- Australia

- /

- Metals and Mining

- /

- ASX:AGC

ASX Penny Stocks Spotlight Australian Gold and Copper Among 3 Noteworthy Picks

Reviewed by Simply Wall St

The Australian market is currently navigating a complex landscape, with the price of gold reaching US$4,300/oz amid concerns about the US credit market and weaker-than-expected local jobs data. In such a setting, investors often turn their attention to smaller companies that can offer unique value propositions. Penny stocks, while an older term, still represent an intriguing investment area where financial strength and growth potential can lead to significant opportunities.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| Alfabs Australia (ASX:AAL) | A$0.45 | A$128.96M | ✅ 4 ⚠️ 3 View Analysis > |

| EZZ Life Science Holdings (ASX:EZZ) | A$2.71 | A$127.84M | ✅ 2 ⚠️ 2 View Analysis > |

| Dusk Group (ASX:DSK) | A$0.91 | A$56.66M | ✅ 4 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$2.63 | A$404.79M | ✅ 4 ⚠️ 3 View Analysis > |

| MotorCycle Holdings (ASX:MTO) | A$3.18 | A$234.7M | ✅ 4 ⚠️ 2 View Analysis > |

| Pureprofile (ASX:PPL) | A$0.041 | A$47.96M | ✅ 3 ⚠️ 1 View Analysis > |

| West African Resources (ASX:WAF) | A$3.04 | A$3.47B | ✅ 4 ⚠️ 1 View Analysis > |

| LaserBond (ASX:LBL) | A$0.505 | A$59.41M | ✅ 4 ⚠️ 1 View Analysis > |

| Praemium (ASX:PPS) | A$0.855 | A$408.45M | ✅ 5 ⚠️ 2 View Analysis > |

| Service Stream (ASX:SSM) | A$2.26 | A$1.38B | ✅ 3 ⚠️ 1 View Analysis > |

Click here to see the full list of 423 stocks from our ASX Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Australian Gold and Copper (ASX:AGC)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Australian Gold and Copper Limited is an exploration company focused on developing a multi-asset gold portfolio in Australia, with a market cap of A$62.96 million.

Operations: Currently, the company does not report any revenue segments.

Market Cap: A$62.96M

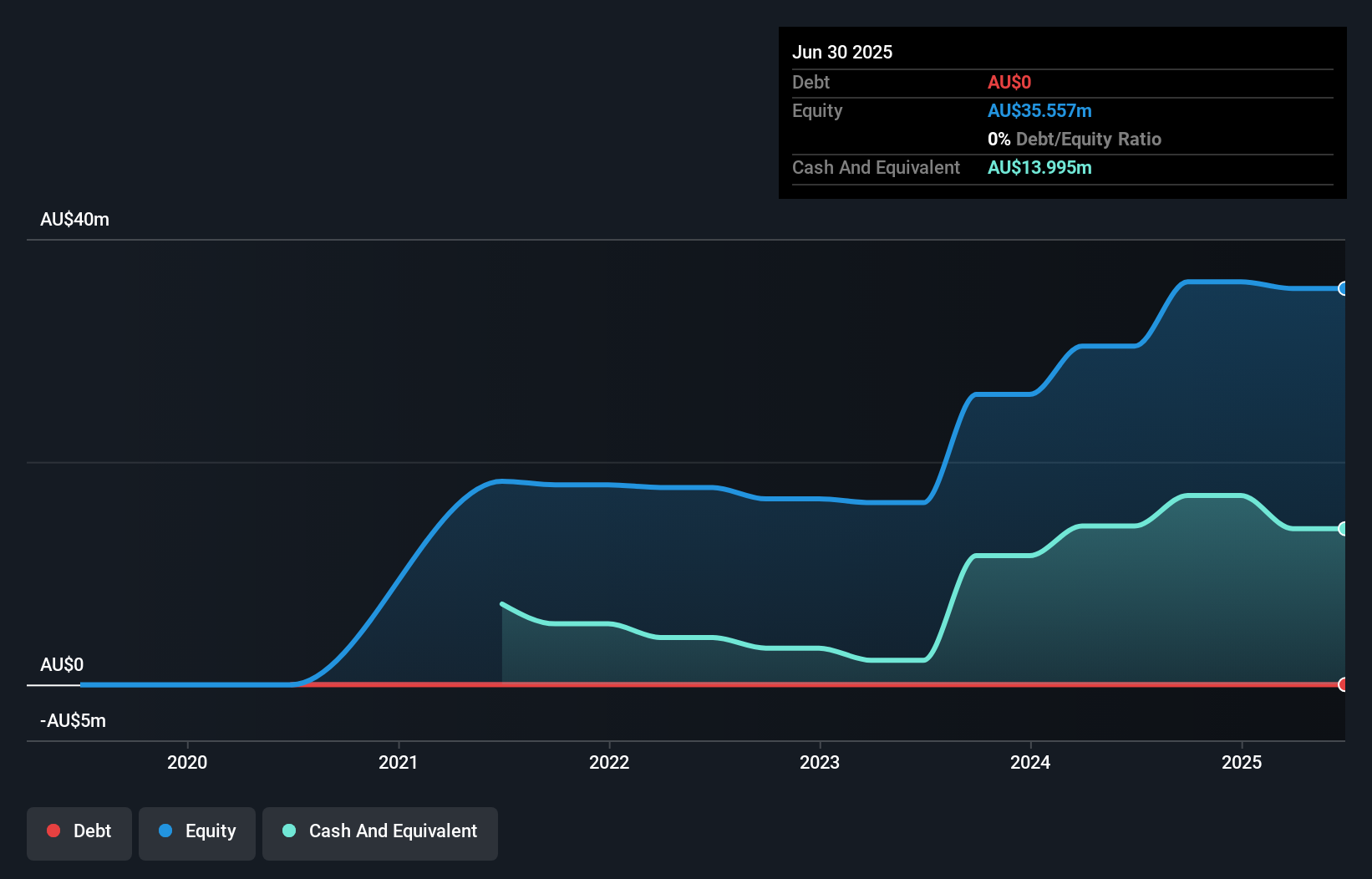

Australian Gold and Copper Limited is a pre-revenue exploration company with a market cap of A$62.96 million, focusing on developing its gold portfolio in Australia. Despite being unprofitable, the company has reduced its losses over the past five years and remains debt-free. Its short-term assets of A$14.3 million comfortably cover both short-term and long-term liabilities, providing a sufficient cash runway for more than a year based on current free cash flow trends. Recent executive changes include appointing Rowan Caren as CFO and Company Secretary, aligning with strategic goals at the South Cobar Project in NSW.

- Click here and access our complete financial health analysis report to understand the dynamics of Australian Gold and Copper.

- Gain insights into Australian Gold and Copper's historical outcomes by reviewing our past performance report.

Helloworld Travel (ASX:HLO)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Helloworld Travel Limited is a travel distribution company operating in Australia, New Zealand, and internationally with a market cap of A$282.55 million.

Operations: The company's revenue is generated from Travel Operations in Australia (A$149.17 million), New Zealand (A$33.68 million), and the Rest of the World (A$3.43 million).

Market Cap: A$282.55M

Helloworld Travel Limited, with a market cap of A$282.55 million, has demonstrated financial resilience by maintaining a debt-free status and achieving profitability over the past five years. Its earnings growth has decelerated to 7.3% this year from an average of 66.2% annually over the last five years, yet it remains above industry averages. The company's short-term assets (A$251.9M) surpass both its short-term and long-term liabilities, indicating solid liquidity management. Despite trading below estimated fair value and offering dividends, its dividend coverage by free cash flow is weak, posing potential sustainability concerns amidst stable volatility levels.

- Get an in-depth perspective on Helloworld Travel's performance by reading our balance sheet health report here.

- Assess Helloworld Travel's future earnings estimates with our detailed growth reports.

SenSen Networks (ASX:SNS)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: SenSen Networks Limited, with a market cap of A$66.36 million, develops and sells SenDISA platform-based products and services across North America, Australia, New Zealand, and Asia.

Operations: The company's revenue segments include A$8.59 million from Australia and New Zealand, A$6.35 million from North America, and A$0.42 million from Asia.

Market Cap: A$66.36M

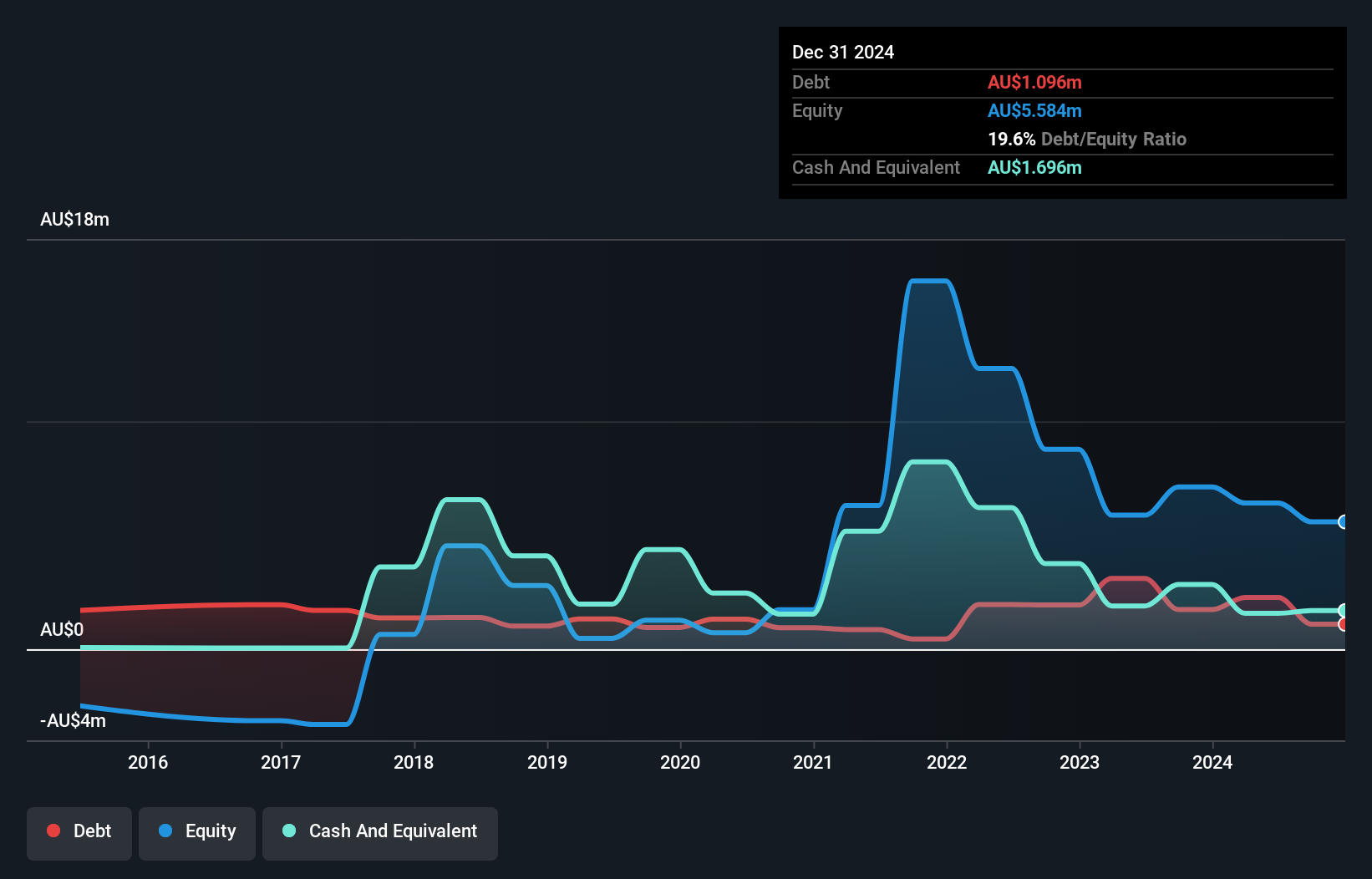

SenSen Networks Limited, with a market cap of A$66.36 million, has recently achieved profitability, reporting A$15.36 million in sales for the year ending June 30, 2025. The company's financial health is underscored by short-term assets (A$8M) exceeding both short-term (A$6.1M) and long-term liabilities (A$275.3K). Despite high share price volatility and a low return on equity of 5.5%, SenSen's debt management is commendable with more cash than total debt and operating cash flow covering 78.7% of its debt obligations. Trading significantly below estimated fair value suggests potential investment appeal amidst these dynamics.

- Dive into the specifics of SenSen Networks here with our thorough balance sheet health report.

- Evaluate SenSen Networks' historical performance by accessing our past performance report.

Seize The Opportunity

- Dive into all 423 of the ASX Penny Stocks we have identified here.

- Want To Explore Some Alternatives? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:AGC

Australian Gold and Copper

An exploration company, explores for and develops multi-asset gold portfolio in Australia.

Flawless balance sheet and slightly overvalued.

Market Insights

Community Narratives