- Australia

- /

- Capital Markets

- /

- ASX:FNX

If EPS Growth Is Important To You, Finexia Financial Group (ASX:FNX) Presents An Opportunity

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Finexia Financial Group (ASX:FNX). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

See our latest analysis for Finexia Financial Group

How Fast Is Finexia Financial Group Growing Its Earnings Per Share?

Over the last three years, Finexia Financial Group has grown earnings per share (EPS) at as impressive rate from a relatively low point, resulting in a three year percentage growth rate that isn't particularly indicative of expected future performance. As a result, we'll zoom in on growth over the last year, instead. Outstandingly, Finexia Financial Group's EPS shot from AU$0.042 to AU$0.10, over the last year. Year on year growth of 140% is certainly a sight to behold. That could be a sign that the business has reached a true inflection point.

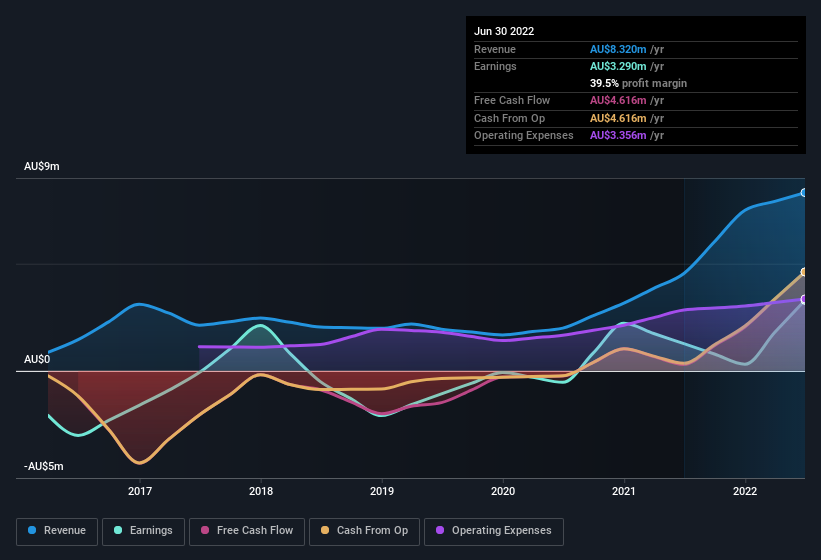

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. Not all of Finexia Financial Group's revenue this year is revenue from operations, so keep in mind the revenue and margin numbers used in this article might not be the best representation of the underlying business. EBIT margins for Finexia Financial Group remained fairly unchanged over the last year, however the company should be pleased to report its revenue growth for the period of 83% to AU$8.3m. That's encouraging news for the company!

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

Finexia Financial Group isn't a huge company, given its market capitalisation of AU$12m. That makes it extra important to check on its balance sheet strength.

Are Finexia Financial Group Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. Because often, the purchase of stock is a sign that the buyer views it as undervalued. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

It's nice to see that there have been no reports of any insiders selling shares in Finexia Financial Group in the previous 12 months. So it's definitely nice that Executive Chairman Neil Sheather bought AU$30k worth of shares at an average price of around AU$0.30. Purchases like this can help the investors understand the views of the management team; in which case they see some potential in Finexia Financial Group.

And the insider buying isn't the only sign of alignment between shareholders and the board, since Finexia Financial Group insiders own more than a third of the company. Owning 37% of the company, insiders have plenty riding on the performance of the the share price. Shareholders and speculators should be reassured by this kind of alignment, as it suggests the business will be run for the benefit of shareholders. Of course, Finexia Financial Group is a very small company, with a market cap of only AU$12m. So despite a large proportional holding, insiders only have AU$4.7m worth of stock. This isn't an overly large holding but it should still keep the insiders motivated to deliver the best outcomes for shareholders.

While insiders already own a significant amount of shares, and they have been buying more, the good news for ordinary shareholders does not stop there. The cherry on top is that the CEO, Neil Sheather is paid comparatively modestly to CEOs at similar sized companies. For companies with market capitalisations under AU$288m, like Finexia Financial Group, the median CEO pay is around AU$421k.

Finexia Financial Group offered total compensation worth AU$274k to its CEO in the year to June 2022. That is actually below the median for CEO's of similarly sized companies. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. It can also be a sign of a culture of integrity, in a broader sense.

Should You Add Finexia Financial Group To Your Watchlist?

Finexia Financial Group's earnings have taken off in quite an impressive fashion. The cherry on top is that insiders own a bunch of shares, and one has been buying more. This quick rundown suggests that the business may be of good quality, and also at an inflection point, so maybe Finexia Financial Group deserves timely attention. Before you take the next step you should know about the 3 warning signs for Finexia Financial Group (2 are potentially serious!) that we have uncovered.

The good news is that Finexia Financial Group is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:FNX

Finexia Financial Group

Provides funds management, advisory, and market trading services in Australia.

Moderate and fair value.

Market Insights

Community Narratives