- Australia

- /

- Hospitality

- /

- ASX:RCT

Do Its Financials Have Any Role To Play In Driving Reef Casino Trust's (ASX:RCT) Stock Up Recently?

Most readers would already be aware that Reef Casino Trust's (ASX:RCT) stock increased significantly by 20% over the past three months. As most would know, fundamentals are what usually guide market price movements over the long-term, so we decided to look at the company's key financial indicators today to determine if they have any role to play in the recent price movement. Particularly, we will be paying attention to Reef Casino Trust's ROE today.

Return on Equity or ROE is a test of how effectively a company is growing its value and managing investors’ money. In short, ROE shows the profit each dollar generates with respect to its shareholder investments.

How Is ROE Calculated?

The formula for ROE is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Reef Casino Trust is:

45% = AU$5.1m ÷ AU$11m (Based on the trailing twelve months to December 2024).

The 'return' refers to a company's earnings over the last year. One way to conceptualize this is that for each A$1 of shareholders' capital it has, the company made A$0.45 in profit.

Check out our latest analysis for Reef Casino Trust

What Has ROE Got To Do With Earnings Growth?

So far, we've learned that ROE is a measure of a company's profitability. Depending on how much of these profits the company reinvests or "retains", and how effectively it does so, we are then able to assess a company’s earnings growth potential. Assuming everything else remains unchanged, the higher the ROE and profit retention, the higher the growth rate of a company compared to companies that don't necessarily bear these characteristics.

A Side By Side comparison of Reef Casino Trust's Earnings Growth And 45% ROE

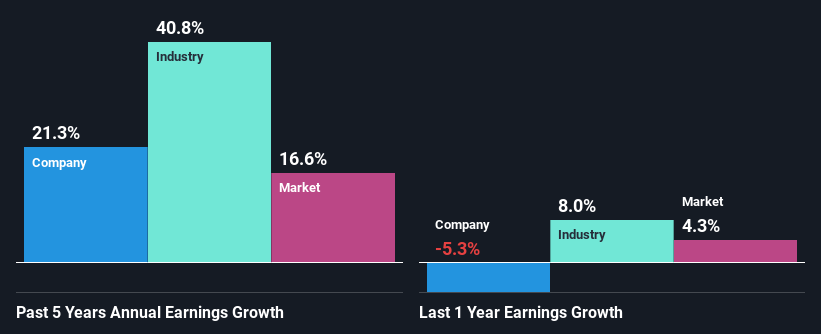

First thing first, we like that Reef Casino Trust has an impressive ROE. Additionally, the company's ROE is higher compared to the industry average of 9.1% which is quite remarkable. So, the substantial 21% net income growth seen by Reef Casino Trust over the past five years isn't overly surprising.

Next, on comparing with the industry net income growth, we found that Reef Casino Trust's reported growth was lower than the industry growth of 41% over the last few years, which is not something we like to see.

The basis for attaching value to a company is, to a great extent, tied to its earnings growth. It’s important for an investor to know whether the market has priced in the company's expected earnings growth (or decline). This then helps them determine if the stock is placed for a bright or bleak future. If you're wondering about Reef Casino Trust's's valuation, check out this gauge of its price-to-earnings ratio, as compared to its industry.

Is Reef Casino Trust Using Its Retained Earnings Effectively?

Reef Casino Trust's significant three-year median payout ratio of 100% (where it is retaining only -0.2% of its income) suggests that the company has been able to achieve a high growth in earnings despite returning most of its income to shareholders.

Additionally, Reef Casino Trust has paid dividends over a period of at least ten years which means that the company is pretty serious about sharing its profits with shareholders.

Conclusion

In total, it does look like Reef Casino Trust has some positive aspects to its business. As noted earlier, its earnings growth has been quite decent, and the high ROE does contribute to that growth. Still, the company invests little to almost none of its profits. This could potentially reduce the odds that the company continues to see the same level of growth in the future. So far, we've only made a quick discussion around the company's earnings growth. To gain further insights into Reef Casino Trust's past profit growth, check out this visualization of past earnings, revenue and cash flows.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:RCT

Reef Casino Trust

Operates as an owner and lessor of the Reef Hotel Casino complex located in Cairns in North Queensland, Australia.

Adequate balance sheet with acceptable track record.

Market Insights

Community Narratives

Recently Updated Narratives

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

CEO: We are winners in the long term in the AI world

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.