- Australia

- /

- Capital Markets

- /

- ASX:AFI

Do These 3 Checks Before Buying Australian Foundation Investment Company Limited (ASX:AFI) For Its Upcoming Dividend

Readers hoping to buy Australian Foundation Investment Company Limited (ASX:AFI) for its dividend will need to make their move shortly, as the stock is about to trade ex-dividend. The ex-dividend date is one business day before a company's record date, which is the date on which the company determines which shareholders are entitled to receive a dividend. It is important to be aware of the ex-dividend date because any trade on the stock needs to have been settled on or before the record date. Therefore, if you purchase Australian Foundation Investment's shares on or after the 14th of August, you won't be eligible to receive the dividend, when it is paid on the 30th of August.

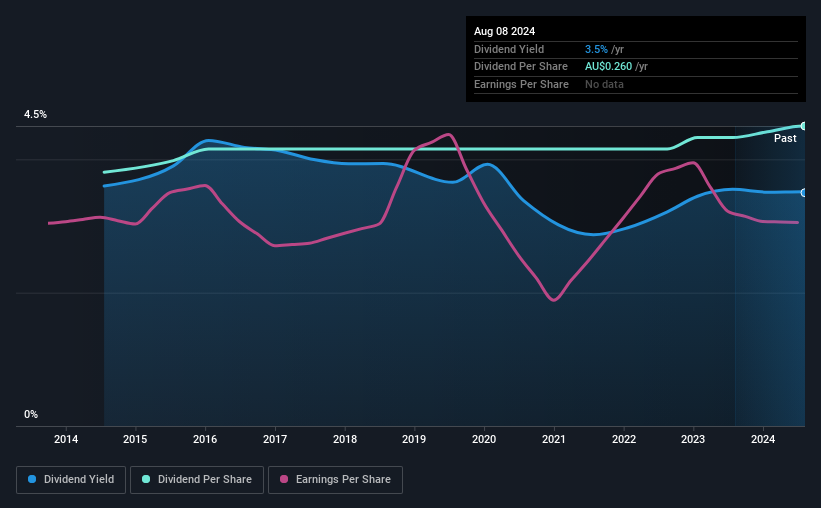

The company's next dividend payment will be AU$0.145 per share, on the back of last year when the company paid a total of AU$0.26 to shareholders. Looking at the last 12 months of distributions, Australian Foundation Investment has a trailing yield of approximately 3.5% on its current stock price of AU$7.43. Dividends are an important source of income to many shareholders, but the health of the business is crucial to maintaining those dividends. We need to see whether the dividend is covered by earnings and if it's growing.

View our latest analysis for Australian Foundation Investment

If a company pays out more in dividends than it earned, then the dividend might become unsustainable - hardly an ideal situation. Australian Foundation Investment paid out 109% of its earnings, which is more than we're comfortable with, unless there are mitigating circumstances.

When a company pays out a dividend that is not well covered by profits, the dividend is generally seen as more vulnerable to being cut.

Have Earnings And Dividends Been Growing?

When earnings decline, dividend companies become much harder to analyse and own safely. If earnings fall far enough, the company could be forced to cut its dividend. Readers will understand then, why we're concerned to see Australian Foundation Investment's earnings per share have dropped 7.0% a year over the past five years. Such a sharp decline casts doubt on the future sustainability of the dividend.

Another key way to measure a company's dividend prospects is by measuring its historical rate of dividend growth. Since the start of our data, 10 years ago, Australian Foundation Investment has lifted its dividend by approximately 1.7% a year on average.

Final Takeaway

From a dividend perspective, should investors buy or avoid Australian Foundation Investment? Earnings per share are in decline and Australian Foundation Investment is paying out what we feel is an uncomfortably high percentage of its profit as dividends. Generally we think dividend investors should avoid businesses in this situation, as high payout ratios and declining earnings can lead to the dividend being cut. All things considered, we're not optimistic about its dividend prospects, and would be inclined to leave it on the shelf for now.

So if you're still interested in Australian Foundation Investment despite it's poor dividend qualities, you should be well informed on some of the risks facing this stock. To help with this, we've discovered 1 warning sign for Australian Foundation Investment that you should be aware of before investing in their shares.

A common investing mistake is buying the first interesting stock you see. Here you can find a full list of high-yield dividend stocks.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:AFI

Adequate balance sheet second-rate dividend payer.