- Australia

- /

- Capital Markets

- /

- ASX:DUI

Undiscovered Gems in Australia to Explore This May 2025

Reviewed by Simply Wall St

As the Australian market navigates through a period of volatility, with the ASX 200 poised for a slight decline amid global trade concerns and fluctuating U.S. Treasury yields, investors are increasingly on the lookout for resilient opportunities. In this landscape, identifying promising small-cap stocks that demonstrate potential growth and stability can be particularly rewarding, especially those that can withstand economic fluctuations and capitalize on emerging trends.

Top 10 Undiscovered Gems With Strong Fundamentals In Australia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Sugar Terminals | NA | 3.78% | 4.30% | ★★★★★★ |

| Schaffer | 25.47% | 6.03% | -5.20% | ★★★★★★ |

| Fiducian Group | NA | 9.97% | 7.85% | ★★★★★★ |

| Hearts and Minds Investments | NA | 47.09% | 49.82% | ★★★★★★ |

| Tribune Resources | NA | -10.33% | -48.18% | ★★★★★★ |

| Djerriwarrh Investments | 1.14% | 8.17% | 7.54% | ★★★★★★ |

| Red Hill Minerals | NA | 95.16% | 40.06% | ★★★★★★ |

| Lycopodium | 6.89% | 16.56% | 32.73% | ★★★★★☆ |

| Carlton Investments | 0.02% | 4.45% | 3.97% | ★★★★★☆ |

| K&S | 20.24% | 1.58% | 25.54% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

Catalyst Metals (ASX:CYL)

Simply Wall St Value Rating: ★★★★★☆

Overview: Catalyst Metals Limited is engaged in the exploration and evaluation of mineral properties across Australia, with a market capitalization of A$1.50 billion.

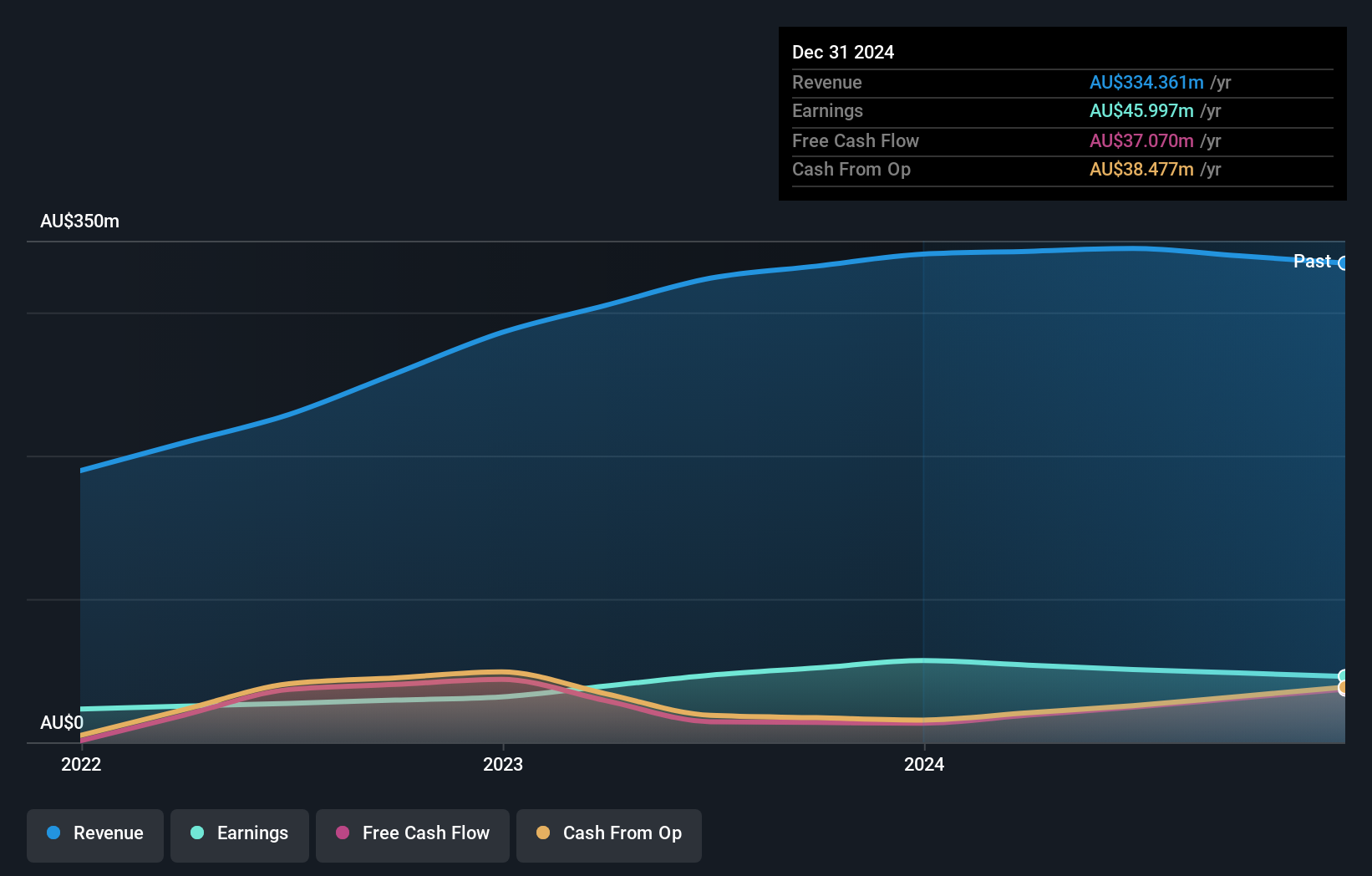

Operations: Catalyst Metals Limited generates revenue primarily from its mineral exploration activities in Tasmania and Western Australia, with the latter contributing A$315.38 million. The company's market capitalization stands at approximately A$1.50 billion.

Catalyst Metals, a promising player in Australia's mining sector, has recently turned profitable and is trading at 51% below its estimated fair value. The company reported a net income of A$46.29 million for the half-year ending December 2024, up from a net loss of A$6.77 million the previous year, highlighting its strong turnaround. With earnings forecasted to grow by 33% annually and interest payments well covered by EBIT at 28 times coverage, Catalyst seems financially robust. The Trident Gold Project offers significant potential with probable ore reserves of 1.3Mt at 4.4g/t Au for 188koz gold, positioning Catalyst for future growth as it progresses towards first ore production later this year.

- Take a closer look at Catalyst Metals' potential here in our health report.

Explore historical data to track Catalyst Metals' performance over time in our Past section.

Diversified United Investment (ASX:DUI)

Simply Wall St Value Rating: ★★★★★☆

Overview: Diversified United Investment Limited is a publicly owned investment manager with a market capitalization of A$1.15 billion.

Operations: Diversified United Investment generates revenue primarily through its investment activities, with reported revenues of A$46.41 million.

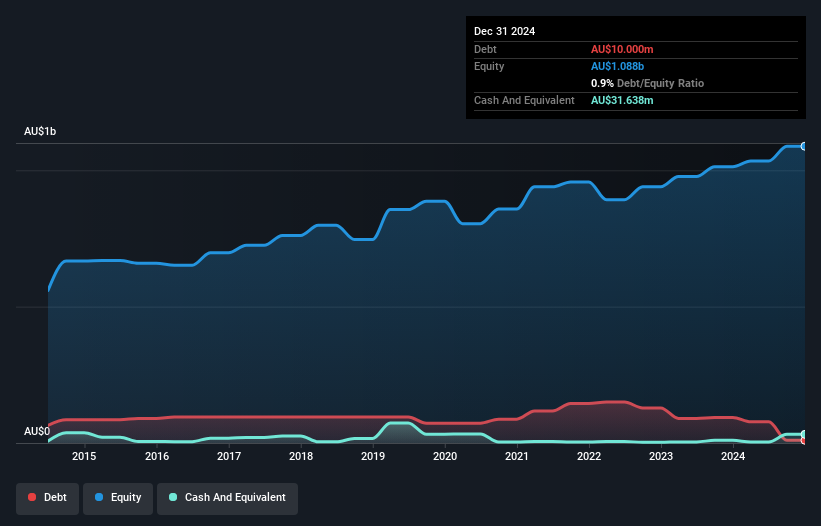

Diversified United Investment stands out with a robust financial footing, despite facing a 7% dip in earnings growth last year. The company impressively covers its interest payments 12 times over with EBIT, showcasing strong operational efficiency. Over the past five years, DUI has significantly reduced its debt-to-equity ratio from 8.2 to just 0.9, indicating prudent financial management. High-quality earnings further bolster its profile, while maintaining more cash than total debt ensures stability. Recently affirming an A$0.07 per share dividend for December's end highlights shareholder value focus amidst industry challenges and opportunities for future growth within the capital markets sector.

Lycopodium (ASX:LYL)

Simply Wall St Value Rating: ★★★★★☆

Overview: Lycopodium Limited is an Australian company that offers engineering and project delivery services across the resources, rail infrastructure, and industrial processes sectors, with a market capitalization of A$421.25 million.

Operations: Lycopodium Limited generates revenue primarily from the resources sector, contributing A$347.83 million, with additional streams from process industries and rail infrastructure amounting to A$10.84 million and A$10.14 million respectively.

Lycopodium, a notable player in the engineering and project management sector, recently joined the S&P/ASX Emerging Companies Index, highlighting its potential within Australia's market. Despite facing a -19.3% earnings growth last year compared to the construction industry's 28.7%, it remains financially sound with cash exceeding total debt and interest payments well-covered by profits. Trading at 19.7% below estimated fair value suggests room for appreciation, while free cash flow positivity and high-quality past earnings provide further stability. The debt-to-equity ratio has risen to 6.9% over five years, reflecting some leverage increase but not overly concerning given its overall financial health.

- Click here and access our complete health analysis report to understand the dynamics of Lycopodium.

Review our historical performance report to gain insights into Lycopodium's's past performance.

Where To Now?

- Click through to start exploring the rest of the 44 ASX Undiscovered Gems With Strong Fundamentals now.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:DUI

Excellent balance sheet average dividend payer.

Market Insights

Community Narratives