- Australia

- /

- Diversified Financial

- /

- ASX:FND

Findi's (ASX:FND) one-year earnings growth trails the enviable shareholder returns

Active investing isn't easy, but for those that do it, the aim is to find the best companies to buy, and to profit handsomely. When an investor finds a multi-bagger (a stock that goes up over 200%), it makes a big difference to their portfolio. For example, Findi Limited (ASX:FND) has generated a beautiful 821% return in just a single year. It's also up 16% in about a month. It is also impressive that the stock is up 336% over three years, adding to the sense that it is a real winner. We love happy stories like this one. The company should be really proud of that performance!

After a strong gain in the past week, it's worth seeing if longer term returns have been driven by improving fundamentals.

See our latest analysis for Findi

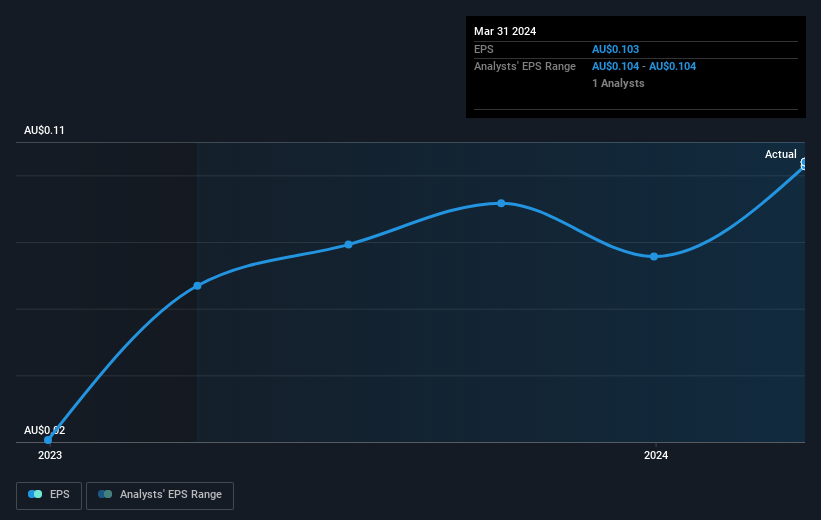

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Findi was able to grow EPS by 54% in the last twelve months. This EPS growth is significantly lower than the 821% increase in the share price. So it's fair to assume the market has a higher opinion of the business than it a year ago. This favorable sentiment is reflected in its (fairly optimistic) P/E ratio of 50.65.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

It's probably worth noting we've seen significant insider buying in the last quarter, which we consider a positive. That said, we think earnings and revenue growth trends are even more important factors to consider. This free interactive report on Findi's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

A Different Perspective

It's good to see that Findi has rewarded shareholders with a total shareholder return of 821% in the last twelve months. That's better than the annualised return of 38% over half a decade, implying that the company is doing better recently. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. It's always interesting to track share price performance over the longer term. But to understand Findi better, we need to consider many other factors. Case in point: We've spotted 3 warning signs for Findi you should be aware of, and 1 of them is concerning.

Findi is not the only stock insiders are buying. So take a peek at this free list of small cap companies at attractive valuations which insiders have been buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Australian exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:FND

Findi

Through its subsidiaries, engages in the development of digital payment systems in India.

High growth potential with mediocre balance sheet.

Market Insights

Community Narratives