- Australia

- /

- Capital Markets

- /

- ASX:MFG

Magellan Financial Group (ASX:MFG): Is the Recent AUM Growth Fully Reflected in Today’s Valuation?

Reviewed by Kshitija Bhandaru

Magellan Financial Group (ASX:MFG) recently reported higher assets under management at the end of September, supported by strong net flows and growth in its institutional segment, particularly Airlie Australian Equities.

See our latest analysis for Magellan Financial Group.

Magellan Financial Group’s recent boost in assets under management and its active buy-back campaign have sparked renewed market optimism, nudging the share price up over the last quarter. Still, the company’s share price is yet to recover its prior highs, with a 7.22% gain over the past 90 days overshadowed by weak year-to-date performance. Total shareholder return paints a mixed picture, positive at 7.35% over the past year and 22.14% over three years, but still down substantially over five years as the business works to regain long-term momentum.

If Magellan's recent uptick has you watching the market for fresh opportunities, you might want to broaden your search and discover fast growing stocks with high insider ownership

With shares climbing on the back of improving fund flows and robust buy-backs, investors now face a crucial question: is Magellan Financial Group undervalued at current levels, or has recent growth already been factored into the price?

Most Popular Narrative: 3.7% Overvalued

The widely followed narrative suggests that Magellan Financial Group’s fair value sits slightly below the last close, hinting at a price that could be running a bit ahead of its current fundamentals. This context directs our attention to the assumptions underpinning the narrative, which are worth a closer look.

Strategic partnerships, particularly with Vinva Investment Management, are expected to play a significant role in driving MFG’s next phase of growth. These partnerships may increase revenue and expand the firm’s AUM through new fund offerings. Successful geographic expansion into North America, the U.K., and EMEA regions could enhance global client reach and diversify the client base, potentially supporting revenue growth.

Curious what future milestones and ambitious targets are included in this estimate? The real story lies in major growth plans, decisive margin strategies, and analysts’ expectations regarding the company’s evolution. The trajectory may surprise you. Find out what powers this price target and see if you agree with the underlying assumptions.

Result: Fair Value of $10.03 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing fee pressure and continued fund outflows could erode margins and threaten Magellan’s recovery if these trends persist.

Find out about the key risks to this Magellan Financial Group narrative.

Another View: Multiples Signal a Different Story

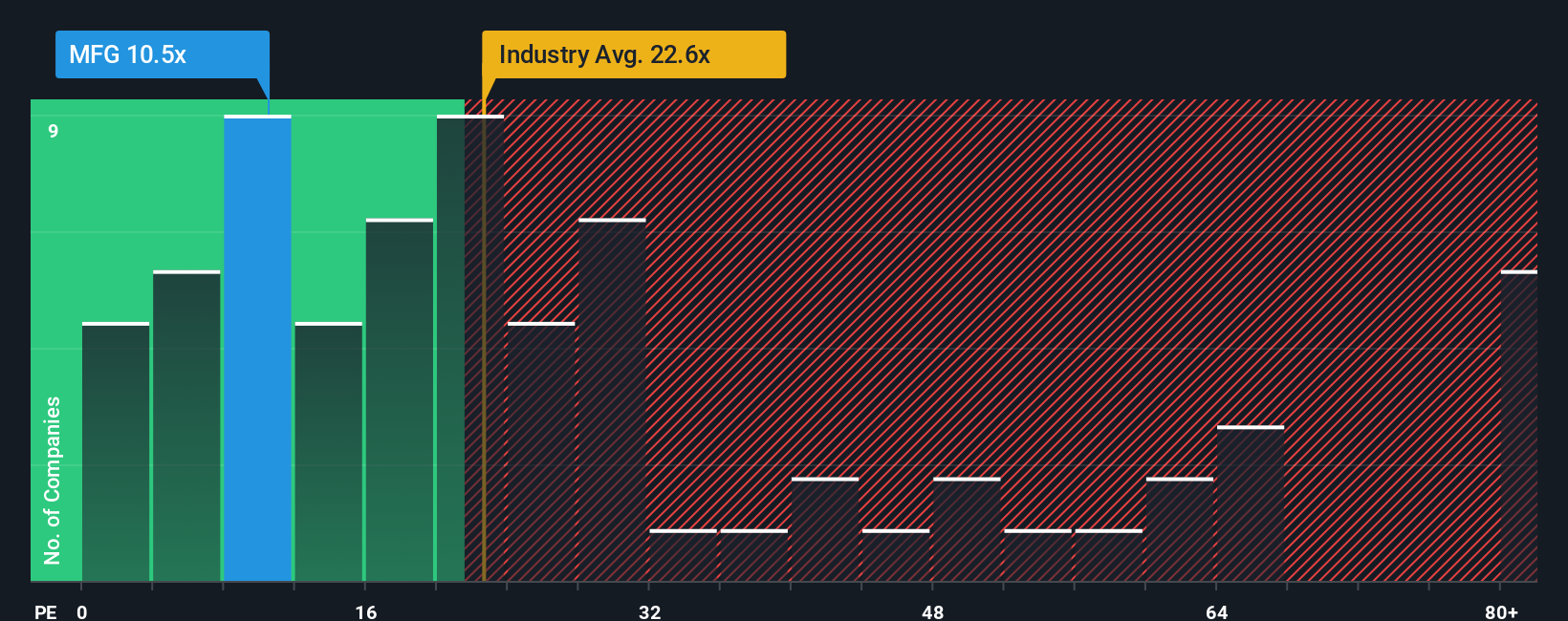

While analysts see Magellan Financial Group as slightly overvalued based on future earnings, our market comparisons show its shares trade at just 10.8 times earnings, a deep discount to both industry peers (22.6x) and the fair ratio (15.5x). This gap suggests the market may be underestimating Magellan's turnaround potential. Does this multiple present an overlooked opportunity, or is the low price a warning sign?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Magellan Financial Group Narrative

If you see the numbers differently or want to chart your own course, you can build a custom Magellan story in just a few minutes. So why not Do it your way?

A great starting point for your Magellan Financial Group research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let opportunity slip away. Take the next step and uncover top investment themes shaping the market with tailored ideas powered by our screeners.

- Tap into steady income potential by checking out these 19 dividend stocks with yields > 3%, which offers robust yields above 3% and has a proven payout history.

- Accelerate your portfolio with these 24 AI penny stocks, gaining momentum and leading artificial intelligence innovations across industries worldwide.

- Make the most of mispriced value by tracking these 898 undervalued stocks based on cash flows, which is primed for a turnaround based on discounted cash flow fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:MFG

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives