- Australia

- /

- Hospitality

- /

- ASX:WEB

Will Web Travel Group's (ASX:WEB) Incentive Plan Shape Its B2B Ambitions and Talent Edge?

Reviewed by Sasha Jovanovic

- Web Travel Group Limited recently issued 2,717,954 performance rights under its employee incentive scheme, aligning with its ongoing efforts to attract and retain key talent in the company.

- This move follows the company's demerger from Webjet Ltd and reflects its B2B platform focus, which has contributed to improvements in operational efficiency and strong growth in bookings and transaction value.

- We'll assess how the new employee incentive scheme supports talent retention and strengthens Web Travel Group's updated investment outlook.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Web Travel Group Investment Narrative Recap

To be a shareholder in Web Travel Group, you need to believe in the long-term advantages of its B2B travel platform and its ability to convert strong transaction growth into sustained profitability, despite ongoing margin pressures. The new issuance of 2,717,954 performance rights under its employee incentive scheme is unlikely to materially change the most important short-term catalyst, conversion of robust total transaction value (TTV) into meaningful revenue growth, or the biggest risk, which remains margin erosion due to rising corporate expenses and cost integration post-demerger.

Among recent announcements, the completion of a A$150 million share buyback stands out, supporting the short-term investment outlook by managing capital structure and potentially boosting earnings per share. This connects closely to the ongoing catalyst of scaling TTV, though margin improvement will be crucial before investors see the real benefit of such capital actions reflected in returns.

By contrast, investors should also note the risk from increasing operating costs linked to the new cost structure, especially if...

Read the full narrative on Web Travel Group (it's free!)

Web Travel Group's narrative projects A$496.4 million revenue and A$123.4 million earnings by 2028. This requires 14.8% yearly revenue growth and a A$112.3 million earnings increase from A$11.1 million today.

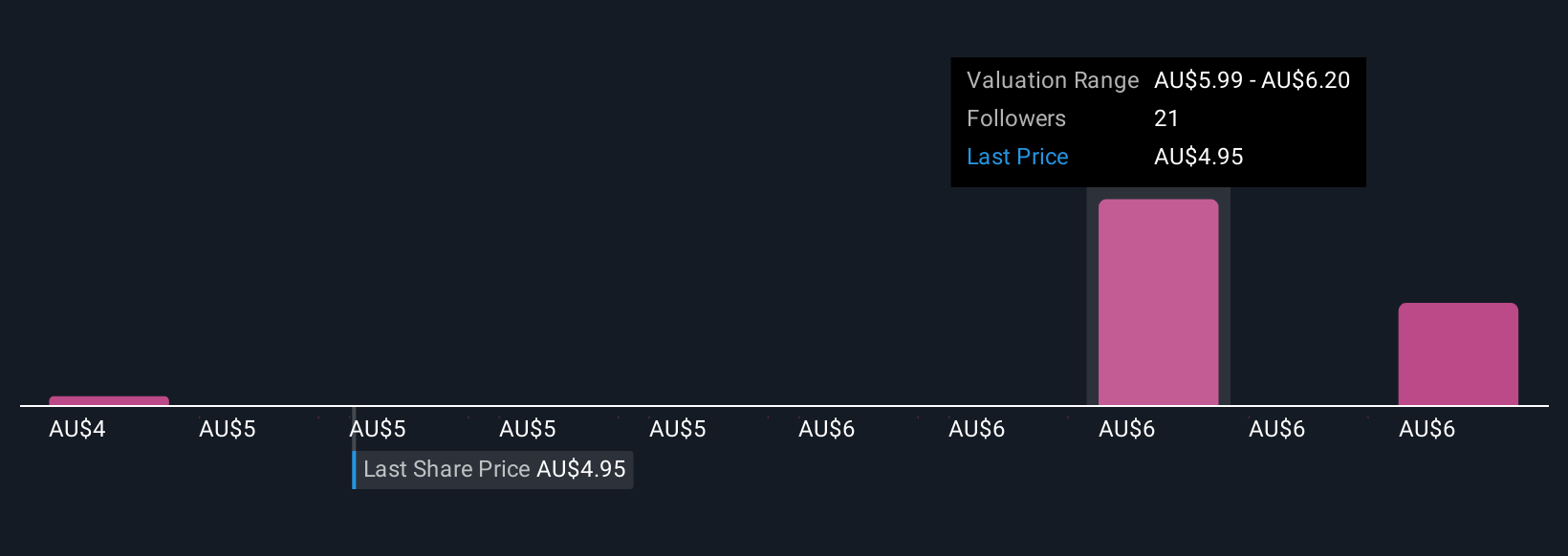

Uncover how Web Travel Group's forecasts yield a A$6.05 fair value, a 36% upside to its current price.

Exploring Other Perspectives

Six individual fair value estimates from the Simply Wall St Community for Web Travel Group range from A$4.48 to A$11.02 per share. With margin erosion posing a real risk to earnings, the diversity of these opinions shows how differently market participants assess the company’s path to sustainable profitability, make sure to explore the full set of perspectives before drawing a conclusion.

Explore 6 other fair value estimates on Web Travel Group - why the stock might be worth over 2x more than the current price!

Build Your Own Web Travel Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Web Travel Group research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Web Travel Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Web Travel Group's overall financial health at a glance.

No Opportunity In Web Travel Group?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

- Rare earth metals are the new gold rush. Find out which 35 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Web Travel Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:WEB

Web Travel Group

Provides online travel booking services in Australia, the United Arab Emirates, the United Kingdom, and internationally.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)