Do ClearView Wealth's (ASX:CVW) Earnings Warrant Your Attention?

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

In contrast to all that, many investors prefer to focus on companies like ClearView Wealth (ASX:CVW), which has not only revenues, but also profits. Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

View our latest analysis for ClearView Wealth

How Quickly Is ClearView Wealth Increasing Earnings Per Share?

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS) outcomes. Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. ClearView Wealth's shareholders have have plenty to be happy about as their annual EPS growth for the last 3 years was 38%. Growth that fast may well be fleeting, but it should be more than enough to pique the interest of the wary stock pickers.

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. It's noted that, last year, ClearView Wealth's revenue from operations was lower than its revenue, so that could distort our analysis of its margins. To cut to the chase ClearView Wealth's EBIT margins dropped last year, and so did its revenue. That will not make it easy to grow profits, to say the least.

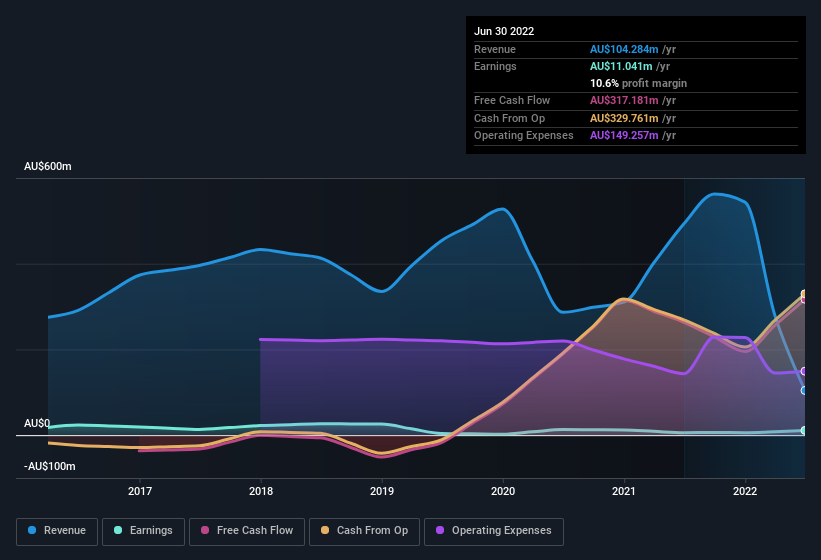

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

ClearView Wealth isn't a huge company, given its market capitalisation of AU$370m. That makes it extra important to check on its balance sheet strength.

Are ClearView Wealth Insiders Aligned With All Shareholders?

It's said that there's no smoke without fire. For investors, insider buying is often the smoke that indicates which stocks could set the market alight. Because often, the purchase of stock is a sign that the buyer views it as undervalued. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

It's nice to see that there have been no reports of any insiders selling shares in ClearView Wealth in the previous 12 months. Add in the fact that Geoff Black, the Independent Chairman of the company, paid AU$25k for shares at around AU$0.49 each. It seems that at least one insider is prepared to show the market there is potential within ClearView Wealth.

Does ClearView Wealth Deserve A Spot On Your Watchlist?

ClearView Wealth's earnings have taken off in quite an impressive fashion. Growth-minded people will be intrigued by the incredible movement in EPS growth. And in fact, it could well signal a fundamental shift in the business economics. If this these factors intrigue you, then an addition of ClearView Wealth to your watchlist won't go amiss. It's still necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with ClearView Wealth (at least 1 which is concerning) , and understanding them should be part of your investment process.

Keen growth investors love to see insider buying. Thankfully, ClearView Wealth isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:CVW

Reasonable growth potential with proven track record.

Similar Companies

Market Insights

Community Narratives