- Australia

- /

- Capital Markets

- /

- ASX:MFF

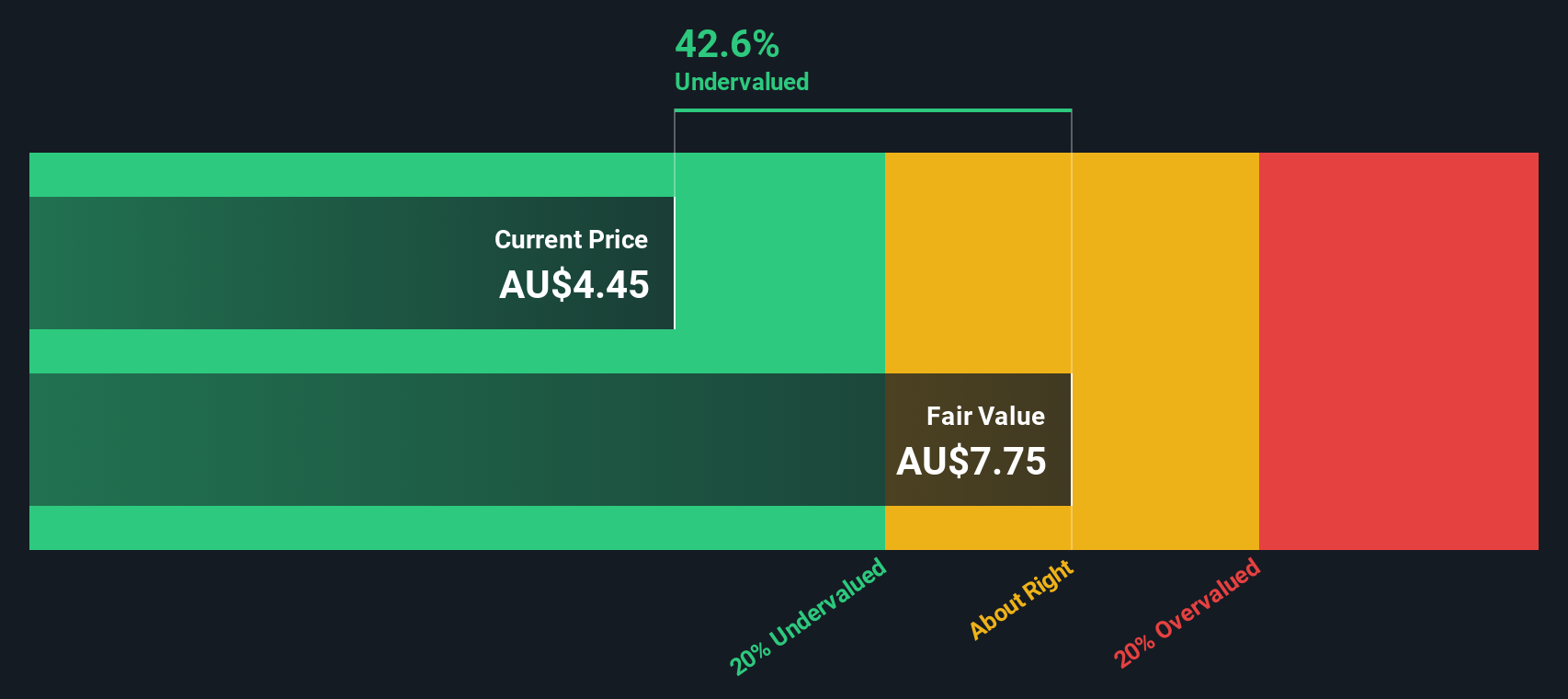

MFF Capital Investments (ASX:MFF): Assessing Valuation After Latest NTA and Dividend Update

Reviewed by Kshitija Bhandaru

MFF Capital Investments (ASX:MFF) just shared its latest Net Tangible Asset figures and confirmed an upcoming dividend payment. This regular update provides a snapshot of the company’s financial position and outlines how it manages shareholder returns.

See our latest analysis for MFF Capital Investments.

MFF Capital Investments’ recent updates have caught investor attention, but momentum has cooled a little after a solid 90-day share price return of 7.01%. While short-term price moves have been muted, the stock’s one-year total return sits at an impressive 27.24%, with triple-digit gains over three and five years for those who stayed the course. Confidence in its capital management is helping shape sentiment, even as markets digest the new dividend details.

If you’re weighing your next move in this market, it could be the perfect time to broaden your search and discover fast growing stocks with high insider ownership

With returns staying strong but new updates now factored into the share price, investors have to ask if there is hidden value left in MFF Capital Investments, or if future growth is already reflected in the current valuation.

Price-to-Earnings of 6.4x: Is it justified?

At a last close price of A$4.73, MFF Capital Investments trades at a remarkably low price-to-earnings (P/E) ratio of just 6.4x, a substantial discount compared to both its industry peers and the broader market.

The price-to-earnings ratio measures how much investors are willing to pay today for each dollar of company earnings. For asset managers and investment companies, it acts as a barometer of profitability expectations and the perceived sustainability of those earnings. A low P/E suggests that the market may be underestimating profit quality or expecting weaker future growth.

For MFF Capital Investments, current pricing looks compelling. Not only does its P/E ratio stand well below the peer average of 23.2x, but it is also much lower than the Australian Capital Markets industry average of 22.6x. This may indicate that the market does not fully appreciate the company’s earnings profile or is discounting future prospects more heavily than warranted.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 6.4x (UNDERVALUED)

However, market sentiment could shift if earnings quality weakens or if capital returns disappoint. This could introduce fresh risks to the current undervaluation case.

Find out about the key risks to this MFF Capital Investments narrative.

Another View: Our DCF Model Paints a Different Picture

Looking at valuation through the lens of our SWS DCF model, MFF Capital Investments appears even more undervalued. The company’s current share price of A$4.73 sits dramatically below our estimate of fair value at A$14.3. This suggests much greater upside than its low price-to-earnings ratio implies. But does this large gap truly reflect a real bargain, or are there hidden risks that justify investor caution?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out MFF Capital Investments for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own MFF Capital Investments Narrative

If you see the numbers differently or want to dig deeper, you can build your own story around MFF Capital Investments in just a few minutes with Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding MFF Capital Investments.

Looking for More Smart Investment Ideas?

Make your next move count by checking out other opportunities that could give your portfolio an edge before the crowd catches on.

- Unlock potential market movers with these 3581 penny stocks with strong financials that combine strong financials and surprising growth stories, remaining off the radar of most investors.

- Strengthen your passive income strategy and track down reliable payouts through these 19 dividend stocks with yields > 3% yielding over 3%. This approach is ideal for building wealth over time.

- Stay ahead in tech innovation by targeting tomorrow’s disruptors with these 24 AI penny stocks, providing access to the latest businesses transforming industries with artificial intelligence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:MFF

Flawless balance sheet established dividend payer.

Market Insights

Community Narratives