- Australia

- /

- Diversified Financial

- /

- ASX:AFG

Most Shareholders Will Probably Find That The CEO Compensation For Australian Finance Group Limited (ASX:AFG) Is Reasonable

Key Insights

- Australian Finance Group to hold its Annual General Meeting on 17th of October

- CEO David Bailey's total compensation includes salary of AU$623.6k

- The total compensation is similar to the average for the industry

- Over the past three years, Australian Finance Group's EPS fell by 3.7% and over the past three years, the total shareholder return was 73%

The share price of Australian Finance Group Limited (ASX:AFG) has increased significantly over the past few years. However, the earnings growth has not kept up with the share price momentum, suggesting that some other factors may be driving the price direction. The upcoming AGM on 17th of October may be an opportunity for shareholders to bring up any concerns they may have for the board’s attention. They will be able to influence managerial decisions through the exercise of their voting power on resolutions, such as CEO remuneration and other matters, which may influence future company prospects. In our analysis below, we show why shareholders may consider holding off a raise for the CEO's compensation until company performance improves.

Check out our latest analysis for Australian Finance Group

Comparing Australian Finance Group Limited's CEO Compensation With The Industry

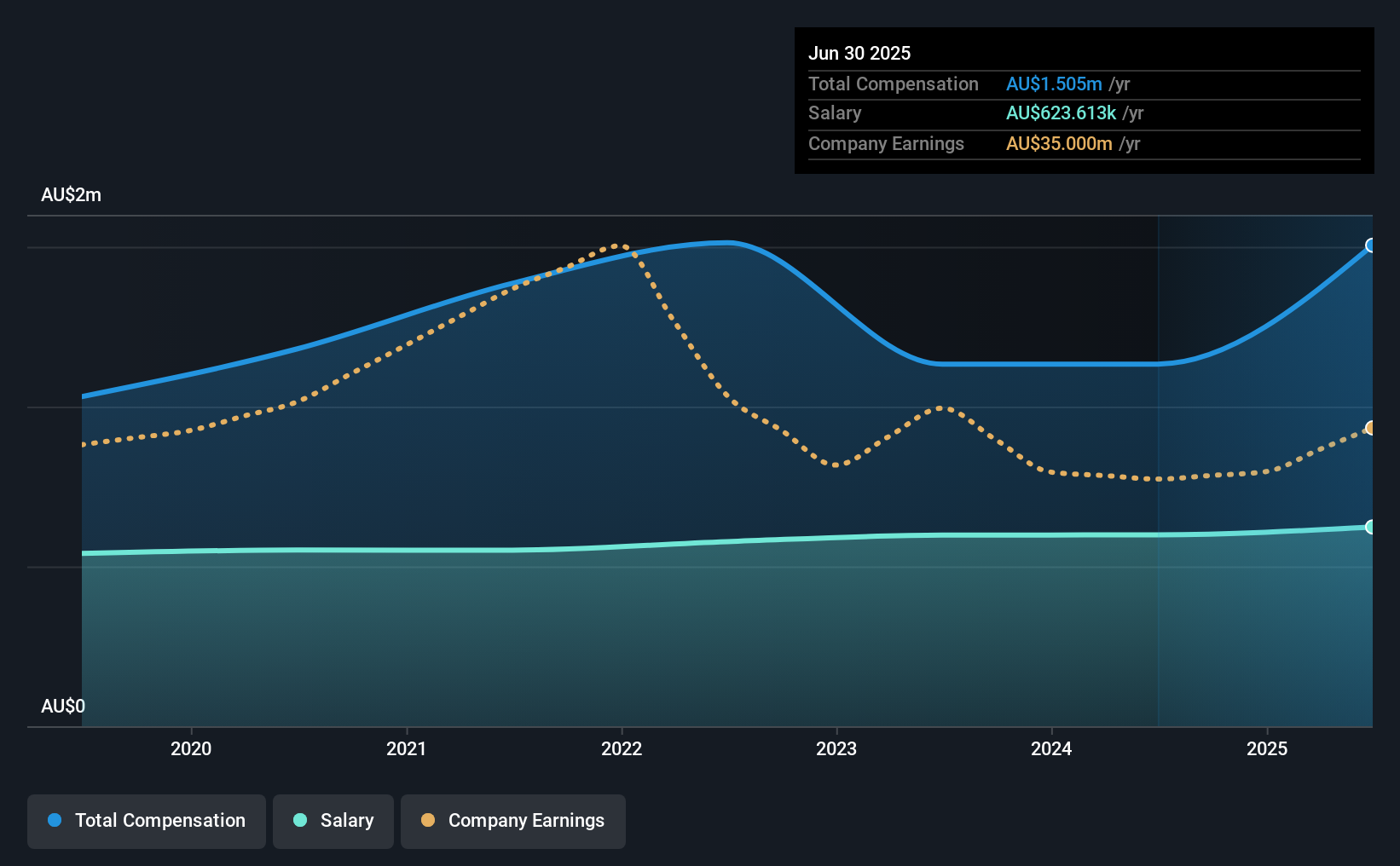

Our data indicates that Australian Finance Group Limited has a market capitalization of AU$688m, and total annual CEO compensation was reported as AU$1.5m for the year to June 2025. Notably, that's an increase of 33% over the year before. While we always look at total compensation first, our analysis shows that the salary component is less, at AU$624k.

In comparison with other companies in the Australian Diversified Financial industry with market capitalizations ranging from AU$308m to AU$1.2b, the reported median CEO total compensation was AU$1.2m. This suggests that Australian Finance Group remunerates its CEO largely in line with the industry average. Furthermore, David Bailey directly owns AU$5.2m worth of shares in the company, implying that they are deeply invested in the company's success.

| Component | 2025 | 2024 | Proportion (2025) |

| Salary | AU$624k | AU$599k | 41% |

| Other | AU$881k | AU$534k | 59% |

| Total Compensation | AU$1.5m | AU$1.1m | 100% |

Talking in terms of the industry, salary represented approximately 64% of total compensation out of all the companies we analyzed, while other remuneration made up 36% of the pie. It's interesting to note that Australian Finance Group allocates a smaller portion of compensation to salary in comparison to the broader industry. If non-salary compensation dominates total pay, it's an indicator that the executive's salary is tied to company performance.

A Look at Australian Finance Group Limited's Growth Numbers

Over the last three years, Australian Finance Group Limited has shrunk its earnings per share by 3.7% per year. Its revenue is up 15% over the last year.

The decline in EPS is a bit concerning. And while it's good to see some good revenue growth recently, the growth isn't really fast enough for us to put aside my concerns around EPS. These factors suggest that the business performance wouldn't really justify a high pay packet for the CEO. Historical performance can sometimes be a good indicator on what's coming up next but if you want to peer into the company's future you might be interested in this free visualization of analyst forecasts.

Has Australian Finance Group Limited Been A Good Investment?

Most shareholders would probably be pleased with Australian Finance Group Limited for providing a total return of 73% over three years. As a result, some may believe the CEO should be paid more than is normal for companies of similar size.

To Conclude...

While the return to shareholders does look promising, it's hard to ignore the lack of earnings growth and this makes us question whether these strong returns will continue. In the upcoming AGM, shareholders will get the opportunity to discuss any concerns with the board, including those related to CEO remuneration and assess if the board's plan will likely improve performance in the future.

It is always advisable to analyse CEO pay, along with performing a thorough analysis of the company's key performance areas. That's why we did our research, and identified 3 warning signs for Australian Finance Group (of which 1 is concerning!) that you should know about in order to have a holistic understanding of the stock.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:AFG

Australian Finance Group

Engages in the mortgage broking business in Australia.

Reasonable growth potential with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.