Last Update 14 Dec 25

IFL: Slightly Lower Discount Rate Will Support Stable Outlook And Fair Pricing

Analysts have nudged their price target on Insignia Financial slightly higher to reflect marginal improvements in discount rate assumptions and long term valuation multiples, while keeping underlying fair value estimates effectively unchanged at around A$4.79 per share.

Valuation Changes

- Fair Value: Unchanged at approximately A$4.79 per share, indicating no material revision to the core valuation.

- Discount Rate: Fallen slightly from 8.46 percent to about 8.45 percent, reflecting a marginally lower required return.

- Revenue Growth: Adjusted only fractionally, remaining effectively stable at around minus 3.53 percent.

- Net Profit Margin: Revised by an immaterial amount, holding steady at roughly 17.23 percent.

- Future P/E: Eased slightly from about 16.64 times to 16.64 times, indicating a minimal change in long term valuation multiples.

Key Takeaways

- Innovative retirement solutions, digital investment, and strategic partnerships enhance revenue growth, operational efficiency, and position Insignia to benefit from demographic trends.

- Platform integration, proprietary advice expansion, and industry regulation bolster cost efficiency, adviser engagement, and support long-term competitive strength and earnings.

- Persistent margin pressure, industry fee reductions, integration execution risks, demographic shifts, and adviser attrition collectively threaten revenue growth, profitability, and long-term strategic positioning.

Catalysts

About Insignia Financial- Provides financial advice, superannuation, wrap platforms and asset management services to members, financial advisers and corporate employers in Australia.

- The rollout of innovative retirement income solutions such as MLC Retirement Boost, alongside strategic partnerships with TAL and Challenger, positions Insignia to capture rising demand driven by Australia's ageing population and growing retiree wealth, supporting future inflows and revenue growth.

- Continued investment in digital platforms, advisor efficiency tools, and AI-driven automation (e.g., streamlined advice review processes, direct-to-consumer digital acquisition in Master Trust) enhances operational efficiency and customer engagement, likely improving net profit margins over time.

- Completion and optimisation of the MLC integration and ongoing Master Trust simplification (including migration to SS&C Bluedoor) unlock cost synergies and significantly reduce operating costs, which have already shown measurable impact and are expected to further improve the cost-to-income ratio and net margins through FY '30.

- Expansion of proprietary advice channels, success in reactivating adviser and client engagement on platforms such as Expand, and service-led initiatives are increasing adviser satisfaction, growing client numbers, and driving higher, more stable recurring revenue streams.

- Industry-wide and regulatory shifts emphasizing retirement outcomes and professional advice continue to channel funds into platforms managed by scale players like Insignia, reinforcing its competitive position and providing tailwinds for assets under management and long-term earnings growth.

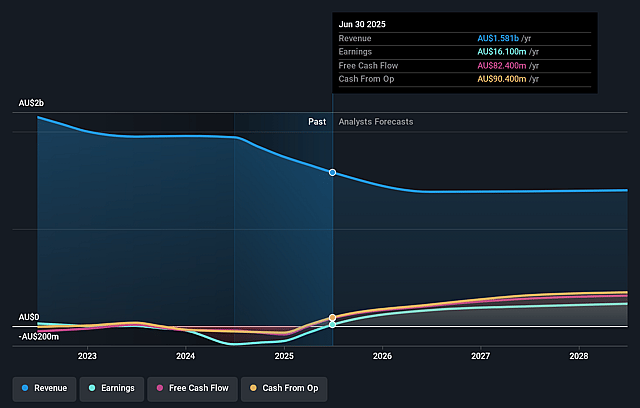

Insignia Financial Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Insignia Financial's revenue will decrease by 4.0% annually over the next 3 years.

- Analysts assume that profit margins will increase from 1.0% today to 16.6% in 3 years time.

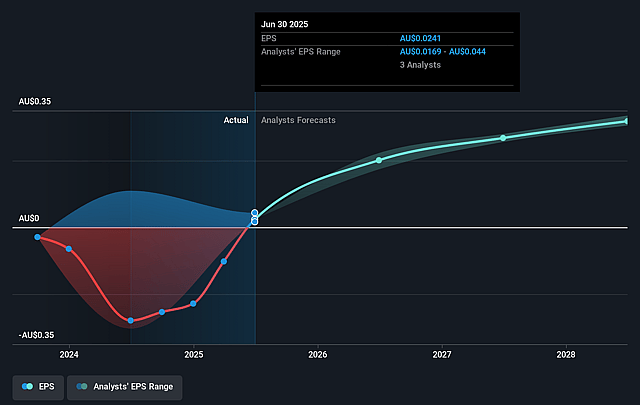

- Analysts expect earnings to reach A$231.6 million (and earnings per share of A$0.32) by about September 2028, up from A$16.1 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting A$287.4 million in earnings, and the most bearish expecting A$203.0 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 17.0x on those 2028 earnings, down from 187.0x today. This future PE is lower than the current PE for the AU Capital Markets industry at 21.6x.

- Analysts expect the number of shares outstanding to decline by 0.05% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.35%, as per the Simply Wall St company report.

Insignia Financial Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Ongoing margin contraction in Master Trust and Wrap segments, driven by recent and upcoming pricing reductions (e.g., MasterKey repricing, MLC Wrap migration), will reduce revenue and net margins, with management explicitly guiding for further negative impacts to earnings in FY26.

- Continued industry-wide fee compression due to regulatory pressure and consumer demand for lower investment management fees threatens overall revenue growth and profitability, especially as competition and margin give-up are cited as near-term headwinds for both platform and asset management businesses.

- Dependence on successful integration and transformation projects (e.g., Master Trust migration to SS&C, automation/AI investments) presents significant execution risk, with sustained high reinvestment OpEx and transition costs potentially offsetting anticipated operating cost declines and hindering net profit improvements if targets are missed or timelines slip.

- Demographic trend toward decumulation as Australia's population ages may materially slow organic growth in funds under management (FUM), thereby constraining long-term recurring revenue opportunities, a risk acknowledged amid Master Trust's historical net outflows and the need for new digital direct strategies to offset declining adviser-led volumes.

- The shrinking pool of financial advisers and the ongoing shift from traditional advice models to direct and digital acquisition threaten Insignia's distribution channels and effectiveness, potentially impeding FUM growth, client acquisition, and revenue if adviser efficiency and digital initiatives do not adequately compensate for industry-wide adviser attrition.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of A$4.65 for Insignia Financial based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be A$1.4 billion, earnings will come to A$231.6 million, and it would be trading on a PE ratio of 17.0x, assuming you use a discount rate of 8.3%.

- Given the current share price of A$4.51, the analyst price target of A$4.65 is 3.0% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Insignia Financial?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.