- Australia

- /

- Capital Markets

- /

- ASX:CIN

Carlton Investments And 2 Other Undiscovered Gems In Australia With Strong Potential

Reviewed by Simply Wall St

As the Australian market navigates a mixed landscape with sectors like staples and materials showing resilience, while others like healthcare and IT face challenges, investors are keenly observing small-cap opportunities amidst broader market fluctuations. In this context, identifying promising stocks involves looking for companies that demonstrate strong fundamentals and potential for growth despite current economic headwinds. Carlton Investments and two other lesser-known Australian stocks offer intriguing possibilities worth exploring.

Top 10 Undiscovered Gems With Strong Fundamentals In Australia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Schaffer | 25.47% | 6.03% | -5.20% | ★★★★★★ |

| Sugar Terminals | NA | 3.14% | 3.53% | ★★★★★★ |

| Fiducian Group | NA | 9.97% | 7.85% | ★★★★★★ |

| Djerriwarrh Investments | 1.14% | 8.17% | 7.54% | ★★★★★★ |

| Hearts and Minds Investments | NA | 47.09% | 49.82% | ★★★★★★ |

| Red Hill Minerals | NA | 75.05% | 36.74% | ★★★★★★ |

| Lycopodium | 6.89% | 16.56% | 32.73% | ★★★★★☆ |

| Steamships Trading | 33.60% | 4.17% | 3.90% | ★★★★★☆ |

| Carlton Investments | 0.02% | 4.45% | 3.97% | ★★★★★☆ |

| K&S | 20.24% | 1.58% | 25.54% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

Carlton Investments (ASX:CIN)

Simply Wall St Value Rating: ★★★★★☆

Overview: Carlton Investments Limited is a publicly owned asset management holding company with a market capitalization of A$858.85 million.

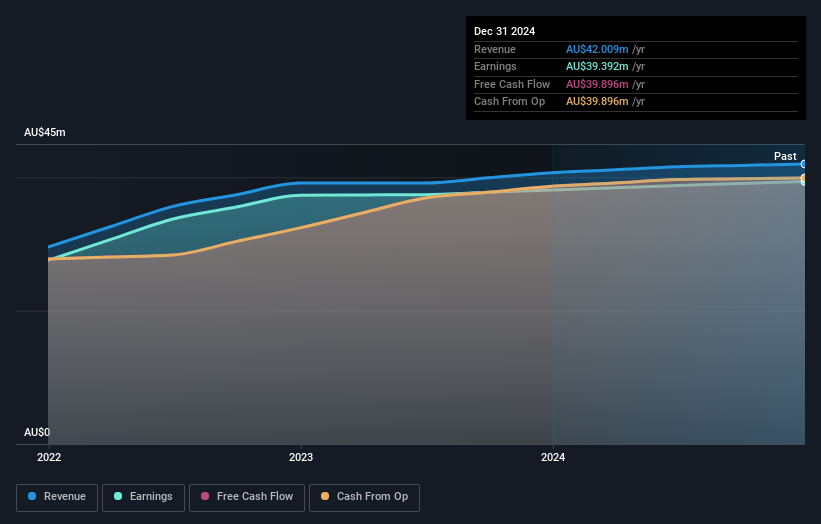

Operations: Carlton Investments generates revenue primarily from the acquisition and long-term holding of shares and units, amounting to A$42 million. The company has a market capitalization of A$858.85 million.

Carlton Investments, a small player in the Australian market, shows a solid financial footing with high-quality earnings and strong debt coverage at 3424x EBIT. Over the past five years, its earnings have grown at 4% annually. Recent half-year results reported A$21.89 million in revenue and A$20.3 million net income, up from last year’s figures of A$21.46 million and A$19.68 million respectively, reflecting steady growth despite trailing behind industry averages. The company also concluded a buyback plan in late 2024, suggesting confidence in its valuation amidst consistent profitability and positive free cash flow generation.

Navigator Global Investments (ASX:NGI)

Simply Wall St Value Rating: ★★★★★☆

Overview: Navigator Global Investments, operating as HFA Holdings Limited, is a fund management company based in Australia with a market capitalization of A$980.16 million.

Operations: HFA Holdings Limited generates revenue primarily from its Lighthouse segment, contributing $137.95 million. The company has a market capitalization of A$980.16 million.

Navigator Global Investments, a fund management firm in Australia, is making waves with its diversified asset portfolio and innovative strategies in commodities and real estate. The company reported impressive results for the half-year ending December 31, 2024, with revenue jumping to US$148.06 million from US$105.9 million a year ago and net income soaring to US$68.79 million from US$9.98 million. This growth was bolstered by a significant one-off gain of A$53.8M impacting earnings positively over the past year, though future profit margins could face pressure due to rising costs and competitive challenges in talent acquisition and fee structures within the industry. Additionally, Navigator's debt-to-equity ratio has risen modestly to 2.4% over five years while maintaining more cash than total debt, indicating financial stability despite these pressures.

United Overseas Australia (ASX:UOS)

Simply Wall St Value Rating: ★★★★★☆

Overview: United Overseas Australia Ltd, along with its subsidiaries, focuses on the development and resale of land and buildings across Malaysia, Singapore, Vietnam, and Australia with a market capitalization of A$983.58 million.

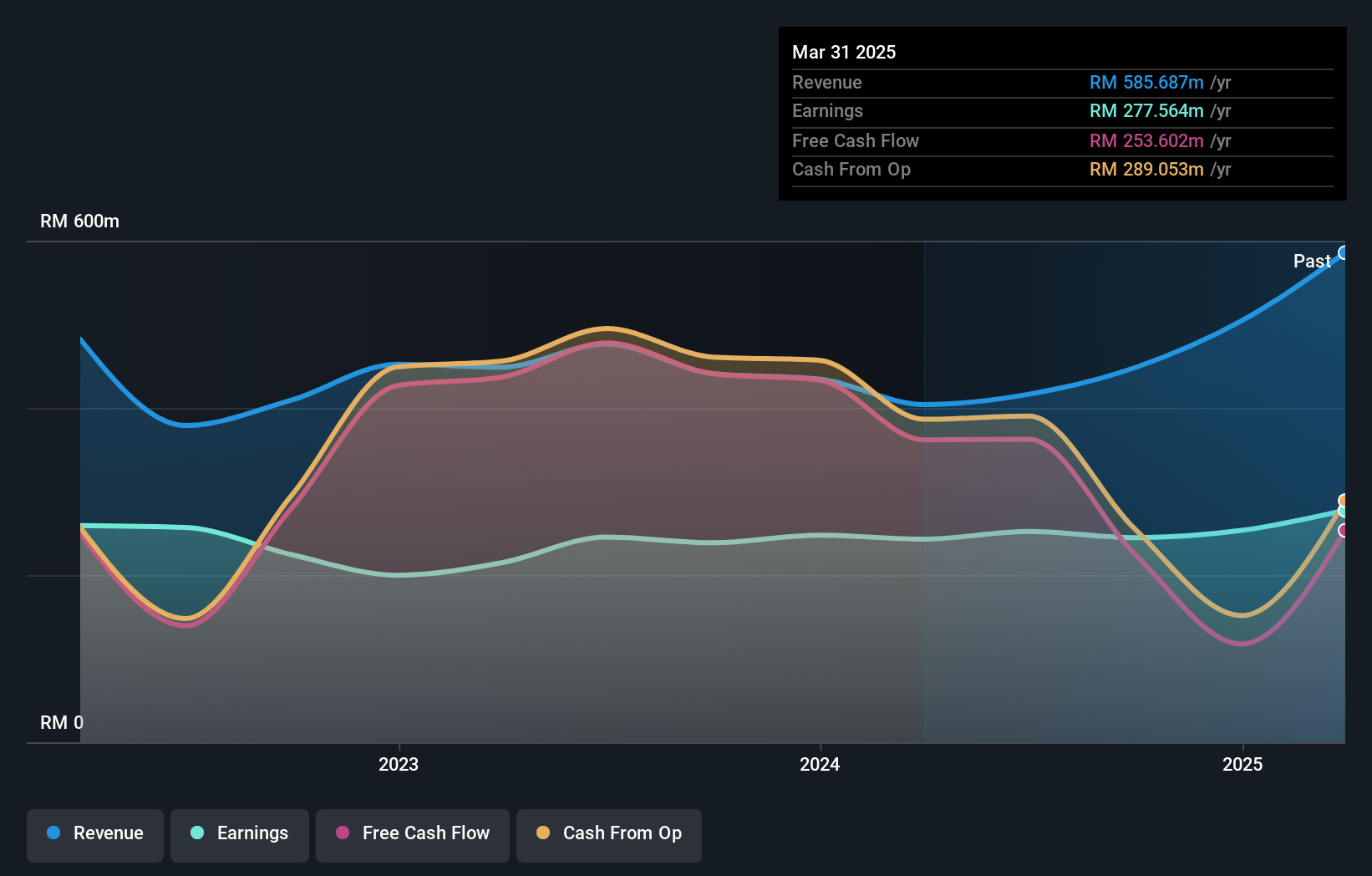

Operations: United Overseas Australia's revenue is primarily derived from the development and resale of land and buildings. The company operates in Malaysia, Singapore, Vietnam, and Australia.

United Overseas Australia, a smaller player in the real estate sector, has shown notable resilience with earnings growing 15.6% in the past year, outpacing the industry average of -8.3%. The company reported net income of A$91.57 million for 2024, up from A$79.22 million previously, reflecting its high-quality earnings and effective cost management. Despite an increase in debt-to-equity ratio from 5.6% to 9.1% over five years, UOS maintains a favorable position with more cash than total debt and a price-to-earnings ratio of 10.7x compared to the market's 18.3x, indicating potential value for investors.

Next Steps

- Delve into our full catalog of 50 ASX Undiscovered Gems With Strong Fundamentals here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:CIN

Carlton Investments

Carlton Investments Limited is a publicly owned asset management holding company.

Excellent balance sheet average dividend payer.

Market Insights

Community Narratives