Amidst a mixed performance in the Australian market, with the ASX200 experiencing a slight downturn and sectors like Health Care showing strength while Materials and Financials lagged, investors continue to seek reliable income streams. In this context, dividend stocks remain a compelling option for those looking to generate steady returns in varying market conditions.

Top 10 Dividend Stocks In Australia

| Name | Dividend Yield | Dividend Rating |

| Nick Scali (ASX:NCK) | 5.29% | ★★★★★☆ |

| Collins Foods (ASX:CKF) | 3.10% | ★★★★★☆ |

| Centuria Capital Group (ASX:CNI) | 7.34% | ★★★★★☆ |

| Eagers Automotive (ASX:APE) | 7.23% | ★★★★★☆ |

| Fiducian Group (ASX:FID) | 4.07% | ★★★★★☆ |

| Fortescue (ASX:FMG) | 8.81% | ★★★★★☆ |

| Charter Hall Group (ASX:CHC) | 3.96% | ★★★★★☆ |

| Premier Investments (ASX:PMV) | 4.59% | ★★★★★☆ |

| Diversified United Investment (ASX:DUI) | 3.17% | ★★★★★☆ |

| Australian United Investment (ASX:AUI) | 3.58% | ★★★★☆☆ |

Click here to see the full list of 27 stocks from our Top ASX Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Beacon Lighting Group (ASX:BLX)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Beacon Lighting Group Limited operates as a retailer of lighting products both in Australia and internationally, with a market capitalization of approximately A$567.09 million.

Operations: Beacon Lighting Group Limited generates A$312.87 million from the sale of light fittings, fans, and energy-efficient products.

Dividend Yield: 3.3%

Beacon Lighting Group maintains a payout ratio of 59.4%, ensuring dividends are well-covered by earnings, with additional support from a cash payout ratio of 34.3%. Despite this, the dividend yield stands at 3.32%, which is modest compared to Australia’s top dividend payers. Over the past decade, although dividends have increased, their growth has been marked by volatility and unreliability. Looking ahead, earnings are expected to grow by 10.26% annually, potentially improving future dividend stability and growth prospects.

- Click to explore a detailed breakdown of our findings in Beacon Lighting Group's dividend report.

- According our valuation report, there's an indication that Beacon Lighting Group's share price might be on the cheaper side.

Centuria Capital Group (ASX:CNI)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Centuria Capital Group is an investment manager based in Australia, specializing in marketing and managing investment products, with a market capitalization of approximately A$1.30 billion.

Operations: Centuria Capital Group generates revenue through various segments, with the primary contributors being Property Funds Management at A$178.53 million, Co-Investments at A$53.33 million, and Development at A$40.07 million.

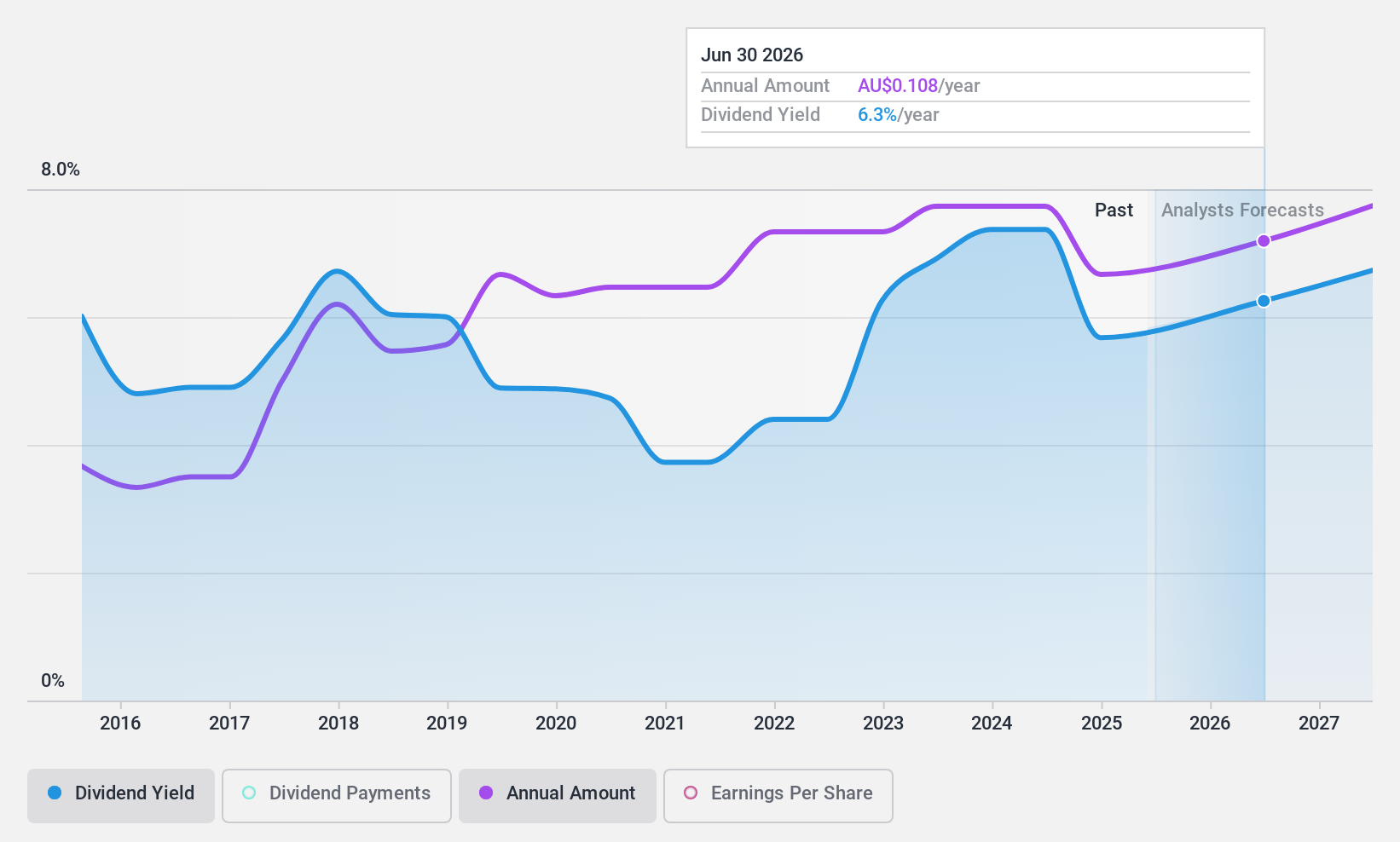

Dividend Yield: 7.3%

Centuria Capital Group offers a dividend yield of 7.34%, ranking it in the top 25% of Australian dividend stocks. However, its dividend history has been unstable, with payments fluctuating significantly over the past decade. Recent distributions include a final payment of A$0.05 per security for mid-2024. While earnings are projected to grow by 17.31% annually, current profit margins have declined to 3.1% from last year's 6.5%. The dividends are adequately supported by both earnings and cash flows, with payout ratios at 76.1% and cash payout ratios at 73.5%, respectively.

- Click here and access our complete dividend analysis report to understand the dynamics of Centuria Capital Group.

- Our comprehensive valuation report raises the possibility that Centuria Capital Group is priced higher than what may be justified by its financials.

Diversified United Investment (ASX:DUI)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Diversified United Investment Limited is a publicly owned investment manager with a market capitalization of approximately A$1.09 billion.

Operations: Diversified United Investment Limited generates its revenue primarily from its operations as an investment company, totaling A$51.05 million.

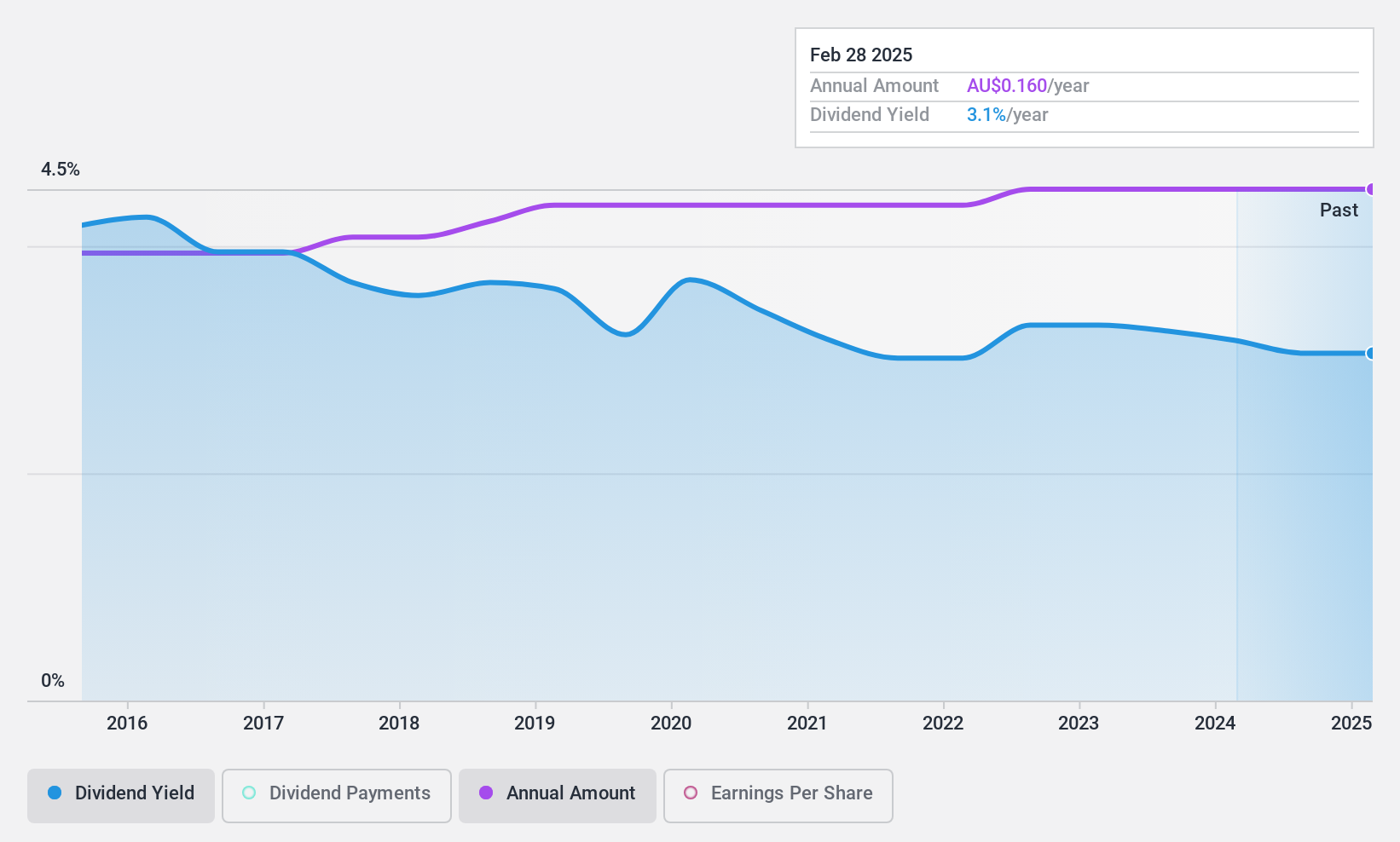

Dividend Yield: 3.2%

Diversified United Investment offers a modest dividend yield of 3.17%, which is lower than the top Australian dividend payers. Despite this, its dividends are well-supported by both earnings and cash flows, with payout ratios standing at 87.8% and cash payout ratios at 87.7% respectively, indicating a sustainable distribution level. Over the past decade, DUI has demonstrated reliability in its dividend payments with consistent growth and stability in dividends per share throughout this period.

- Dive into the specifics of Diversified United Investment here with our thorough dividend report.

- The analysis detailed in our Diversified United Investment valuation report hints at an inflated share price compared to its estimated value.

Make It Happen

- Access the full spectrum of 27 Top ASX Dividend Stocks by clicking on this link.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:CNI

Centuria Capital Group

An investment manager, markets and manages investment products primarily in Australia.

Solid track record average dividend payer.

Similar Companies

Market Insights

Community Narratives