The Australian market has experienced a downturn, with the ASX200 closing down 0.75% amid concerns over potential tariffs and delayed interest rate cuts. In such a climate, investors often seek opportunities in areas that may offer growth potential despite broader market challenges. Penny stocks, though an older term, continue to attract attention due to their affordability and potential for significant returns when backed by solid financials.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| Embark Early Education (ASX:EVO) | A$0.765 | A$144.95M | ★★★★☆☆ |

| Helloworld Travel (ASX:HLO) | A$1.93 | A$312.61M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.55 | A$341.08M | ★★★★★☆ |

| MaxiPARTS (ASX:MXI) | A$1.87 | A$103.44M | ★★★★★★ |

| LaserBond (ASX:LBL) | A$0.6075 | A$72.68M | ★★★★★★ |

| SHAPE Australia (ASX:SHA) | A$2.75 | A$229.66M | ★★★★★★ |

| Navigator Global Investments (ASX:NGI) | A$1.645 | A$815.98M | ★★★★★☆ |

| Perenti (ASX:PRN) | A$1.17 | A$1.09B | ★★★★★★ |

| West African Resources (ASX:WAF) | A$1.49 | A$1.75B | ★★★★★★ |

| EZZ Life Science Holdings (ASX:EZZ) | A$3.00 | A$135.49M | ★★★★★★ |

Click here to see the full list of 1,035 stocks from our ASX Penny Stocks screener.

Let's explore several standout options from the results in the screener.

Chilwa Minerals (ASX:CHW)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Chilwa Minerals Limited focuses on the exploration and development of heavy mineral sands projects in Africa, with a market capitalization of A$60.93 million.

Operations: Chilwa Minerals Limited has not reported any revenue segments.

Market Cap: A$60.93M

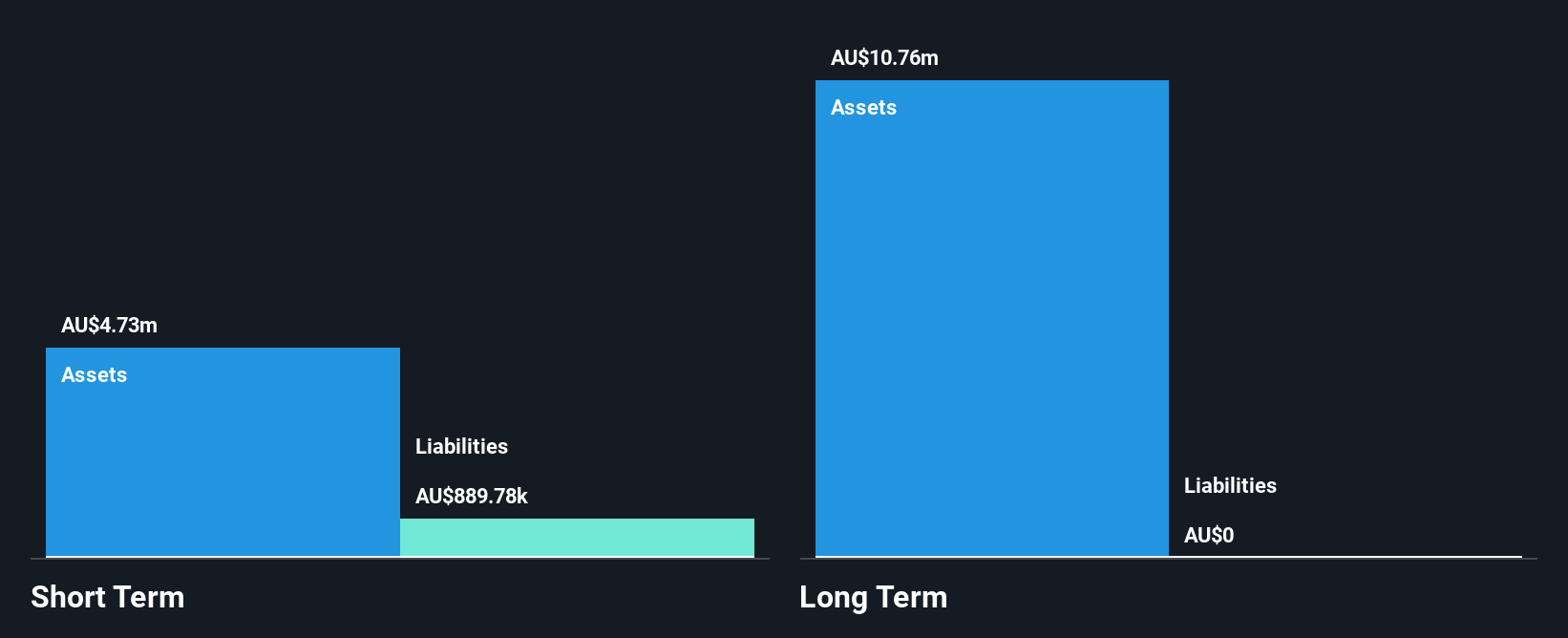

Chilwa Minerals Limited, with a market cap of A$60.93 million, is pre-revenue and focuses on heavy mineral sands projects in Africa. The company recently completed several follow-on equity offerings totaling approximately A$11.18 million at A$0.86 per share, which may bolster its cash position and extend its cash runway beyond the current forecast of over a year based on free cash flow estimates. Despite being unprofitable with a net loss of A$1.74 million for the year ended June 2024, Chilwa's short-term assets exceed liabilities, and it has no long-term liabilities or significant debt concerns.

- Jump into the full analysis health report here for a deeper understanding of Chilwa Minerals.

- Examine Chilwa Minerals' past performance report to understand how it has performed in prior years.

InvestSMART Group (ASX:INV)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: InvestSMART Group Limited offers financial services and products to retail investors in Australia, with a market cap of A$13.86 million.

Operations: The company's revenue is derived from its Retail Financial Services segment, amounting to A$9.96 million.

Market Cap: A$13.86M

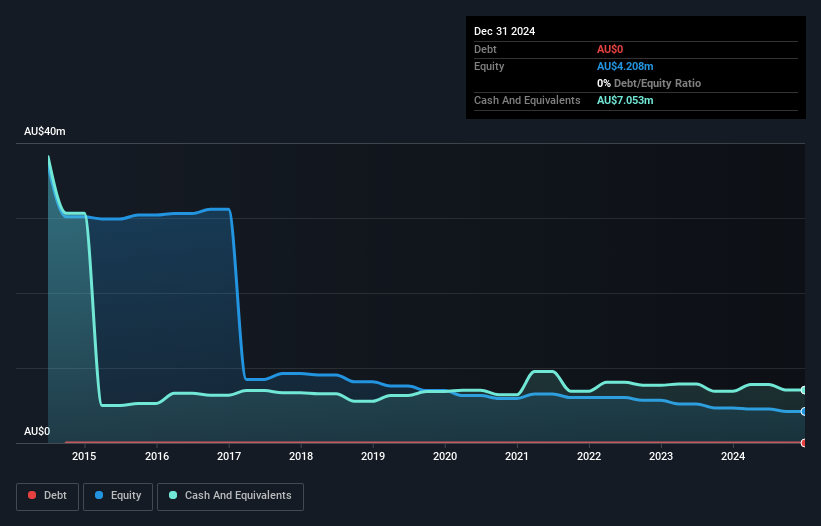

InvestSMART Group Limited, with a market cap of A$13.86 million, operates in the financial services sector and reported a revenue of A$10.1 million for the year ending June 2024. Despite being unprofitable, it has reduced losses over five years by 15.7% annually and maintains a positive free cash flow, ensuring over three years of cash runway without incurring debt. The seasoned management team and board further strengthen its position amidst ongoing challenges in profitability. Recent executive changes include Effie Zahos stepping down as Chief Content Officer to focus on her media role while rejoining the board as director.

- Get an in-depth perspective on InvestSMART Group's performance by reading our balance sheet health report here.

- Understand InvestSMART Group's track record by examining our performance history report.

Reckon (ASX:RKN)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Reckon Limited provides software solutions in Australia, the United States, and internationally with a market cap of A$62.88 million.

Operations: The company generates revenue from its Business Group, which contributes A$41.68 million, and its Practice Management Legal Group, which adds A$11.99 million.

Market Cap: A$62.88M

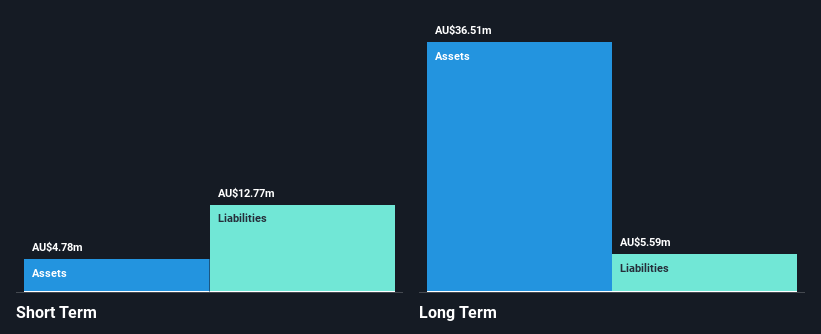

Reckon Limited, with a market cap of A$62.88 million, operates in the software sector and generates significant revenue from its Business and Practice Management Legal Groups. Despite having no debt, Reckon's short-term assets (A$4.8M) fall short of covering its liabilities (A$12.8M), posing liquidity challenges. The company trades at a favorable price-to-earnings ratio compared to the broader Australian market and benefits from a seasoned management team with an average tenure of over 13 years. However, recent negative earnings growth highlights ongoing profitability concerns despite forecasts suggesting future improvement.

- Take a closer look at Reckon's potential here in our financial health report.

- Evaluate Reckon's prospects by accessing our earnings growth report.

Turning Ideas Into Actions

- Discover the full array of 1,035 ASX Penny Stocks right here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:RKN

Reckon

Provides software solutions in Australia, the United States, and internationally.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives