- Australia

- /

- Capital Markets

- /

- ASX:IFL

How Insignia Financial’s Return to Profit and Fresh Margin Guidance (ASX:IFL) Has Changed Its Investment Story

Reviewed by Simply Wall St

- Insignia Financial recently announced full-year earnings for the period ended June 30, 2025, reporting sales of A$1,581.4 million and returning to a net profit of A$16.1 million after a very large loss in the prior year.

- The company also provided FY26 guidance, emphasizing expectations for group net revenue margin and highlighting anticipated margin impacts from Master Trust repricing efforts.

- We'll explore how Insignia Financial's shift back to profitability and new margin guidance impact the company's ongoing transformation and future outlook.

Outshine the giants: these 20 early-stage AI stocks could fund your retirement.

Insignia Financial Investment Narrative Recap

To be a shareholder in Insignia Financial, you need confidence in the company's transformation progress and its cost discipline driving sustainable profitability. The return to net profit and narrowed FY26 revenue margin guidance point to progress on these goals, but also signal that pressure from Master Trust repricing and execution risks remain material short-term factors; these issues remain the most important catalysts and risks for the business, respectively.

Among recent announcements, the 2026 earnings guidance is most relevant. By projecting a group net revenue margin of 40.5 to 41.5 basis points, management highlights its focus on navigating margin impacts as Master Trust repricing unfolds. This margin outlook is critical to watch, as it directly affects earnings momentum and market confidence.

Yet, it is important to remember that, despite returning to profitability, the complexity and timing of Master Trust transformation mean investors should be aware of...

Read the full narrative on Insignia Financial (it's free!)

Insignia Financial's narrative projects A$1.4 billion revenue and A$205.4 million earnings by 2028. This requires a 7.3% annual revenue decline and an earnings increase of A$357.6 million from A$-152.2 million today.

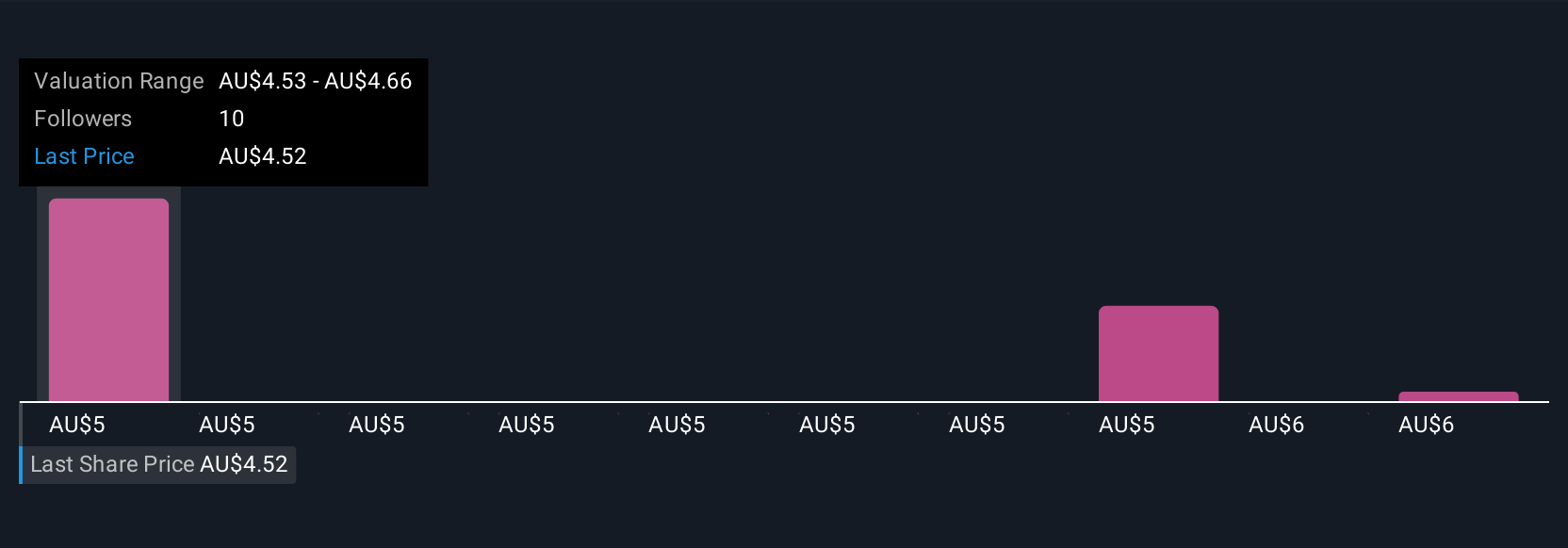

Uncover how Insignia Financial's forecasts yield a A$4.53 fair value, in line with its current price.

Exploring Other Perspectives

Fair value estimates from three Simply Wall St Community members range widely from A$4.53 to A$5.83 per share. With revenue margin headwinds from Master Trust repricing in play, take time to review these different viewpoints to see how other investors are weighing the upcoming challenges and opportunities.

Explore 3 other fair value estimates on Insignia Financial - why the stock might be worth as much as 30% more than the current price!

Build Your Own Insignia Financial Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Insignia Financial research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Insignia Financial research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Insignia Financial's overall financial health at a glance.

Interested In Other Possibilities?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 28 companies in the world exploring or producing it. Find the list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The end of cancer? These 27 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:IFL

Insignia Financial

Provides financial advice, superannuation, wrap platforms and asset management services to members, financial advisers and corporate employers in Australia.

Good value with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion