- Australia

- /

- Renewable Energy

- /

- ASX:LGI

Discovering Berkeley Energia And 2 Other ASX Penny Stocks

Reviewed by Simply Wall St

The Australian market has been experiencing volatility, with the ASX 200 expected to continue its downward trend following a significant selloff influenced by global economic factors. Amidst this turbulence, investors often seek opportunities that offer potential growth at lower entry points. Penny stocks, though an older term, still represent smaller or newer companies that can provide value when backed by strong financials and clear growth strategies.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| Embark Early Education (ASX:EVO) | A$0.76 | A$139.45M | ★★★★☆☆ |

| LaserBond (ASX:LBL) | A$0.55 | A$64.47M | ★★★★★★ |

| MaxiPARTS (ASX:MXI) | A$1.79 | A$99.02M | ★★★★★★ |

| SHAPE Australia (ASX:SHA) | A$2.84 | A$235.47M | ★★★★★★ |

| Helloworld Travel (ASX:HLO) | A$1.92 | A$312.61M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.495 | A$306.97M | ★★★★★☆ |

| Navigator Global Investments (ASX:NGI) | A$1.575 | A$771.88M | ★★★★★☆ |

| EZZ Life Science Holdings (ASX:EZZ) | A$2.92 | A$134.78M | ★★★★★★ |

| SKS Technologies Group (ASX:SKS) | A$1.59 | A$190.52M | ★★★★★★ |

| Vita Life Sciences (ASX:VLS) | A$1.78 | A$99.85M | ★★★★★★ |

Click here to see the full list of 1,052 stocks from our ASX Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Berkeley Energia (ASX:BKY)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Berkeley Energia Limited focuses on the exploration and development of mineral properties in Spain, with a market cap of A$151.57 million.

Operations: Currently, there are no reported revenue segments for the company.

Market Cap: A$151.57M

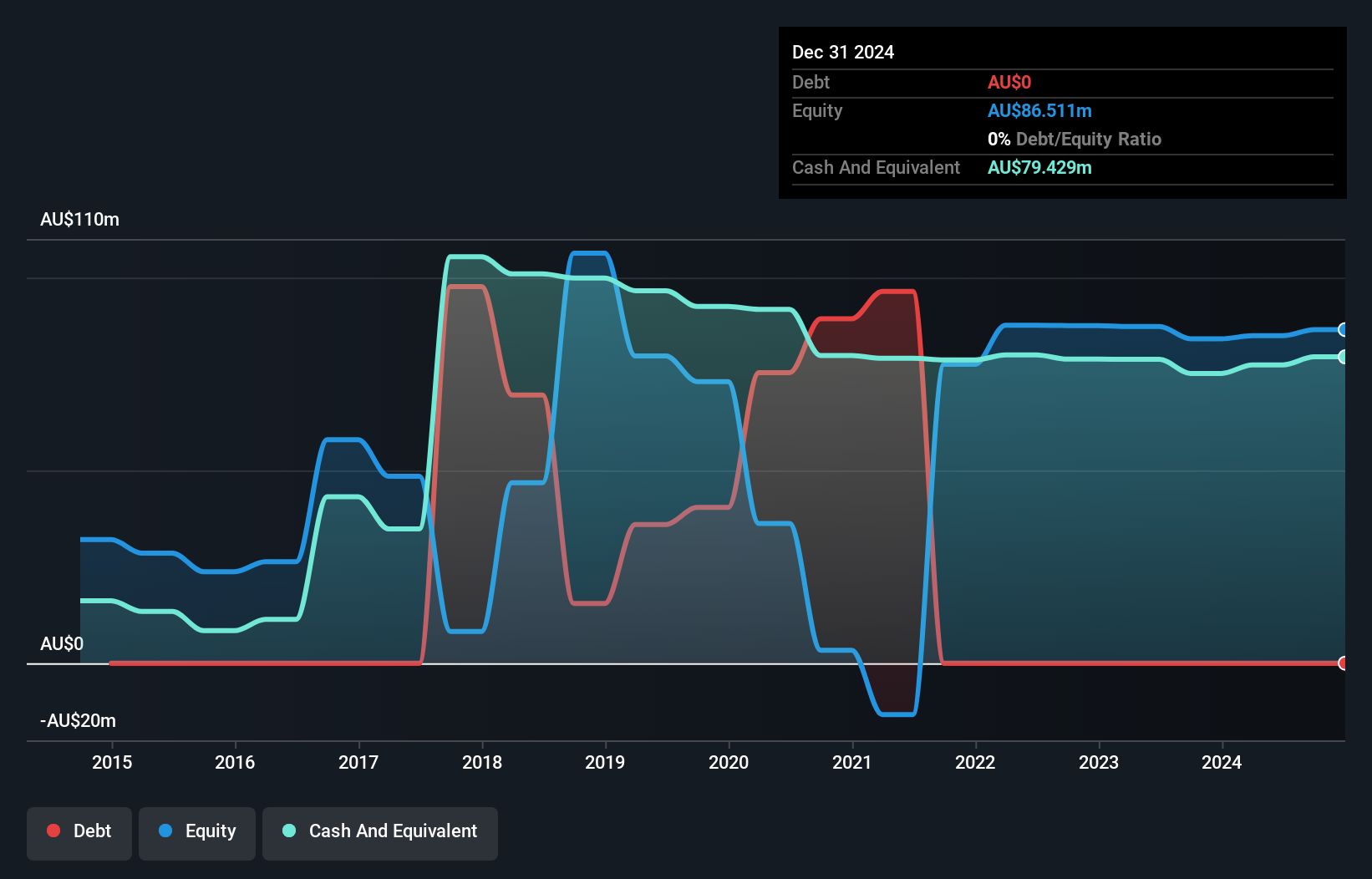

Berkeley Energia is a pre-revenue company with a market cap of A$151.57 million, focusing on mineral exploration in Spain. Despite its lack of revenue, the company has no debt and sufficient cash runway for over three years, assuming continued growth in free cash flow. Its management and board are seasoned, with average tenures of 9.2 and 12.7 years respectively. While the share price has been highly volatile recently, Berkeley's short-term assets significantly exceed its liabilities, providing financial stability amidst ongoing unprofitability and reduced losses over five years at a rate of 25.9% per year.

- Dive into the specifics of Berkeley Energia here with our thorough balance sheet health report.

- Gain insights into Berkeley Energia's historical outcomes by reviewing our past performance report.

Djerriwarrh Investments (ASX:DJW)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Djerriwarrh Investments Limited is a publicly owned investment manager with a market cap of A$841.26 million.

Operations: The company's revenue segment consists solely of its portfolio of investments, generating A$53.38 million.

Market Cap: A$841.26M

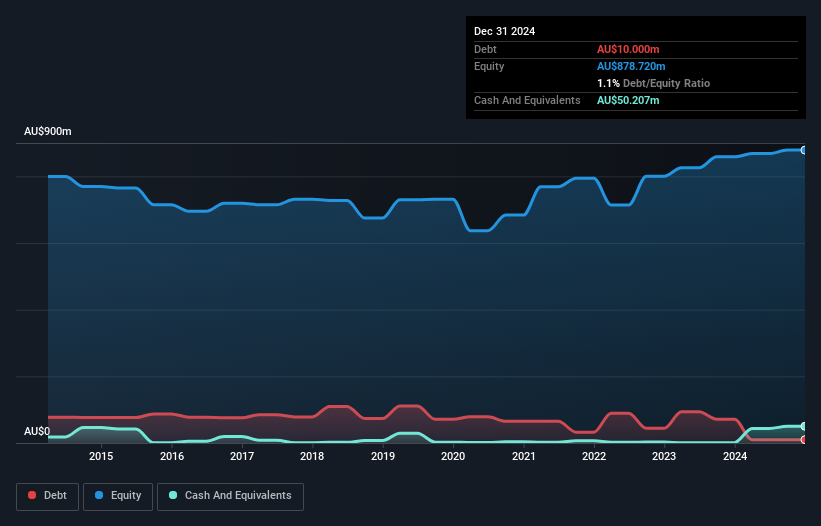

Djerriwarrh Investments, with a market cap of A$841.26 million, is not pre-revenue and generates A$53.38 million from its investment portfolio. The company's debt is well covered by operating cash flow, and it maintains more cash than its total debt, indicating strong financial health. Short-term assets exceed both short- and long-term liabilities, providing liquidity stability. Although the Return on Equity is low at 4.5%, earnings have grown consistently over five years despite negative growth in the past year. The seasoned management team further supports operational stability; however, the dividend yield of 4.78% isn't well covered by earnings or free cash flows.

- Take a closer look at Djerriwarrh Investments' potential here in our financial health report.

- Explore historical data to track Djerriwarrh Investments' performance over time in our past results report.

LGI (ASX:LGI)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: LGI Limited focuses on carbon abatement and renewable energy solutions utilizing biogas from landfill, with a market cap of A$269.98 million.

Operations: The company's revenue is derived from three segments: Carbon Abatement (A$14.63 million), Renewable Energy (A$16.15 million), and Infrastructure Construction and Management (A$2.45 million).

Market Cap: A$269.98M

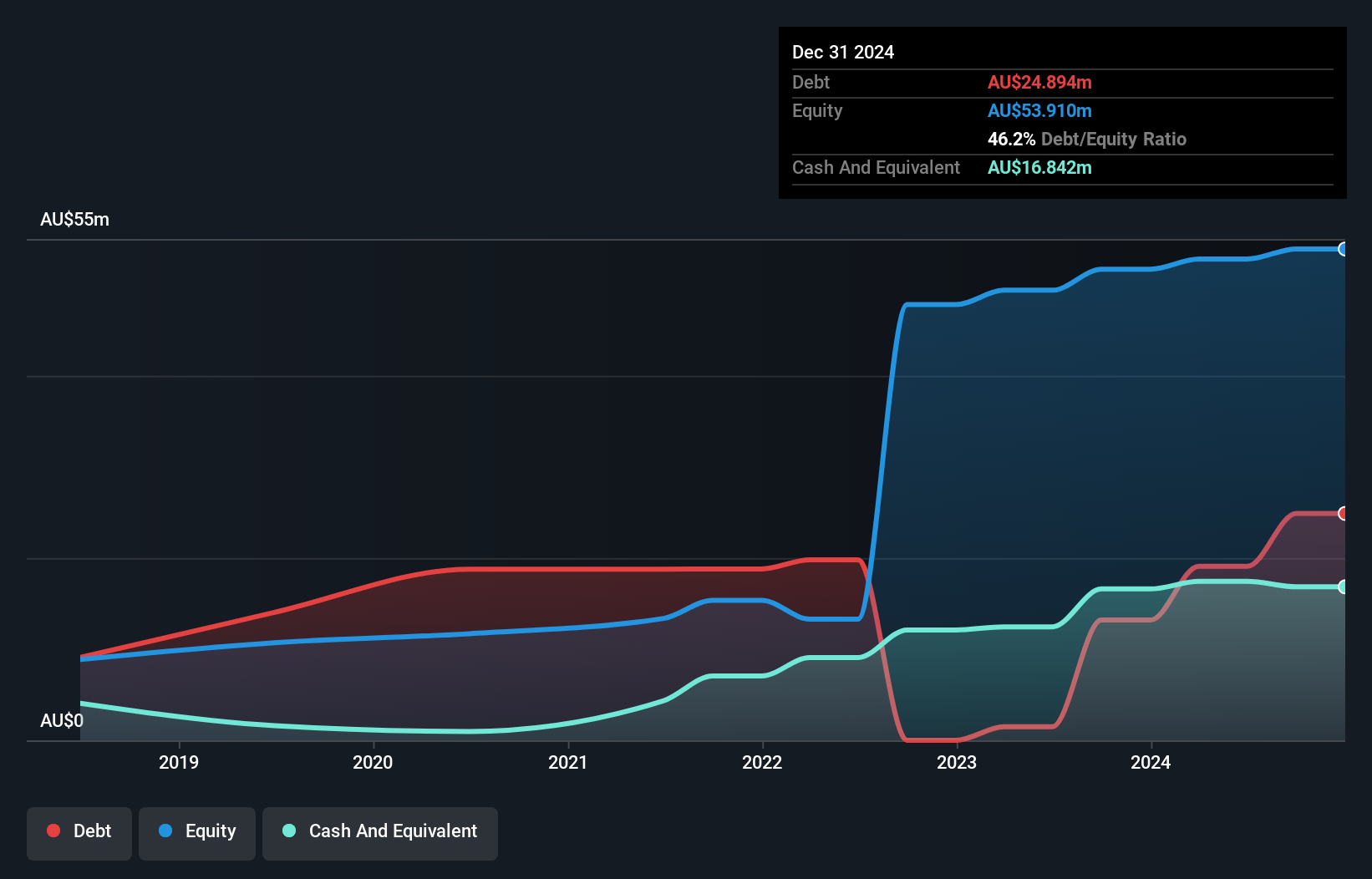

LGI Limited, with a market cap of A$269.98 million, derives revenue from carbon abatement (A$14.63 million), renewable energy (A$16.15 million), and infrastructure construction (A$2.45 million). Despite a low Return on Equity at 12.6%, the company has shown significant earnings growth over five years but slowed to 3.6% last year, still outpacing industry averages. Financial health is supported by well-covered debt through operating cash flow and interest coverage by EBIT, though short-term assets fall short of long-term liabilities coverage. The management team is experienced, and shareholders have not faced dilution recently.

- Unlock comprehensive insights into our analysis of LGI stock in this financial health report.

- Gain insights into LGI's future direction by reviewing our growth report.

Where To Now?

- Unlock our comprehensive list of 1,052 ASX Penny Stocks by clicking here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:LGI

LGI

Provides carbon abatement and renewable energy solutions with biogas from landfill.

Excellent balance sheet with reasonable growth potential.

Market Insights

Community Narratives