- Australia

- /

- Capital Markets

- /

- ASX:ASX

ASX Limited (ASX:ASX): Exploring Valuation as Rate Cut Hopes and Banking Regulation Shape Market Sentiment

Reviewed by Simply Wall St

ASX Limited (ASX:ASX) is catching attention as Australian shares respond to positive momentum from Wall Street and speculation around a potential US interest rate cut. Local traders are also monitoring new banking regulations and sector scrutiny.

See our latest analysis for ASX.

ASX’s share price has edged up over the past month, reflecting improved sentiment across the Australian financial sector as rate cut hopes and regulatory headlines dominate the discussion. However, momentum remains subdued, with the one-year total shareholder return sitting at -8.9%. This indicates that investors are still weighing up long-term risks versus growth potential.

If you’re interested in uncovering stocks that are making waves for other reasons, consider broadening your search and discovering fast growing stocks with high insider ownership.

With ASX shares ticking higher but long-term returns still lagging, the big question for investors is whether the stock is trading at a bargain or if the market has already factored in future growth prospects.

Most Popular Narrative: 10.5% Undervalued

Compared to ASX’s last close price of A$58.20, the most popular narrative’s fair value estimate stands higher at A$65.00. This sets the tone for investor optimism amid ongoing sector transformation and digital expansion.

Expansion and demand in high-margin technology and data offerings, driven by appetite for analytics, connectivity, and market information from both domestic and global market participants, provides opportunity for recurring, diversified non-transactional income, supporting overall margin expansion and earnings stability.

Curious what powers this bullish price call? One bold assumption underpins the valuation: a future profit multiple worthy of elite market operators. Want to discover which closely-watched metrics are driving the projected premium? Dive into the narrative and spot the number that could justify such upside.

Result: Fair Value of $65.00 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent cost pressures and ongoing regulatory scrutiny remain key risks that could dampen margin expansion and limit earnings growth moving forward.

Find out about the key risks to this ASX narrative.

Another View: Price-To-Earnings Perspective

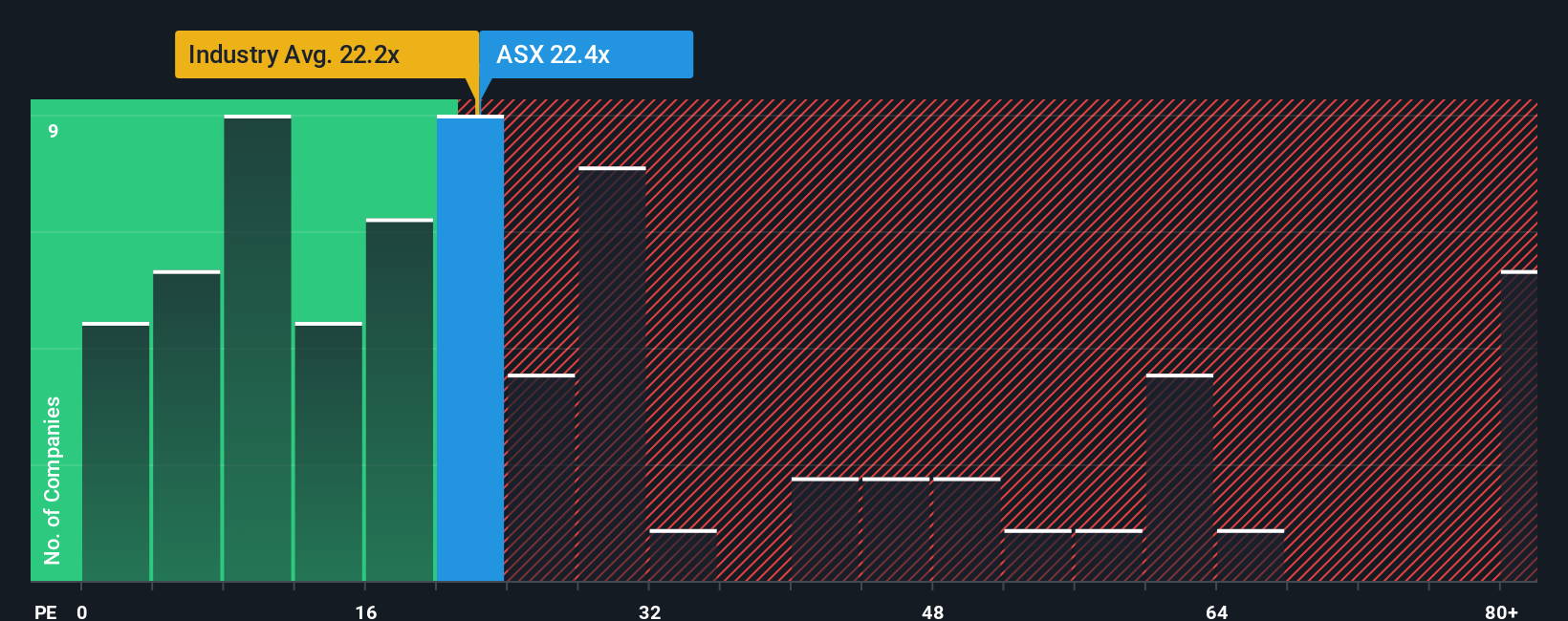

Looking through the lens of price-to-earnings, ASX’s ratio sits at 22.5x, nearly matching the industry average of 22.4x. This figure is well above its own fair ratio of 16.5x. While the company appears inexpensive compared to historical peer extremes, it may carry valuation risk if the market returns to that lower fair ratio. Does this highlight hidden caution or unrecognized value?

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out ASX for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 923 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own ASX Narrative

Prefer a different perspective or want to dig into the numbers yourself? You can craft your own personalized view in just minutes: Do it your way.

A great starting point for your ASX research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t limit your portfolio; tap into more opportunities using our screeners. Uncover stocks with explosive growth potential, breakthrough tech, and resilient dividends waiting to boost your returns.

- Catalyze your gains by tracking these 3579 penny stocks with strong financials, which could be poised for rapid moves and dramatic upside.

- Spot the innovators transforming artificial intelligence by checking out these 25 AI penny stocks, which are setting new standards in automation and smart solutions.

- Sustain your income with these 15 dividend stocks with yields > 3%, built for attractive yields well above market averages.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:ASX

ASX

Operates as a multi-asset class and integrated exchange company in Australia and internationally.

Excellent balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

CEO: We are winners in the long term in the AI world

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.