- Australia

- /

- Diversified Financial

- /

- ASX:HLI

Shareholders May Be More Conservative With Helia Group Limited's (ASX:HLI) CEO Compensation For Now

Key Insights

- Helia Group's Annual General Meeting to take place on 9th of May

- Total pay for CEO Pauline Blight-Johnston includes AU$902.1k salary

- Total compensation is 126% above industry average

- Over the past three years, Helia Group's EPS grew by 63% and over the past three years, the total shareholder return was 122%

CEO Pauline Blight-Johnston has done a decent job of delivering relatively good performance at Helia Group Limited (ASX:HLI) recently. As shareholders go into the upcoming AGM on 9th of May, CEO compensation will probably not be their focus, but rather the steps management will take to continue the growth momentum. However, some shareholders may still want to keep CEO compensation within reason.

See our latest analysis for Helia Group

Comparing Helia Group Limited's CEO Compensation With The Industry

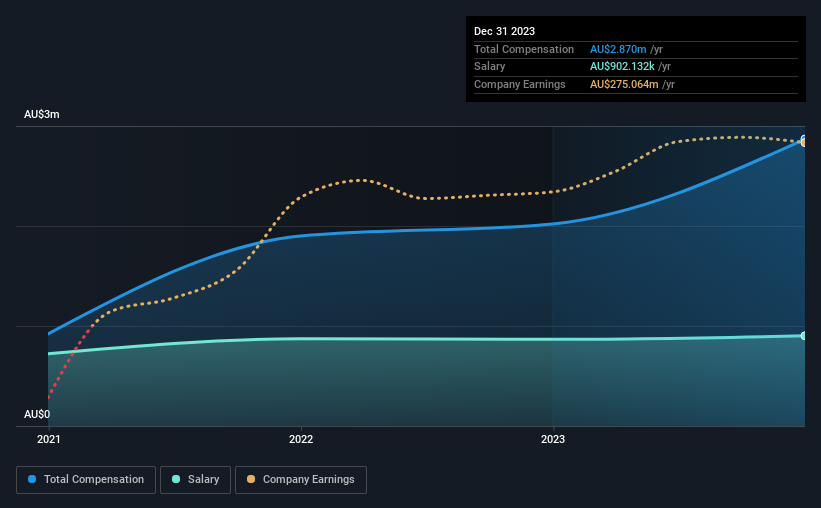

According to our data, Helia Group Limited has a market capitalization of AU$1.1b, and paid its CEO total annual compensation worth AU$2.9m over the year to December 2023. Notably, that's an increase of 42% over the year before. While we always look at total compensation first, our analysis shows that the salary component is less, at AU$902k.

On examining similar-sized companies in the Australian Diversified Financial industry with market capitalizations between AU$608m and AU$2.4b, we discovered that the median CEO total compensation of that group was AU$1.3m. This suggests that Pauline Blight-Johnston is paid more than the median for the industry. What's more, Pauline Blight-Johnston holds AU$655k worth of shares in the company in their own name.

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | AU$902k | AU$866k | 31% |

| Other | AU$2.0m | AU$1.2m | 69% |

| Total Compensation | AU$2.9m | AU$2.0m | 100% |

On an industry level, roughly 58% of total compensation represents salary and 42% is other remuneration. It's interesting to note that Helia Group allocates a smaller portion of compensation to salary in comparison to the broader industry. It's important to note that a slant towards non-salary compensation suggests that total pay is tied to the company's performance.

A Look at Helia Group Limited's Growth Numbers

Helia Group Limited has seen its earnings per share (EPS) increase by 63% a year over the past three years. It achieved revenue growth of 19% over the last year.

This demonstrates that the company has been improving recently and is good news for the shareholders. It's a real positive to see this sort of revenue growth in a single year. That suggests a healthy and growing business. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has Helia Group Limited Been A Good Investment?

Most shareholders would probably be pleased with Helia Group Limited for providing a total return of 122% over three years. As a result, some may believe the CEO should be paid more than is normal for companies of similar size.

In Summary...

The company's decent performance might have made most shareholders happy, possibly making CEO remuneration the least of the concerns to be discussed in the upcoming AGM. However, any decision to raise CEO pay might be met with some objections from the shareholders given that the CEO is already paid higher than the industry average.

We can learn a lot about a company by studying its CEO compensation trends, along with looking at other aspects of the business. In our study, we found 4 warning signs for Helia Group you should be aware of, and 2 of them shouldn't be ignored.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

Valuation is complex, but we're here to simplify it.

Discover if Helia Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:HLI

Helia Group

Helia Group Limited, together with its subsidiaries, is involved in the loan mortgage insurance business primarily in Australia.

Undervalued with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives