- Australia

- /

- Specialty Stores

- /

- ASX:AX1

3 ASX Growth Companies With Insider Ownership Expecting 19% Earnings Growth

Reviewed by Simply Wall St

The ASX200 is set to open 0.12% lower today, despite strong performances on Wall Street, as Australian investors await a rate cut decision from the Reserve Bank (RBA) later today. This cautious market environment highlights the importance of identifying growth companies with high insider ownership, as such stocks often signal confidence from those closest to the business and can offer robust earnings potential even amid economic uncertainties.

Top 10 Growth Companies With High Insider Ownership In Australia

| Name | Insider Ownership | Earnings Growth |

| Clinuvel Pharmaceuticals (ASX:CUV) | 10.4% | 27.4% |

| Catalyst Metals (ASX:CYL) | 17% | 54.5% |

| Genmin (ASX:GEN) | 12% | 117.7% |

| AVA Risk Group (ASX:AVA) | 15.7% | 118.8% |

| Pointerra (ASX:3DP) | 18.7% | 126.4% |

| Liontown Resources (ASX:LTR) | 16.4% | 69.4% |

| Hillgrove Resources (ASX:HGO) | 10.4% | 70.9% |

| Acrux (ASX:ACR) | 17.4% | 91.6% |

| Adveritas (ASX:AV1) | 21.1% | 144.2% |

| Plenti Group (ASX:PLT) | 12.8% | 106.4% |

Here's a peek at a few of the choices from the screener.

Accent Group (ASX:AX1)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Accent Group Limited (ASX:AX1) operates in Australia and New Zealand, focusing on the retail, distribution, and franchise of lifestyle footwear, apparel, and accessories with a market cap of A$1.32 billion.

Operations: The company's revenue segments consist of A$1.27 billion from retail and A$463.20 million from wholesale operations in Australia and New Zealand.

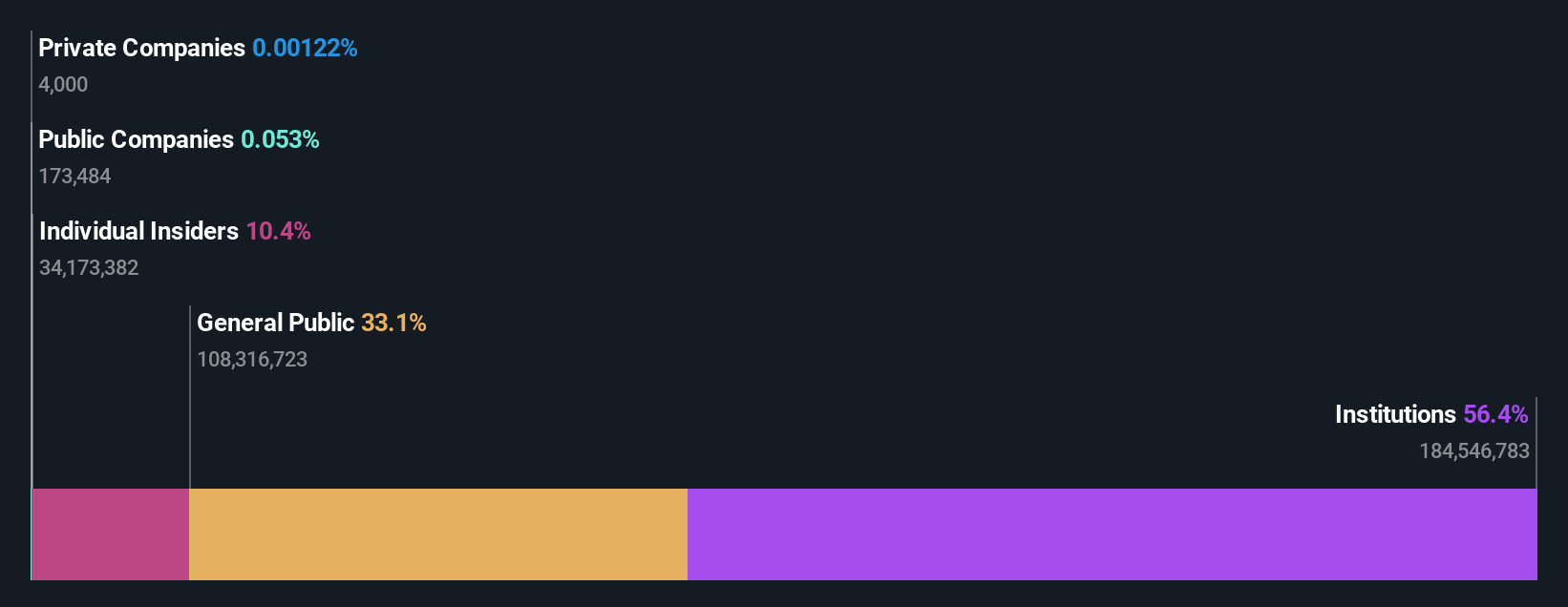

Insider Ownership: 17.7%

Earnings Growth Forecast: 15.2% p.a.

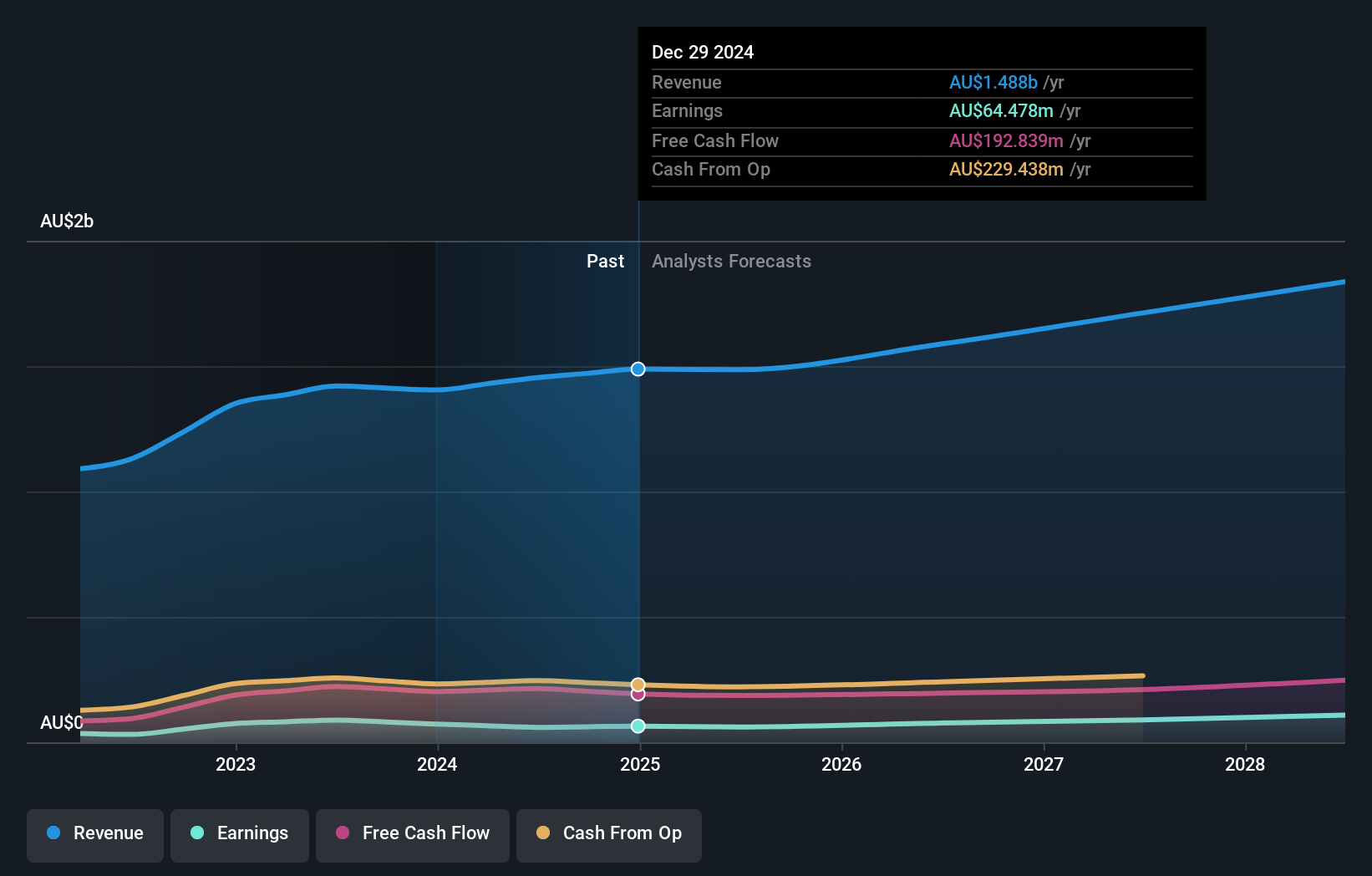

Accent Group has demonstrated moderate revenue growth, with sales increasing to A$1.45 billion for the year ending June 30, 2024. However, net income declined to A$59.53 million from A$88.65 million the previous year. Insider ownership remains high with no substantial insider selling over the past quarter, although there have been no significant insider purchases either. The company recently issued shares through a private placement involving Frasers Group Plc and announced a reduced dividend of A$0.045 per share.

- Delve into the full analysis future growth report here for a deeper understanding of Accent Group.

- According our valuation report, there's an indication that Accent Group's share price might be on the cheaper side.

Flight Centre Travel Group (ASX:FLT)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Flight Centre Travel Group Limited (ASX:FLT) is a global travel retailing service provider for both leisure and corporate sectors, with a market cap of approximately A$4.74 billion.

Operations: Flight Centre Travel Group Limited generates revenue primarily from its leisure sector (A$1.35 billion) and corporate sector (A$1.11 billion).

Insider Ownership: 13.5%

Earnings Growth Forecast: 19.7% p.a.

Flight Centre Travel Group's revenue is forecast to grow 8% annually, outpacing the Australian market's 5.4%. Earnings are expected to rise by 19.72% per year, faster than the market's 12.3%. Despite a history of unstable dividends, the company trades at 16% below its estimated fair value. Recent earnings showed significant improvement with net income increasing from A$47 million to A$139 million year-over-year. The company is actively seeking acquisitions and investments in growth segments like Cruise & Touring.

- Click here and access our complete growth analysis report to understand the dynamics of Flight Centre Travel Group.

- According our valuation report, there's an indication that Flight Centre Travel Group's share price might be on the expensive side.

Technology One (ASX:TNE)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Technology One Limited develops, markets, sells, implements, and supports integrated enterprise business software solutions in Australia and internationally with a market cap of A$7.78 billion.

Operations: The company's revenue segments consist of A$317.24 million from Software, A$83.83 million from Corporate, and A$68.13 million from Consulting.

Insider Ownership: 12.3%

Earnings Growth Forecast: 14.8% p.a.

Technology One's revenue is projected to grow 11.5% annually, surpassing the Australian market's 5.4%. Earnings are expected to rise by 14.8% per year, also outpacing the market average of 12.3%. Recent developments include the appointment of Paul Robson as an independent Non-Executive Director, bringing extensive experience in SaaS businesses and strategic transformation. The company's Return on Equity is forecasted to be high at 32.7% in three years' time.

- Navigate through the intricacies of Technology One with our comprehensive analyst estimates report here.

- Our valuation report here indicates Technology One may be overvalued.

Taking Advantage

- Gain an insight into the universe of 100 Fast Growing ASX Companies With High Insider Ownership by clicking here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:AX1

Accent Group

Engages in the retail, distribution, and franchise of lifestyle footwear, apparel, and accessories in Australia and New Zealand.

Very undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives