- Australia

- /

- Metals and Mining

- /

- ASX:MLX

3 Undiscovered Gems In Australia With Promising Potential

Reviewed by Simply Wall St

In the current Australian market landscape, the Reserve Bank of Australia's decision to hold interest rates steady has been a focal point, with many analysts anticipating potential changes in the near future. Amidst this backdrop, small-cap stocks have shown varied performance across sectors, presenting opportunities for investors seeking undiscovered gems that demonstrate resilience and growth potential. Identifying promising stocks often involves looking for companies that can navigate economic uncertainties and capitalize on sector-specific trends.

Top 10 Undiscovered Gems With Strong Fundamentals In Australia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Sugar Terminals | NA | 3.78% | 4.30% | ★★★★★★ |

| Schaffer | 25.47% | 6.03% | -5.20% | ★★★★★★ |

| Fiducian Group | NA | 9.97% | 7.85% | ★★★★★★ |

| Euroz Hartleys Group | NA | 5.92% | -17.96% | ★★★★★★ |

| Hearts and Minds Investments | NA | 47.09% | 49.82% | ★★★★★★ |

| Tribune Resources | NA | -10.33% | -48.18% | ★★★★★★ |

| Djerriwarrh Investments | 1.14% | 8.17% | 7.54% | ★★★★★★ |

| Red Hill Minerals | NA | 95.16% | 40.06% | ★★★★★★ |

| Lycopodium | 6.89% | 16.56% | 32.73% | ★★★★★☆ |

| K&S | 20.24% | 1.58% | 25.54% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

Helia Group (ASX:HLI)

Simply Wall St Value Rating: ★★★★★☆

Overview: Helia Group Limited, along with its subsidiaries, operates in the loan mortgage insurance sector primarily in Australia and has a market capitalization of approximately A$1.29 billion.

Operations: Helia Group generates revenue primarily from conducting loan mortgage insurance business, amounting to A$504.73 million. The company's financial performance is characterized by a focus on this core revenue stream within the Australian market.

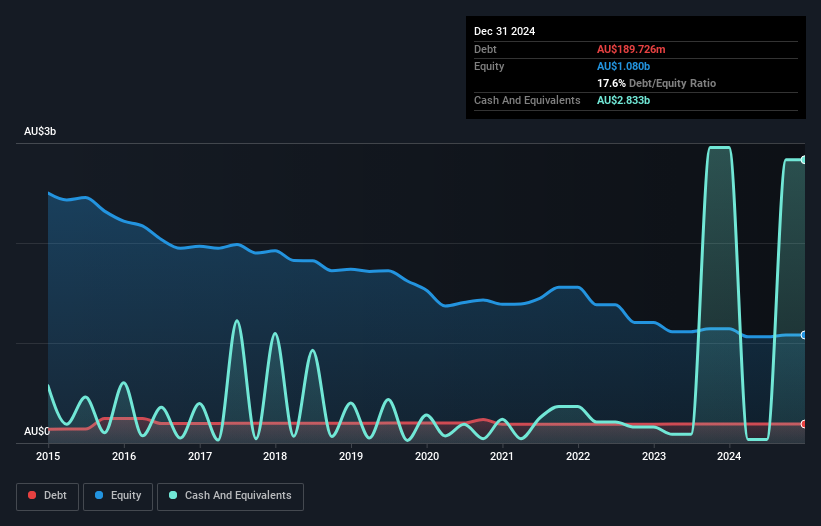

Helia Group, a player in Australia's loan mortgage insurance sector, is navigating some headwinds. With earnings growth at -15.8% over the past year, it trails behind the Diversified Financial industry average of -6.8%. The debt-to-equity ratio has risen from 13.1% to 17.6% over five years, yet Helia trades at a substantial discount of 70.9% below its estimated fair value, indicating potential undervaluation compared to peers and industry standards. Despite these financial challenges and an anticipated revenue drop of 16.1%, Helia maintains high customer satisfaction through technological integration and strong financial performance that supports revenue growth amidst economic fluctuations.

K&S (ASX:KSC)

Simply Wall St Value Rating: ★★★★☆☆

Overview: K&S Corporation Limited operates in the transportation and logistics, warehousing, and fuel distribution sectors across Australia and New Zealand, with a market capitalization of A$448.86 million.

Operations: K&S generates revenue primarily from its Australian transport segment (A$553.12 million), followed by fuel distribution (A$213.29 million) and New Zealand transport (A$74.99 million).

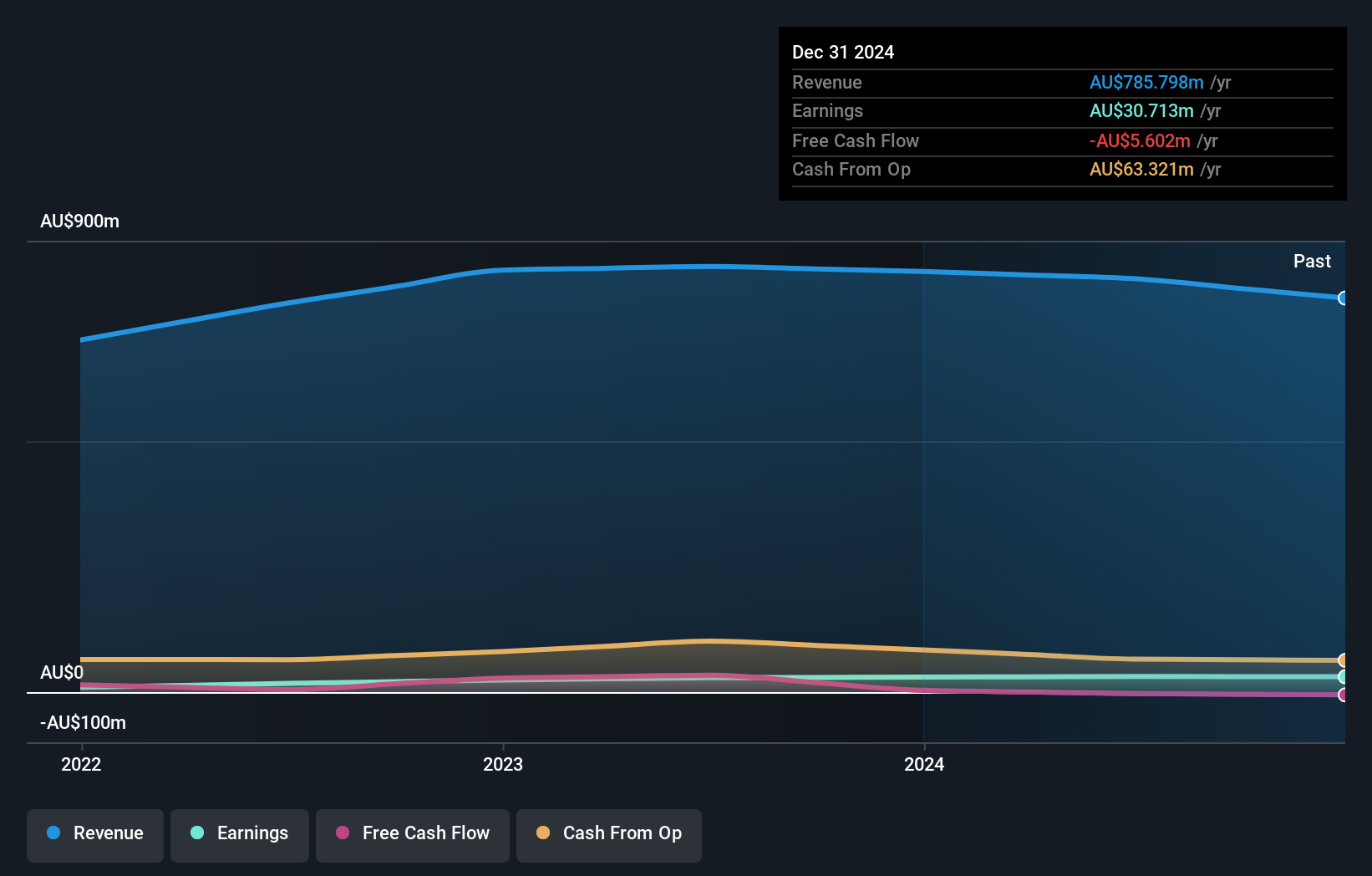

K&S, a nimble player in Australia's logistics sector, showcases a satisfactory net debt to equity ratio of 12.7%, reflecting prudent financial management. Over the past five years, its earnings have impressively grown at an annual rate of 25.5%, though recent growth (2.8%) lags behind the industry average of 5.3%. The company’s price-to-earnings ratio stands at 14.6x, below the Australian market average of 18.5x, suggesting potential value for investors seeking under-the-radar opportunities. Despite not being free cash flow positive currently, K&S has high-quality earnings and strong interest coverage with EBIT covering interest payments by 9.5 times, indicating robust operational performance amidst industry challenges.

- Click here and access our complete health analysis report to understand the dynamics of K&S.

Evaluate K&S' historical performance by accessing our past performance report.

Metals X (ASX:MLX)

Simply Wall St Value Rating: ★★★★★★

Overview: Metals X Limited is an Australian company focused on tin production, with a market capitalization of approximately A$509.68 million.

Operations: Metals X Limited generates revenue primarily from its 50% stake in the Renison Tin Operation, contributing A$218.82 million.

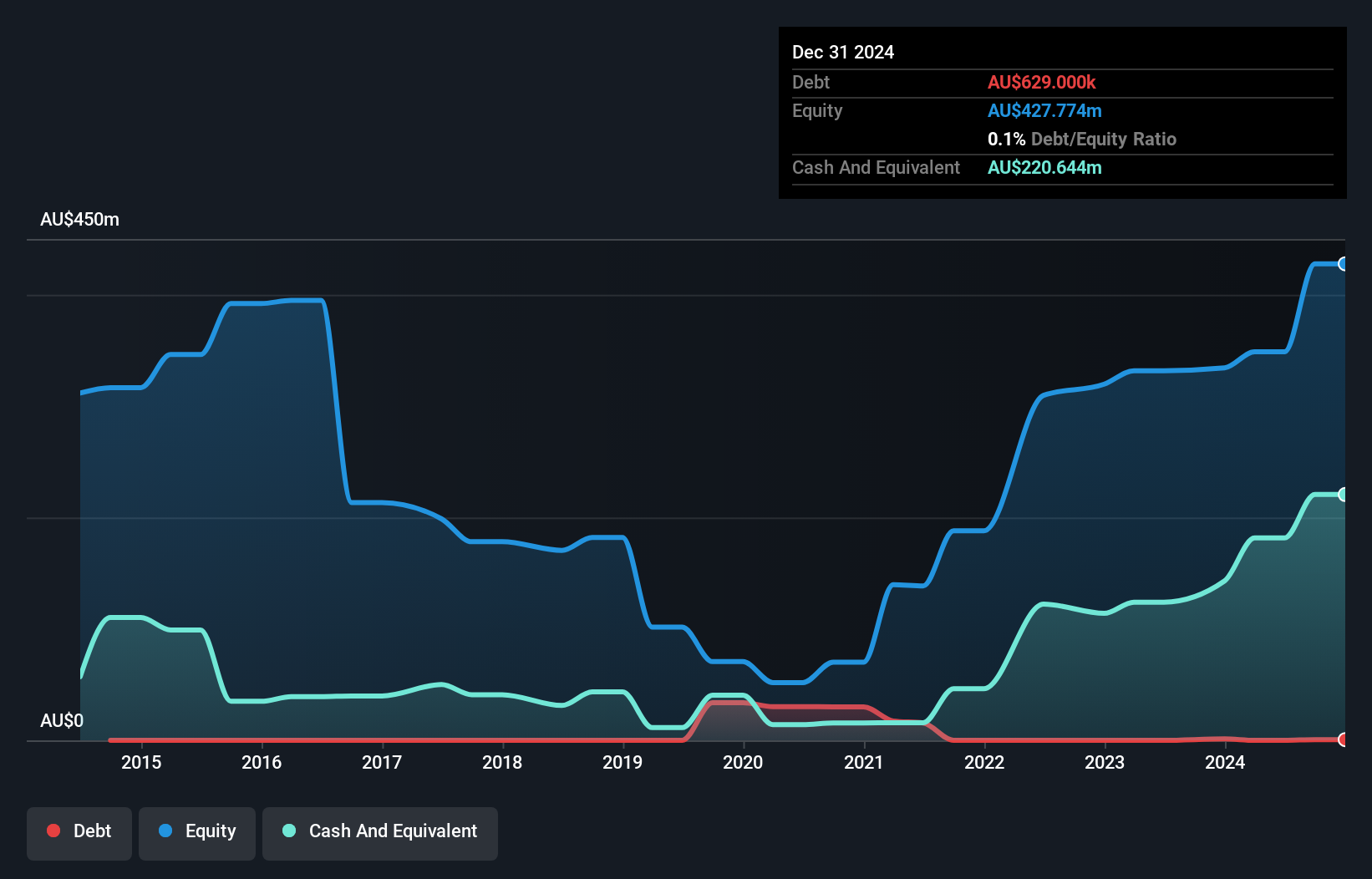

Metals X is making waves with its impressive earnings growth of 601.7% over the past year, significantly outpacing the Metals and Mining industry average of 14.3%. The company has effectively slashed its debt to equity ratio from 47.7% to a mere 0.1% in five years, showcasing robust financial management. Trading at a strikingly low valuation, it's positioned at 99.1% below estimated fair value, offering potential upside for investors seeking undervalued opportunities in Australia’s market landscape. Despite a notable A$20.2M one-off gain affecting recent results, Metals X maintains strong cash flow and holds more cash than total debt, indicating financial resilience amidst industry challenges.

- Delve into the full analysis health report here for a deeper understanding of Metals X.

Assess Metals X's past performance with our detailed historical performance reports.

Summing It All Up

- Unlock more gems! Our ASX Undiscovered Gems With Strong Fundamentals screener has unearthed 46 more companies for you to explore.Click here to unveil our expertly curated list of 49 ASX Undiscovered Gems With Strong Fundamentals.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:MLX

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives