- Australia

- /

- Hospitality

- /

- ASX:SGR

The Star Entertainment Group Limited's (ASX:SGR) Revenues Are Not Doing Enough For Some Investors

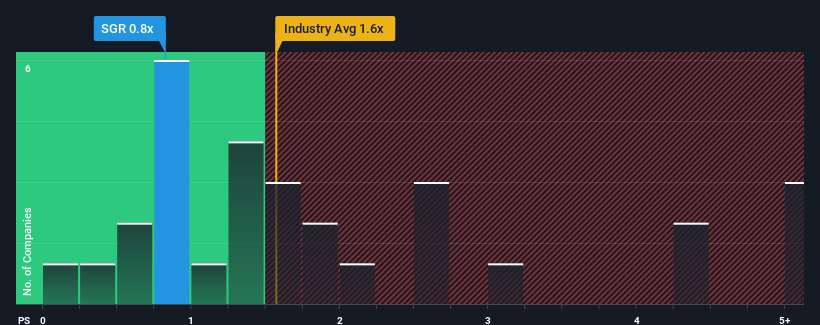

When close to half the companies operating in the Hospitality industry in Australia have price-to-sales ratios (or "P/S") above 1.6x, you may consider The Star Entertainment Group Limited (ASX:SGR) as an attractive investment with its 0.8x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

Check out our latest analysis for Star Entertainment Group

How Star Entertainment Group Has Been Performing

With revenue growth that's inferior to most other companies of late, Star Entertainment Group has been relatively sluggish. Perhaps the market is expecting the current trend of poor revenue growth to continue, which has kept the P/S suppressed. If you still like the company, you'd be hoping revenue doesn't get any worse and that you could pick up some stock while it's out of favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Star Entertainment Group.Do Revenue Forecasts Match The Low P/S Ratio?

In order to justify its P/S ratio, Star Entertainment Group would need to produce sluggish growth that's trailing the industry.

Retrospectively, the last year delivered an exceptional 22% gain to the company's top line. The latest three year period has also seen a 26% overall rise in revenue, aided extensively by its short-term performance. Accordingly, shareholders would have probably been satisfied with the medium-term rates of revenue growth.

Turning to the outlook, the next three years should bring diminished returns, with revenue decreasing 2.8% per annum as estimated by the eight analysts watching the company. With the industry predicted to deliver 7.2% growth per annum, that's a disappointing outcome.

In light of this, it's understandable that Star Entertainment Group's P/S would sit below the majority of other companies. Nonetheless, there's no guarantee the P/S has reached a floor yet with revenue going in reverse. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

The Bottom Line On Star Entertainment Group's P/S

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

It's clear to see that Star Entertainment Group maintains its low P/S on the weakness of its forecast for sliding revenue, as expected. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. Unless there's material change, it's hard to envision a situation where the stock price will rise drastically.

Having said that, be aware Star Entertainment Group is showing 2 warning signs in our investment analysis, and 1 of those is significant.

If these risks are making you reconsider your opinion on Star Entertainment Group, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:SGR

Star Entertainment Group

Operates and manages integrated resorts in Australia.

Undervalued with very low risk.

Similar Companies

Market Insights

Community Narratives