- United Kingdom

- /

- Biotech

- /

- LSE:GNS

Top 3 Undervalued Small Caps With Insider Buying To Watch

Reviewed by Simply Wall St

As global markets grapple with economic slowdown worries and the S&P 500 Index experiences its sharpest weekly decline in 18 months, small-cap stocks are not immune to these broader market sentiments. With fewer job openings signaling a weakening U.S. labor market and heightened investor nervousness, identifying undervalued opportunities becomes crucial. In such a volatile environment, stocks that exhibit strong fundamentals combined with insider buying can present compelling investment opportunities.

Top 10 Undervalued Small Caps With Insider Buying

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Bytes Technology Group | 22.9x | 5.2x | 18.73% | ★★★★★☆ |

| Essentra | 771.1x | 1.5x | 42.70% | ★★★★★☆ |

| Genus | 160.2x | 1.9x | 2.21% | ★★★★★☆ |

| Delek US Holdings | NA | 0.1x | 22.88% | ★★★★★☆ |

| CVS Group | 22.8x | 1.3x | 40.27% | ★★★★☆☆ |

| Primaris Real Estate Investment Trust | 12.3x | 3.3x | 40.66% | ★★★★☆☆ |

| German American Bancorp | 13.7x | 4.6x | 47.35% | ★★★☆☆☆ |

| MYR Group | 31.5x | 0.4x | 47.17% | ★★★☆☆☆ |

| Studsvik | 20.3x | 1.2x | 42.39% | ★★★☆☆☆ |

| Community West Bancshares | 18.7x | 2.9x | 42.25% | ★★★☆☆☆ |

We'll examine a selection from our screener results.

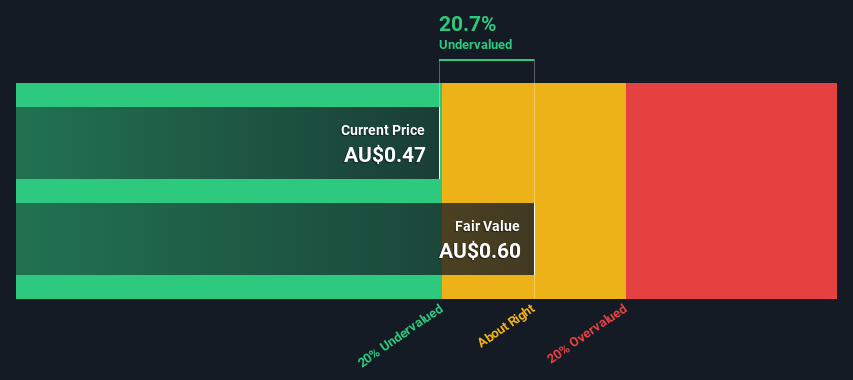

Tabcorp Holdings (ASX:TAH)

Simply Wall St Value Rating: ★★★★★☆

Overview: Tabcorp Holdings operates in gaming services and wagering and media, with a market cap of approximately A$4.38 billion.

Operations: Tabcorp Holdings generates revenue primarily from Wagering and Media ($2.16 billion) and Gaming Services ($176.1 million). The company has seen fluctuations in its net income margin, with a notable drop to -57.63% as of September 2024. Operating expenses have remained significant, often surpassing $2 billion annually, impacting overall profitability despite consistently high gross profit margins of 100%.

PE: -0.7x

Tabcorp Holdings, a small-cap stock, has seen significant insider confidence with share purchases in the last quarter. Despite reporting a net loss of A$1.36 billion for the year ending June 30, 2024, compared to net income of A$66.5 million the previous year, earnings are forecasted to grow by 117.91% annually. The company’s recent dividend decrease to A$0.003 per share and its reliance on external borrowing highlight both challenges and potential for future growth in this sector.

- Navigate through the intricacies of Tabcorp Holdings with our comprehensive valuation report here.

Review our historical performance report to gain insights into Tabcorp Holdings''s past performance.

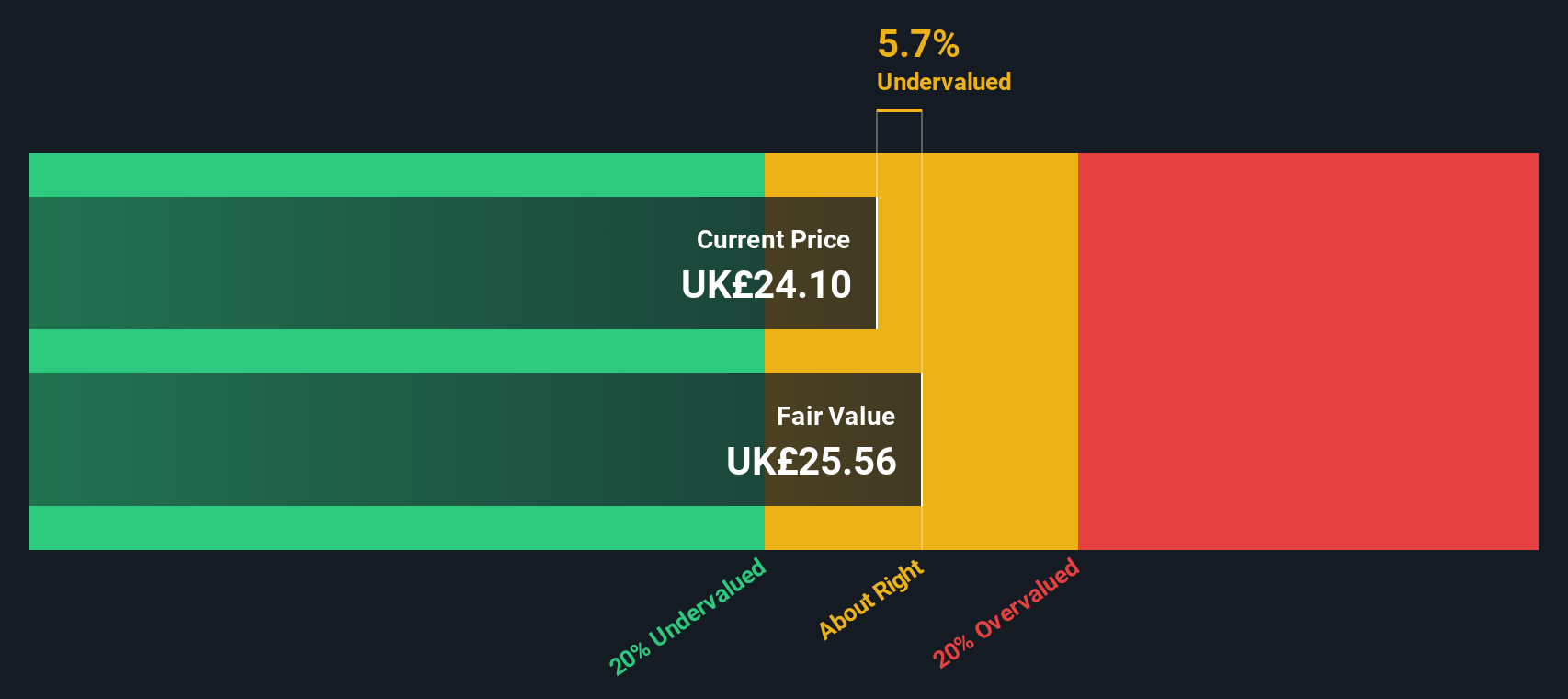

Genus (LSE:GNS)

Simply Wall St Value Rating: ★★★★★☆

Overview: Genus is a biotechnology company focused on animal genetics, with operations in bovine and porcine sectors, and has a market cap of £2.50 billion.

Operations: Genus generates revenue primarily from its Genus ABS and Genus PIC segments, with the latter contributing more significantly. The company's gross profit margin has shown variability, peaking at 68.02% in March 2024. Operating expenses and R&D costs are notable components of its cost structure.

PE: 160.2x

Genus, a smaller company, recently proposed a final dividend of 21.7 pence per share, payable on December 6, 2024. Despite reporting lower sales of GBP 668.8 million and net income dropping to GBP 7.9 million for the year ending June 30, insider confidence remains high with recent share purchases indicating potential growth prospects. Earnings are forecast to grow by an impressive 39% annually despite current profit margins being lower than last year at just over 1%.

- Delve into the full analysis valuation report here for a deeper understanding of Genus.

Explore historical data to track Genus' performance over time in our Past section.

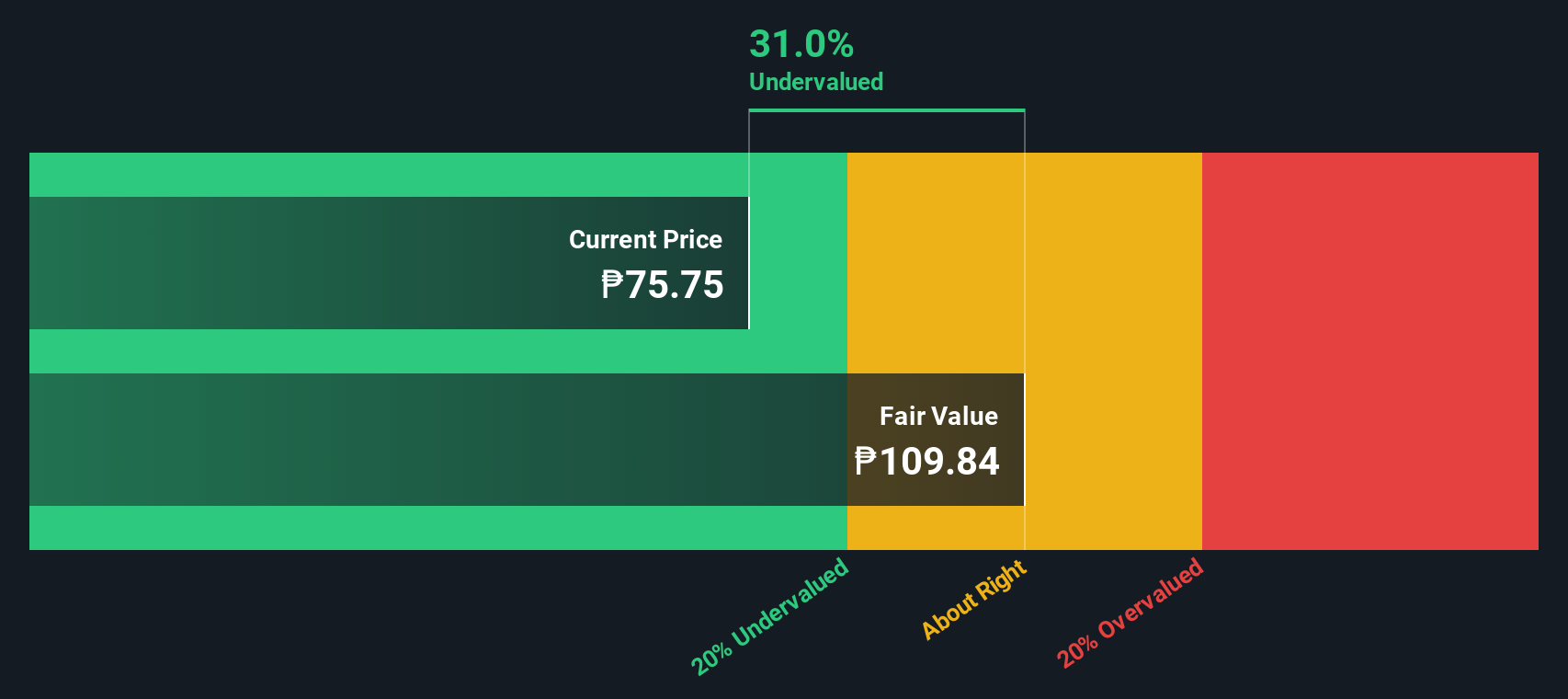

Security Bank (PSE:SECB)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Security Bank operates as a financial institution offering retail, business, wholesale banking, and financial market services with a market cap of ₱106.64 billion.

Operations: The company generates revenue primarily from Wholesale Banking, Retail Banking, and Business Banking segments. Despite a gross profit margin of 100%, the net income margin has shown variability, most recently at 23.14% in Q2 2024. Operating expenses have been significant, with General & Administrative Expenses being a major component.

PE: 6.0x

Security Bank, a small-cap stock, has seen insider confidence with Independent Director Enrico Cruz purchasing 49,000 shares worth approximately PHP 2.9 million in recent months. Despite having a high level of bad loans at 3.4% and a low allowance for bad loans at 83%, the company forecasts earnings growth of 15.73% annually. Recent executive appointments aim to strengthen risk management and remedial divisions, while net income for H1 2024 rose to PHP 5.4 billion from PHP 4.9 billion last year, reflecting solid financial performance amidst challenges.

- Dive into the specifics of Security Bank here with our thorough valuation report.

Assess Security Bank's past performance with our detailed historical performance reports.

Summing It All Up

- Get an in-depth perspective on all 172 Undervalued Small Caps With Insider Buying by using our screener here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:GNS

Genus

Operates as an animal genetics company in North America, Latin America, the United Kingdom, rest of Europe, the Middle East, Russia, Africa, and Asia.

Reasonable growth potential second-rate dividend payer.