- Canada

- /

- Oil and Gas

- /

- TSX:HWX

Undervalued Small Caps With Insider Action In Global For July 2025

Reviewed by Simply Wall St

As global markets navigate a landscape marked by solid corporate earnings and inflationary pressures, small-cap stocks have shown resilience, with the Russell 2000 Index posting gains amidst mixed performances in other indices. In this environment, identifying promising small-cap opportunities often involves looking for companies that demonstrate strong fundamentals and potential for growth despite broader market challenges.

Top 10 Undervalued Small Caps With Insider Buying Globally

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Daiwa House Logistics Trust | 11.4x | 6.9x | 20.88% | ★★★★★☆ |

| Hemisphere Energy | 5.3x | 2.2x | 7.76% | ★★★★☆☆ |

| Nexus Industrial REIT | 6.7x | 3.0x | 14.67% | ★★★★☆☆ |

| Sagicor Financial | 10.2x | 0.4x | -171.54% | ★★★★☆☆ |

| CVS Group | 45.1x | 1.3x | 38.97% | ★★★★☆☆ |

| Seeing Machines | NA | 2.9x | 45.04% | ★★★★☆☆ |

| A.G. BARR | 19.5x | 1.8x | 46.10% | ★★★☆☆☆ |

| Saturn Oil & Gas | 2.8x | 0.5x | -127.54% | ★★★☆☆☆ |

| Morguard North American Residential Real Estate Investment Trust | 5.6x | 1.8x | 12.54% | ★★★☆☆☆ |

| DIRTT Environmental Solutions | 11.7x | 0.7x | 3.57% | ★★★☆☆☆ |

Let's explore several standout options from the results in the screener.

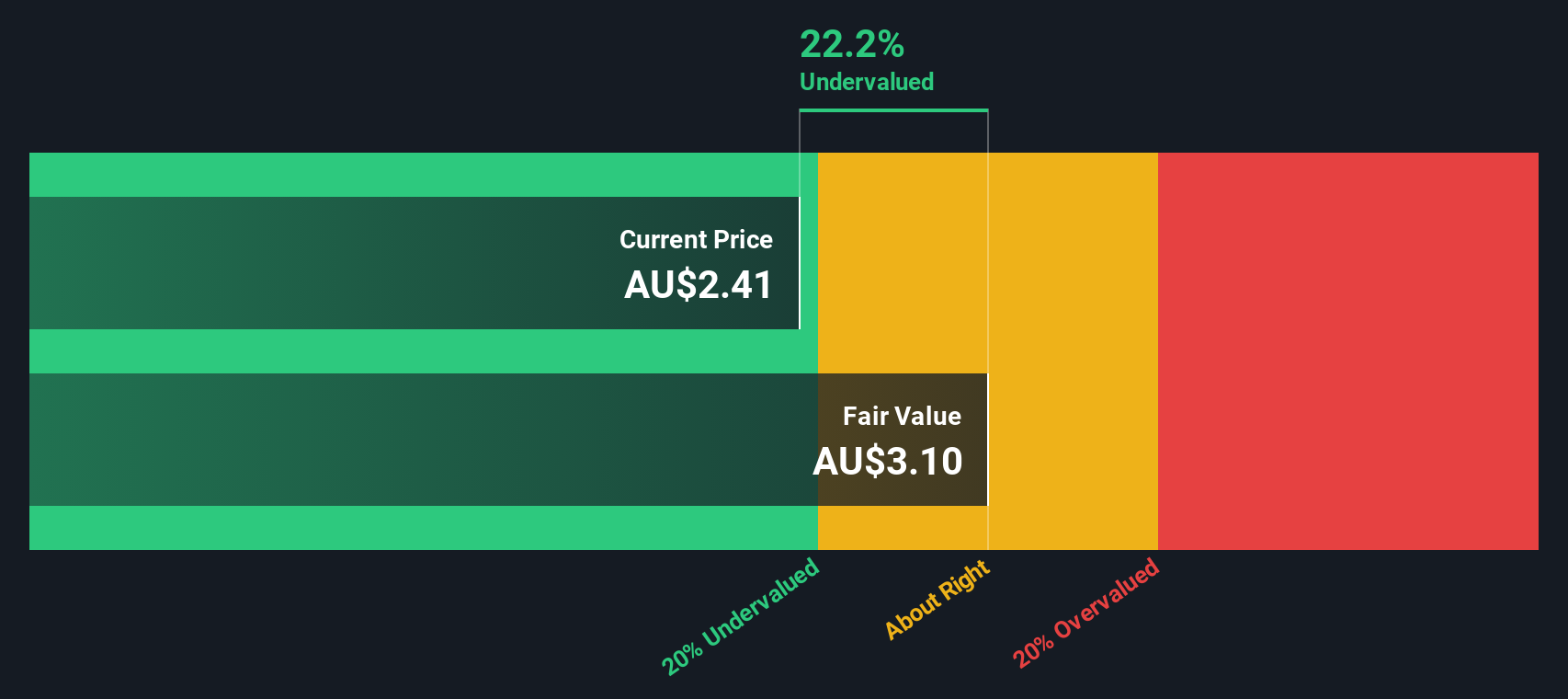

Growthpoint Properties Australia (ASX:GOZ)

Simply Wall St Value Rating: ★★★★★☆

Overview: Growthpoint Properties Australia is a real estate investment trust focused on owning and managing a diversified portfolio of office and industrial properties, with a market capitalization of A$3.50 billion.

Operations: The primary revenue streams are derived from office and industrial segments, contributing A$204.5 million and A$103.2 million, respectively. Over recent periods, the company experienced a declining net income margin trend, reaching -85.37% as of December 2024. Notably, gross profit margins have also shown a downward trajectory over time, with the latest figure at 80.46%.

PE: -6.5x

Growthpoint Properties Australia, a smaller player in the property market, is navigating a challenging financial landscape. They rely entirely on external borrowing, making their funding riskier compared to those with customer deposits. Despite this, earnings are projected to grow by 84% annually. Recent insider confidence was demonstrated through share purchases over the past year. A CFO transition is underway as Dion Andrews steps down after 15 years, signaling potential shifts in strategic direction post-August 2025 results release.

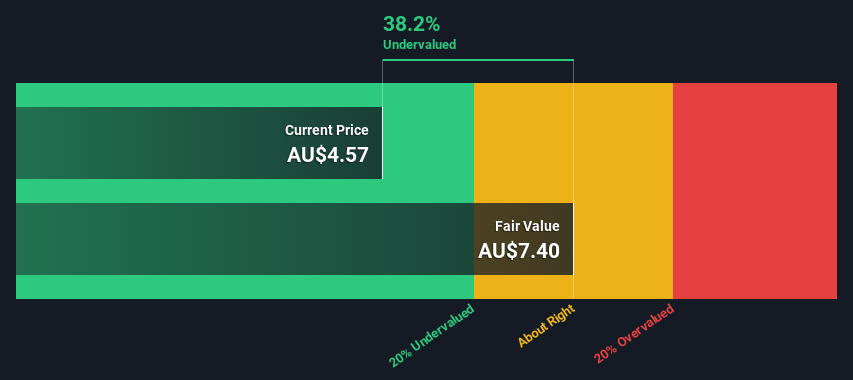

HMC Capital (ASX:HMC)

Simply Wall St Value Rating: ★★★★★☆

Overview: HMC Capital is a company engaged in real estate operations with a market capitalization of A$1.15 billion.

Operations: HMC Capital's revenue is primarily derived from its real estate segment, with a significant portion adjusted through segment adjustments. The company has experienced a notable trend in its gross profit margin, which reached 100% consistently from June 2023 onwards. Operating expenses have been substantial, impacting net income margins, which have shown improvement over time.

PE: 7.2x

HMC Capital, a small company with potential, recently saw insider confidence as an individual purchased 1 million shares for A$4.8 million, boosting their stake by 4.83%. While earnings are expected to decline by 1.5% annually over the next three years, revenue is projected to grow at a rate of 11.75% per year. The company relies entirely on external borrowing for funding, which adds risk but also highlights its growth ambitions in the market.

- Take a closer look at HMC Capital's potential here in our valuation report.

Examine HMC Capital's past performance report to understand how it has performed in the past.

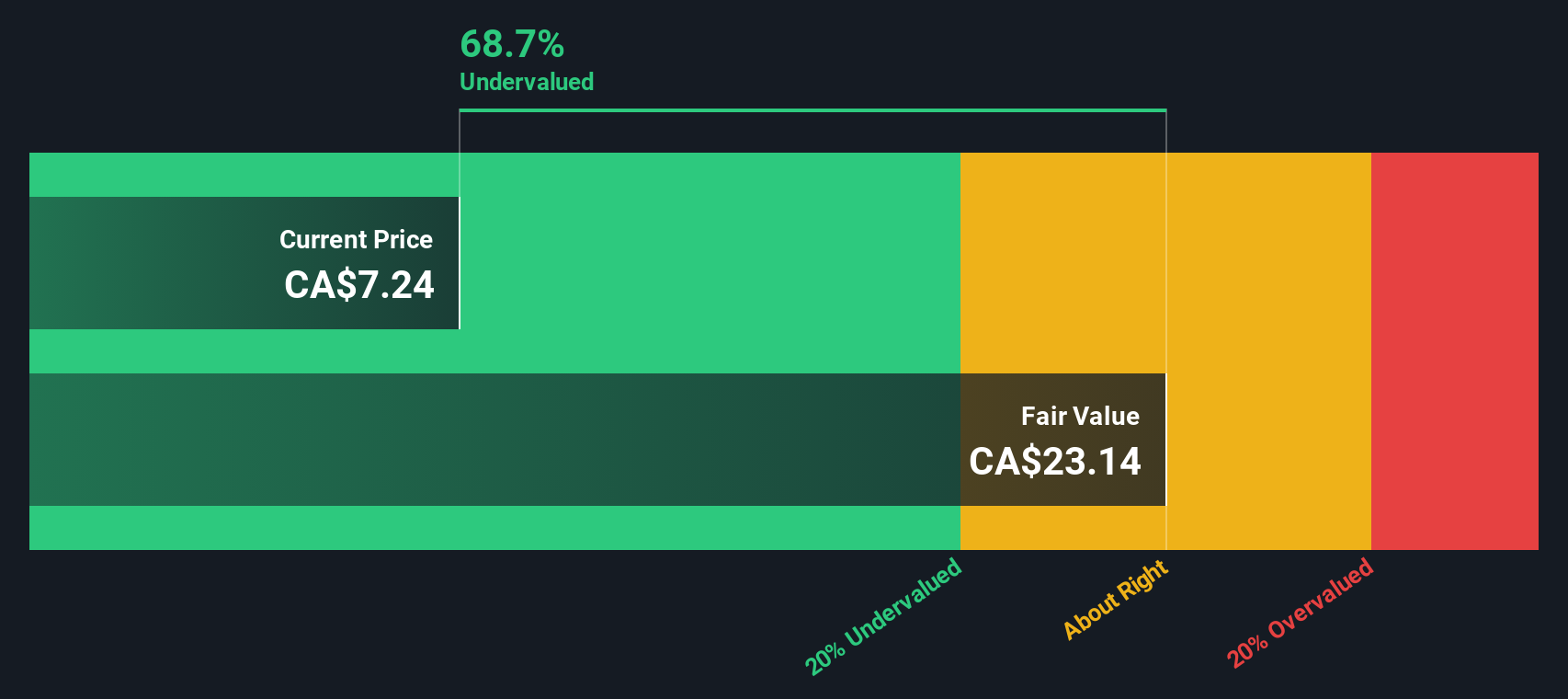

Headwater Exploration (TSX:HWX)

Simply Wall St Value Rating: ★★★★★★

Overview: Headwater Exploration is engaged in the exploration, development, and production of petroleum and natural gas, with a market cap of CA$1.89 billion.

Operations: Headwater Exploration generates revenue primarily from the exploration, development, and production of petroleum and natural gas, with recent revenue reaching CA$540.80 million. The company's gross profit margin has shown variability over time but was recorded at 76.44% in the latest period. Operating expenses include significant components such as depreciation and amortization, alongside general and administrative costs which amounted to CA$22.89 million recently.

PE: 8.5x

Headwater Exploration, a smaller company in the energy sector, has shown promising financial performance despite future earnings projections suggesting a 20% annual decline over the next three years. In Q1 2025, they reported CAD 170.16 million in sales and CAD 50 million net income, marking an increase from last year. The company maintains higher-risk funding through external borrowing. Insider confidence is evident with recent share purchases by executives, indicating belief in potential growth despite challenges ahead.

- Get an in-depth perspective on Headwater Exploration's performance by reading our valuation report here.

Understand Headwater Exploration's track record by examining our Past report.

Key Takeaways

- Get an in-depth perspective on all 120 Undervalued Global Small Caps With Insider Buying by using our screener here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Headwater Exploration might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:HWX

Headwater Exploration

Engages in the exploration, development, and production of petroleum and natural gas resources in Canada.

Very undervalued with flawless balance sheet.

Market Insights

Community Narratives