy Limited, with a market cap of A$44.27 million, is a pre-revenue company focused on oil and gas exploration in the U.S., generating minimal revenue of A$0.14 million. Recent strategic moves include the appointment of Mr. Edward J May as CFO and Mr. John Cathcart as Non-Executive Director, both bringing extensive industry experience which could strengthen financial oversight and strategic direction. Despite having more cash than total debt, Helios faces challenges with short-term liabilities exceeding assets and a volatile share price, but recent capital raised through convertible notes may provide some financial flexibility for future operations.

- Navigate through the intricacies of Helios Energy with our comprehensive balance sheet health report here.

- Explore historical data to track Helios Energy's performance over time in our past results report.

K&S (ASX:KSC)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: K&S Corporation Limited operates in transportation and logistics, warehousing, and fuel distribution across Australia and New Zealand with a market cap of A$504.97 million.

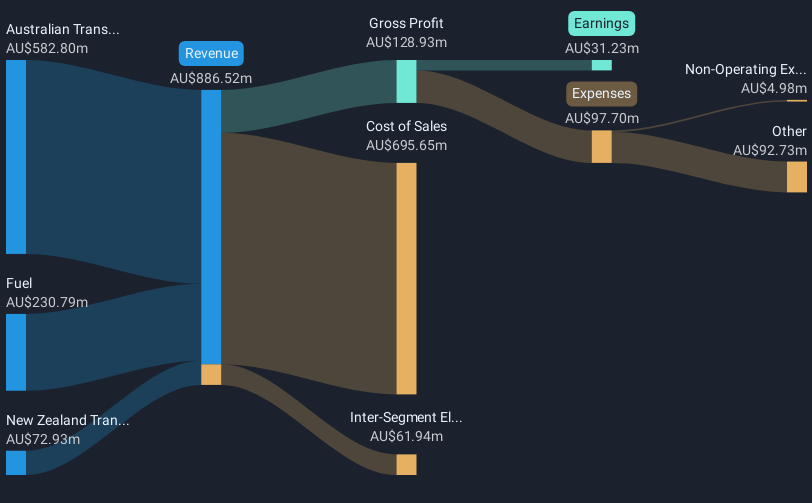

Operations: The company's revenue is primarily derived from Australian Transport at A$553.12 million, Fuel at A$213.29 million, and New Zealand Transport at A$74.99 million.

Market Cap: A$504.97M

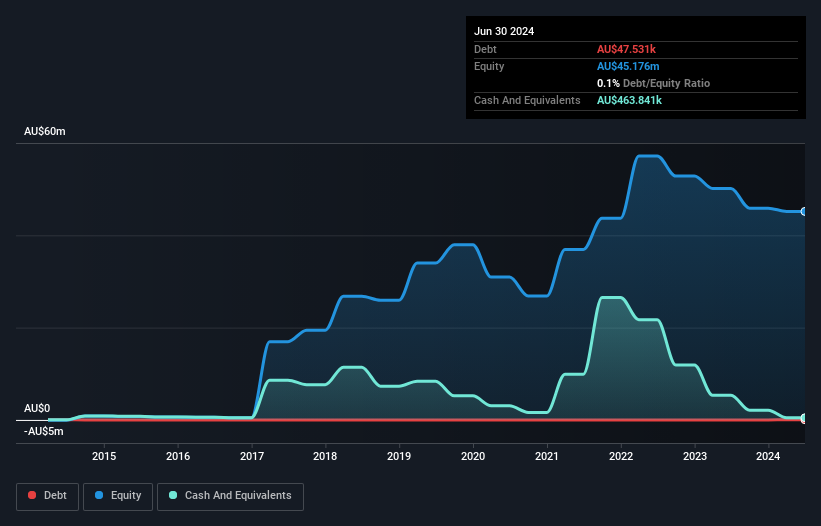

K&S Corporation Limited, with a market cap of A$504.97 million, shows mixed performance indicators typical of penny stocks. While its earnings have grown 25.5% annually over the past five years, recent results indicate a decline in sales and revenue compared to the previous year. The company's debt is well covered by operating cash flow, yet short-term assets do not cover long-term liabilities. Despite stable weekly volatility and no significant shareholder dilution recently, K&S's dividend yield is not fully supported by free cash flows, reflecting cautious optimism for potential investors in its logistics operations across Australia and New Zealand.

- Unlock comprehensive insights into our analysis of K&S stock in this financial health report.

- Review our historical performance report to gain insights into K&S' track record.

Pengana Capital Group (ASX:PCG)

Simply Wall St Financial Health Rating: ★★★★★★

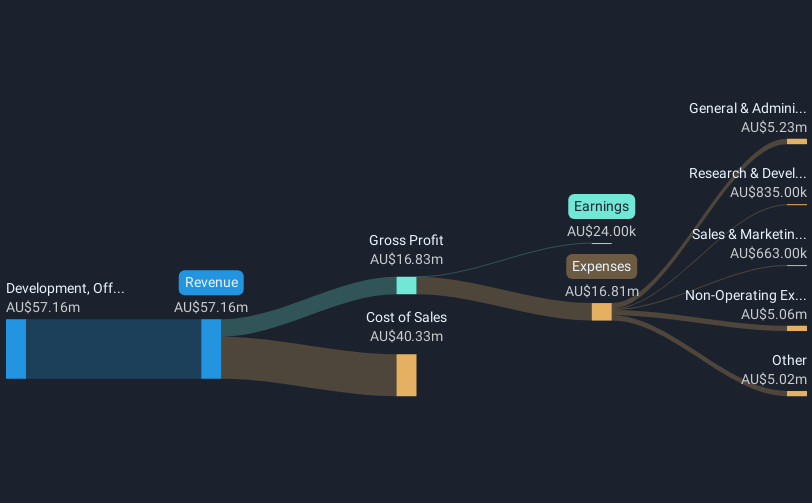

Overview: Pengana Capital Group (ASX:PCG) is a publicly owned investment manager with a market capitalization of A$76.79 million.

Operations: Pengana Capital Group does not report any specific revenue segments.

Market Cap: A$76.79M

Pengana Capital Group, with a market cap of A$76.79 million, has recently turned profitable, reporting half-year revenues of A$34.91 million and net income of A$3.5 million. The company has no debt, enhancing its financial stability and eliminating concerns over interest payments. Pengana's short-term assets significantly exceed both its short-term and long-term liabilities, indicating sound liquidity management. However, the return on equity remains low at 0.03%. The company announced a share buyback program to repurchase up to 10% of its shares by November 2025 and declared an ordinary dividend per share for the recent period ending December 2024.

- Dive into the specifics of Pengana Capital Group here with our thorough balance sheet health report.

- Assess Pengana Capital Group's future earnings estimates with our detailed growth reports.

Where To Now?

- Click through to start exploring the rest of the 1,008 ASX Penny Stocks now.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if K&S might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:KSC

K&S

Engages in the transportation and logistics, warehousing and fuel distribution businesses in Australia and New Zealand.

Adequate balance sheet with acceptable track record.