- Australia

- /

- Office REITs

- /

- ASX:CMW

Undervalued Small Caps With Insider Action On ASX In December 2024

Reviewed by Simply Wall St

The Australian market is feeling the ripple effects of Wall Street's reaction to the Federal Reserve's cautious stance on U.S. interest rates, with ASX 200 futures expected to open lower amid global economic uncertainty. As inflation expectations and commodity prices fluctuate, investors are keeping a keen eye on small-cap stocks that might offer resilience and potential value in these volatile conditions. In this environment, identifying small-cap stocks with insider action can provide insights into potential opportunities.

Top 10 Undervalued Small Caps With Insider Buying In Australia

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Infomedia | 40.9x | 3.7x | 37.75% | ★★★★★★ |

| Magellan Financial Group | 8.2x | 5.2x | 31.52% | ★★★★★☆ |

| Centuria Capital Group | 20.7x | 4.6x | 47.37% | ★★★★☆☆ |

| Abacus Group | NA | 5.4x | 25.84% | ★★★★☆☆ |

| Healius | NA | 0.6x | 11.77% | ★★★★☆☆ |

| Tabcorp Holdings | NA | 0.6x | 6.80% | ★★★★☆☆ |

| Corporate Travel Management | 21.8x | 2.6x | 46.89% | ★★★☆☆☆ |

| BSP Financial Group | 7.9x | 2.8x | 0.02% | ★★★☆☆☆ |

| Eureka Group Holdings | 19.8x | 6.3x | 26.93% | ★★★☆☆☆ |

| Cromwell Property Group | NA | 4.6x | -15.03% | ★★★☆☆☆ |

Let's dive into some prime choices out of from the screener.

Cromwell Property Group (ASX:CMW)

Simply Wall St Value Rating: ★★★☆☆☆

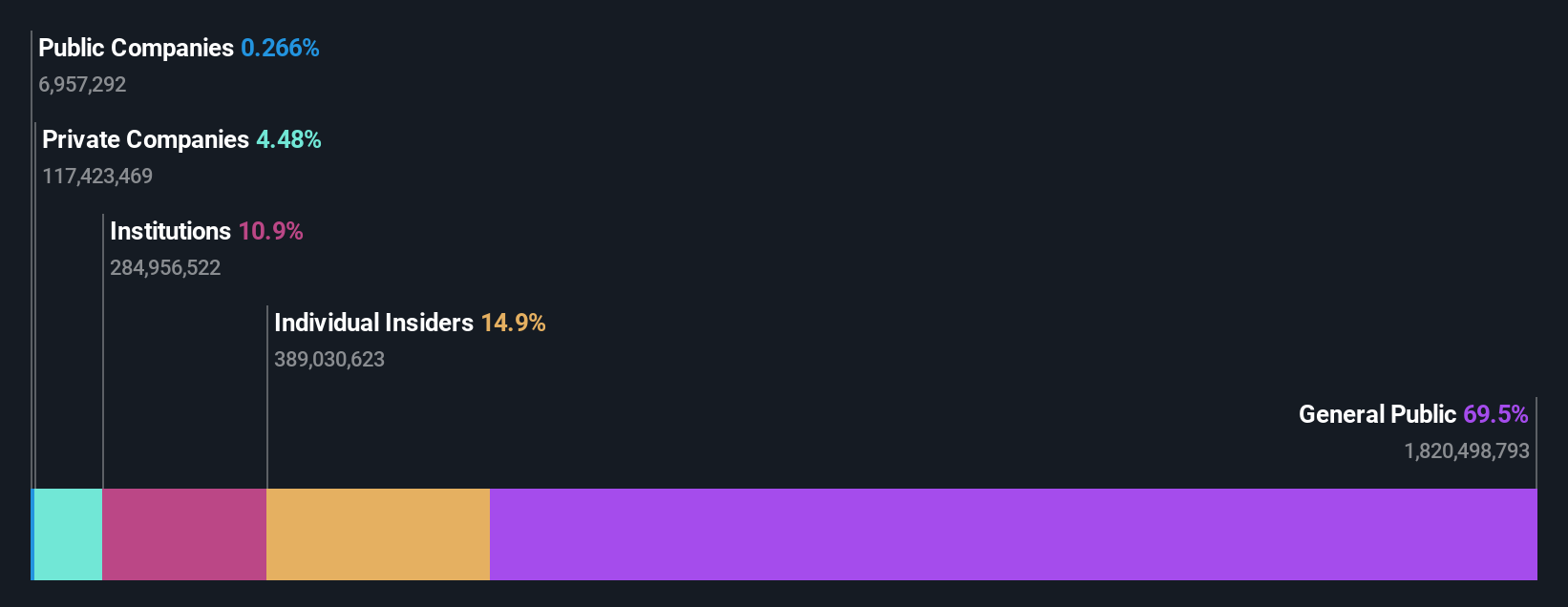

Overview: Cromwell Property Group is a real estate investment and funds management company with operations focused on property investment and management, having a market capitalization of approximately A$2.29 billion.

Operations: The company's revenue streams primarily include Co-Investments, Investment Portfolio, and Funds and Asset Management. Over recent periods, the gross profit margin has shown a decline from 89.21% to 82.84%. Operating expenses have been significant, with notable non-operating expenses impacting net income margins negatively in recent quarters.

PE: -3.6x

Cromwell Property Group, a smaller player in Australia's market, is attracting attention due to its perceived lower market valuation. Despite the challenges of covering interest payments with earnings and relying entirely on external borrowing for funding, insider confidence shines as key individuals have been purchasing shares from June to September 2024. The company recently affirmed a cash dividend of A$0.0075 per share for Q3 2024, hinting at stable income prospects amidst projected earnings growth of 45.93% annually.

- Click to explore a detailed breakdown of our findings in Cromwell Property Group's valuation report.

Understand Cromwell Property Group's track record by examining our Past report.

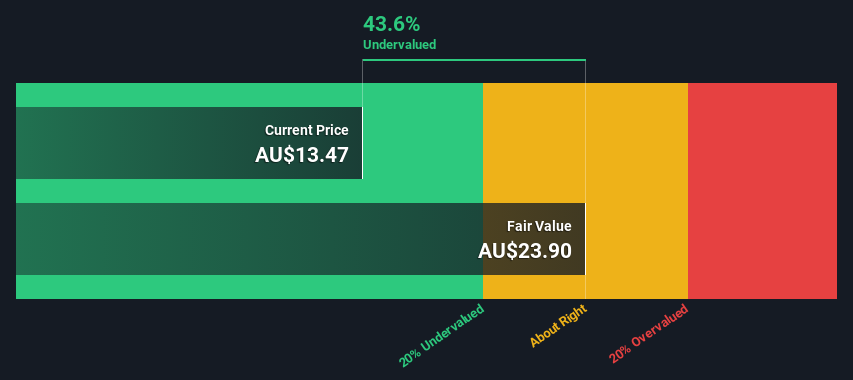

Monadelphous Group (ASX:MND)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Monadelphous Group is an Australian engineering company specializing in engineering construction and maintenance services, with a market capitalization of A$1.35 billion.

Operations: Monadelphous Group's revenue primarily stems from its Maintenance and Industrial Services segment, contributing A$1.32 billion, followed by Engineering Construction with A$712.70 million. The company's gross profit margin has shown an upward trend, reaching 7.10% as of June 2024. Operating expenses have been relatively stable around the A$59 million to A$60 million range in recent periods, impacting net income margins which were recorded at approximately 3.09%.

PE: 21.3x

Monadelphous Group, a smaller Australian company, is capturing attention with its projected 8.18% annual earnings growth and insider confidence shown through recent share purchases. The company has announced revenue guidance for fiscal year 2025, expecting high single-digit growth driven by increased activity levels. Despite relying on external borrowing for funding, Monadelphous plans to leverage its strong balance sheet to explore acquisitions aimed at service expansion and market diversification, indicating potential long-term sustainable growth in the industry.

- Get an in-depth perspective on Monadelphous Group's performance by reading our valuation report here.

Explore historical data to track Monadelphous Group's performance over time in our Past section.

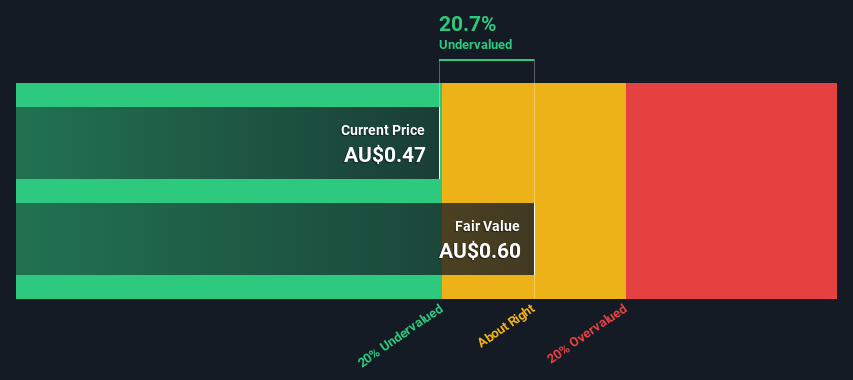

Tabcorp Holdings (ASX:TAH)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Tabcorp Holdings is an Australian company primarily involved in gaming services and wagering and media operations, with a market cap of approximately A$4.29 billion.

Operations: The company generates revenue primarily from Wagering and Media, with a smaller contribution from Gaming Services. Over recent periods, the gross profit margin has consistently been at 100%, indicating that all revenue translates directly into gross profit. However, the net income margin has varied significantly, reflecting fluctuations in non-operating expenses and operating costs such as sales and marketing.

PE: -1.0x

Tabcorp Holdings, a smaller player in Australia's market, is catching attention with insider confidence as an executive recently purchased 250,000 shares for A$215,000. This move suggests belief in the company's potential despite past shareholder dilution and reliance on higher-risk external borrowing. With earnings projected to grow by 113% annually and an upcoming Q1 2025 results announcement on December 6, there's interest in how Tabcorp navigates its financial challenges while aiming for growth.

Taking Advantage

- Investigate our full lineup of 22 Undervalued ASX Small Caps With Insider Buying right here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:CMW

Cromwell Property Group

Cromwell Property Group (ASX:CMW) is a real estate investor and fund manager with operations on three continents and a global investor base.

Second-rate dividend payer low.