As the Australian market hovers around 8,600 points on the XJO, with materials leading the charge thanks to strong performances in metals like copper and gold, investors are keenly observing how economic factors such as bond yields and interest rates might influence future movements. In this environment of cautious optimism, dividend stocks stand out as a reliable choice for those seeking steady income streams amidst market fluctuations.

Top 10 Dividend Stocks In Australia

| Name | Dividend Yield | Dividend Rating |

| Treasury Wine Estates (ASX:TWE) | 7.08% | ★★★★★☆ |

| Super Retail Group (ASX:SUL) | 5.88% | ★★★★★☆ |

| Sugar Terminals (NSX:SUG) | 7.86% | ★★★★★☆ |

| Steadfast Group (ASX:SDF) | 3.90% | ★★★★★☆ |

| MFF Capital Investments (ASX:MFF) | 3.74% | ★★★★★☆ |

| Lindsay Australia (ASX:LAU) | 5.71% | ★★★★★☆ |

| Kina Securities (ASX:KSL) | 7.42% | ★★★★★☆ |

| Fiducian Group (ASX:FID) | 4.28% | ★★★★★☆ |

| EQT Holdings (ASX:EQT) | 4.48% | ★★★★★☆ |

| Accent Group (ASX:AX1) | 7.25% | ★★★★★☆ |

Click here to see the full list of 32 stocks from our Top ASX Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Korvest (ASX:KOV)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Korvest Ltd is an Australian company that manufactures and supplies cable and pipe support systems, fastening solutions, and galvanising services, with a market cap of A$166.01 million.

Operations: Korvest Ltd's revenue is derived from its Production segment, generating A$10.58 million, and its Industrial Products segment, contributing A$108.99 million.

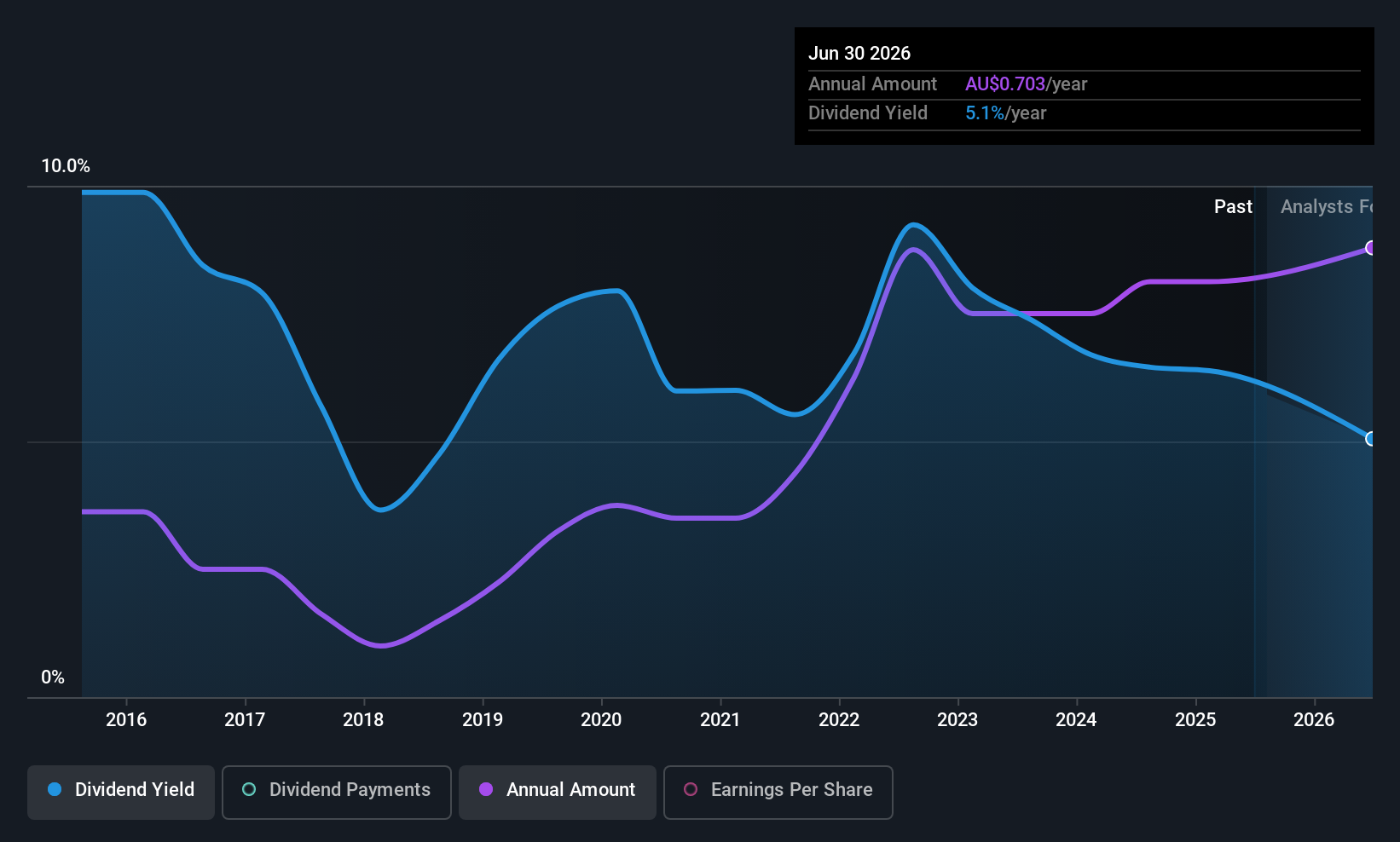

Dividend Yield: 4.6%

Korvest's dividends are covered by both earnings and cash flows, with payout ratios of 58% and 51.3%, respectively, indicating sustainability. However, the dividend yield of 4.63% is lower than the top quartile in Australia. Despite a volatile dividend history over the past decade, recent increases offer some optimism. The company's price-to-earnings ratio of 12.6x suggests good value compared to the broader market average of 21.5x, though future earnings are expected to decline by an average of 5.5% annually over three years.

- Dive into the specifics of Korvest here with our thorough dividend report.

- Upon reviewing our latest valuation report, Korvest's share price might be too optimistic.

Macquarie Group (ASX:MQG)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Macquarie Group Limited is a diversified financial services company operating across Australia, New Zealand, the Americas, Europe, the Middle East, Africa and Asia with a market cap of A$72.03 billion.

Operations: Macquarie Group Limited generates revenue through its key segments, including Macquarie Capital (A$2.99 billion), Macquarie Asset Management (A$4.56 billion), Banking and Financial Services (A$3.41 billion), Commodities and Global Markets (A$6.01 billion), and Corporate (A$715 million).

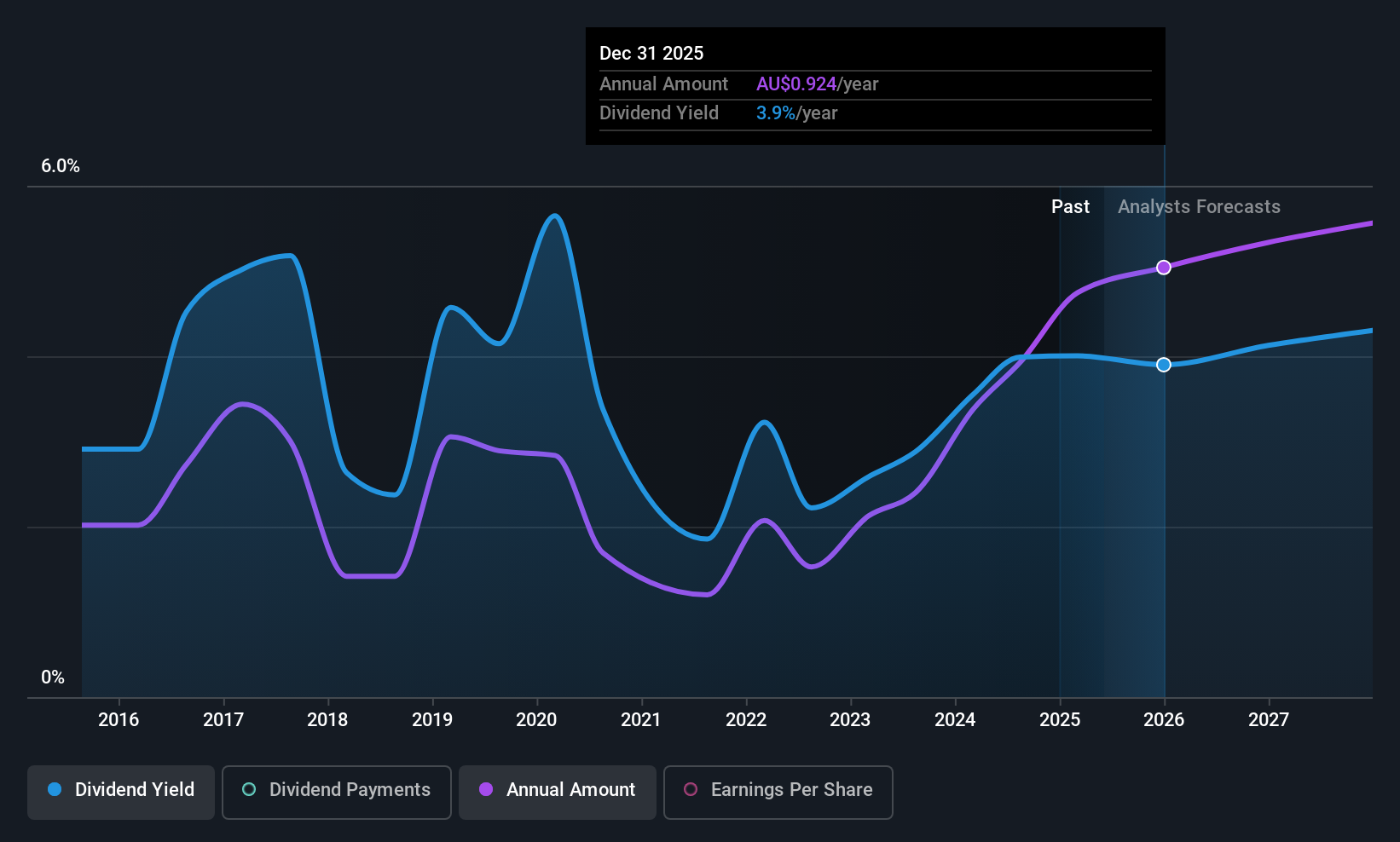

Dividend Yield: 3.3%

Macquarie Group's dividend yield of 3.3% is below the top quartile in Australia, and its dividends have been volatile over the past decade. Despite this, recent increases suggest some improvement. The payout ratio of 67.6% indicates dividends are covered by earnings, with forecasts showing continued coverage at 65.5%. Macquarie's price-to-earnings ratio of 19.8x offers relative value compared to the market average, while recent executive changes and strategic divestments may impact future performance.

- Take a closer look at Macquarie Group's potential here in our dividend report.

- Our expertly prepared valuation report Macquarie Group implies its share price may be lower than expected.

QBE Insurance Group (ASX:QBE)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: QBE Insurance Group Limited underwrites general insurance and reinsurance risks across the Australia Pacific, North America, and international markets, with a market cap of A$28.60 billion.

Operations: QBE Insurance Group Limited generates revenue from its operations in international markets ($10.08 billion), North America ($7.76 billion), and Australia Pacific ($5.83 billion).

Dividend Yield: 4.1%

QBE Insurance Group's dividend yield of 4.14% lags behind the top quartile in Australia, and its dividend history has been unstable over the past decade. However, dividends are well covered by both earnings and cash flows, with payout ratios at 44.9% and 26.3%, respectively. Recent executive changes, including a new CFO starting January 2026, may influence strategic direction. The company also completed a A$300 million fixed-income offering to bolster capital management strategies amidst anticipated earnings decline.

- Click here to discover the nuances of QBE Insurance Group with our detailed analytical dividend report.

- Our valuation report unveils the possibility QBE Insurance Group's shares may be trading at a discount.

Summing It All Up

- Get an in-depth perspective on all 32 Top ASX Dividend Stocks by using our screener here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Korvest might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:KOV

Korvest

Manufactures and supplies cable and pipe support systems, fastening solutions, and galvanising services in Australia.

Outstanding track record with flawless balance sheet and pays a dividend.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

TXT will see revenue grow 26% with a profit margin boost of almost 40%

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026