- Australia

- /

- Capital Markets

- /

- ASX:EP1

E&P Financial Group (ASX:EP1) shareholders have endured a 41% loss from investing in the stock five years ago

Ideally, your overall portfolio should beat the market average. But every investor is virtually certain to have both over-performing and under-performing stocks. At this point some shareholders may be questioning their investment in E&P Financial Group Limited (ASX:EP1), since the last five years saw the share price fall 49%. The falls have accelerated recently, with the share price down 19% in the last three months.

So let's have a look and see if the longer term performance of the company has been in line with the underlying business' progress.

View our latest analysis for E&P Financial Group

E&P Financial Group isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

Over half a decade E&P Financial Group reduced its trailing twelve month revenue by 9.0% for each year. That's definitely a weaker result than most pre-profit companies report. It seems pretty reasonable to us that the share price dipped 8% per year in that time. We doubt many shareholders are delighted with this share price performance. It is possible for businesses to bounce back but as Buffett says, 'turnarounds seldom turn'.

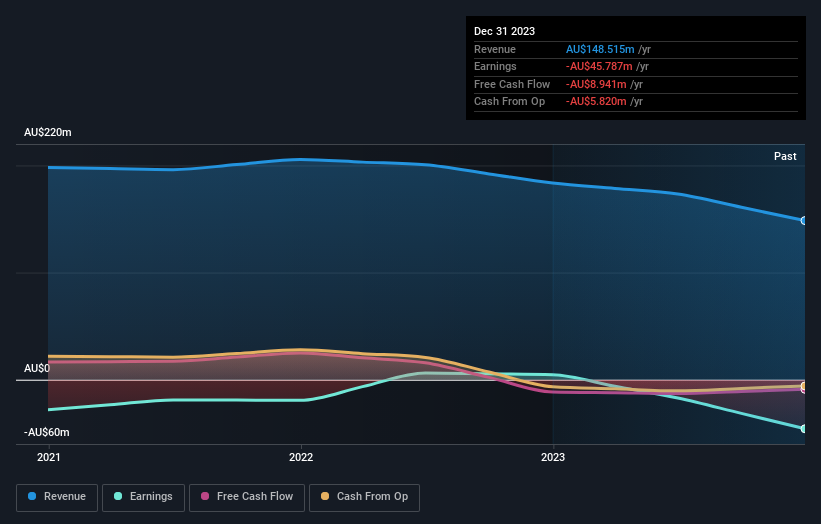

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

This free interactive report on E&P Financial Group's balance sheet strength is a great place to start, if you want to investigate the stock further.

What About The Total Shareholder Return (TSR)?

We've already covered E&P Financial Group's share price action, but we should also mention its total shareholder return (TSR). The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. E&P Financial Group's TSR of was a loss of 41% for the 5 years. That wasn't as bad as its share price return, because it has paid dividends.

A Different Perspective

E&P Financial Group shareholders gained a total return of 2.3% during the year. Unfortunately this falls short of the market return. But at least that's still a gain! Over five years the TSR has been a reduction of 7% per year, over five years. So this might be a sign the business has turned its fortunes around. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Like risks, for instance. Every company has them, and we've spotted 2 warning signs for E&P Financial Group (of which 1 doesn't sit too well with us!) you should know about.

If you are like me, then you will not want to miss this free list of undervalued small caps that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Australian exchanges.

Valuation is complex, but we're here to simplify it.

Discover if E&P Financial Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:EP1

E&P Financial Group

Engages in the financial services business in Australia, the United States, and Hong Kong.

Flawless balance sheet and slightly overvalued.