IDP Education Limited (ASX:IEL) has announced that it will be increasing its dividend from last year's comparable payment on the 28th of September to A$0.20. This takes the annual payment to 1.7% of the current stock price, which is about average for the industry.

View our latest analysis for IDP Education

IDP Education's Dividend Is Well Covered By Earnings

Solid dividend yields are great, but they only really help us if the payment is sustainable. Prior to this announcement, IDP Education was paying out 77% of earnings and more than 75% of free cash flows. This indicates that the company is more focused on returning cash to shareholders than growing the business, but we don't think that there are necessarily signs that the dividend might be unsustainable.

The next year is set to see EPS grow by 77.3%. Assuming the dividend continues along the course it has been charting recently, our estimates show the payout ratio being 48% which brings it into quite a comfortable range.

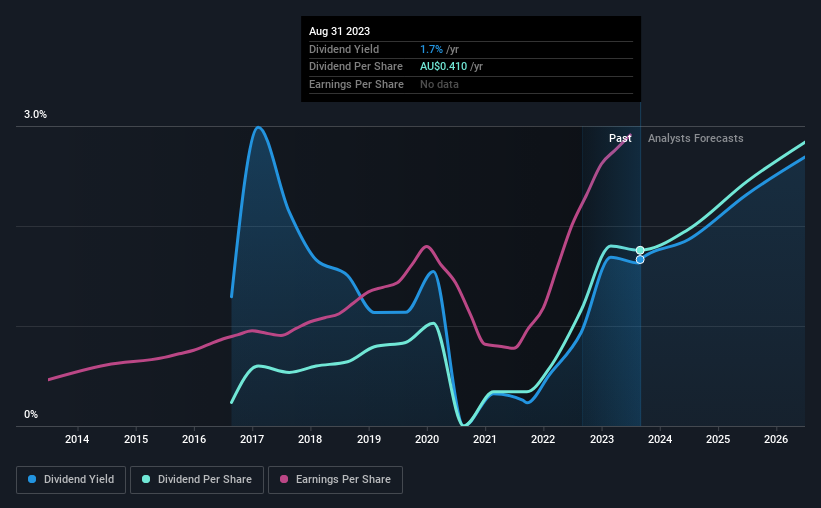

IDP Education's Dividend Has Lacked Consistency

IDP Education has been paying dividends for a while, but the track record isn't stellar. This makes us cautious about the consistency of the dividend over a full economic cycle. Since 2016, the annual payment back then was A$0.055, compared to the most recent full-year payment of A$0.41. This implies that the company grew its distributions at a yearly rate of about 33% over that duration. IDP Education has grown distributions at a rapid rate despite cutting the dividend at least once in the past. Companies that cut once often cut again, so we would be cautious about buying this stock solely for the dividend income.

Dividend Growth Could Be Constrained

With a relatively unstable dividend, it's even more important to evaluate if earnings per share is growing, which could point to a growing dividend in the future. It's encouraging to see that IDP Education has been growing its earnings per share at 21% a year over the past five years. EPS is growing rapidly, although the company is also paying out a large portion of its profits as dividends. If earnings keep growing, the dividend may be sustainable, but generally we'd prefer to see a fast growing company reinvest in further growth.

Our Thoughts On IDP Education's Dividend

In summary, while it's always good to see the dividend being raised, we don't think IDP Education's payments are rock solid. Strong earnings growth means IDP Education has the potential to be a good dividend stock in the future, despite the current payments being at elevated levels. We would probably look elsewhere for an income investment.

Companies possessing a stable dividend policy will likely enjoy greater investor interest than those suffering from a more inconsistent approach. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. Earnings growth generally bodes well for the future value of company dividend payments. See if the 15 IDP Education analysts we track are forecasting continued growth with our free report on analyst estimates for the company. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:IEL

IDP Education

Engages in the placement of students into education institutions in Australia, the United Kingdom, the United States, Canada, New Zealand, and Ireland.

Reasonable growth potential with adequate balance sheet.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

GE Vernova revenue will grow by 13% with a future PE of 64.7x

A buy recommendation

Growing between 25-50% for the next 3-5 years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026