- Australia

- /

- Hospitality

- /

- ASX:GYG

Guzman y Gomez (ASX:GYG): Assessing Valuation After $100 Million Buyback and Expansion Strategy

Reviewed by Kshitija Bhandaru

Guzman y Gomez (ASX:GYG) has launched a A$100 million share buyback program. This move sends a clear signal of management’s confidence in the company’s valuation and outlook while reaffirming its growth strategy.

See our latest analysis for Guzman y Gomez.

GYG’s recent buyback announcement comes after steady expansion plans, including new restaurant rollouts across Australia, and a reaffirmed outlook for earnings. After an initial lift following the buyback news, the 1-month share price return stands at 8.4%. However, the year-to-date share price is still down 35.6% and total shareholder return over one year sits at -32.9%. Momentum may be rebuilding as the company looks to translate growth initiatives into improved performance.

If you’re interested in what else is gaining traction beyond the headlines, now’s a great time to broaden your horizons and discover fast growing stocks with high insider ownership

After the recent rally, is GYG’s current share price undervaluing its future potential, or is the market already factoring in the next wave of restaurant expansion and profit growth?

Most Popular Narrative: 7% Undervalued

With Guzman y Gomez closing at A$25.69 versus a narrative fair value of A$27.62, the most-watched valuation sees notable upside from current levels. This perspective hinges on ambitious expansion and profitability projections that set GYG apart in the fast-casual restaurant landscape.

GYG is strongly positioned to benefit from consumers' increasing demand for convenient, high-quality fast-casual dining. Its rapid network expansion (98 Board-approved pipeline sites, goal of 1,000 stores in Australia, ongoing global rollout) capitalizes on this and supports sustained revenue growth and significant operating leverage over the next several years.

Curious what underpins this bullish stance? The narrative forecasts a major leap in both earnings and margins, underpinned by aggressive new site rollouts and evolving consumer trends. But there is more. Find out which specific financial milestones and pivotal strategies are driving the confidence in a higher valuation.

Result: Fair Value of $27.62 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, market saturation from rapid store expansion or underperformance in the US could quickly challenge the bullish narrative and reduce future earnings expectations.

Find out about the key risks to this Guzman y Gomez narrative.

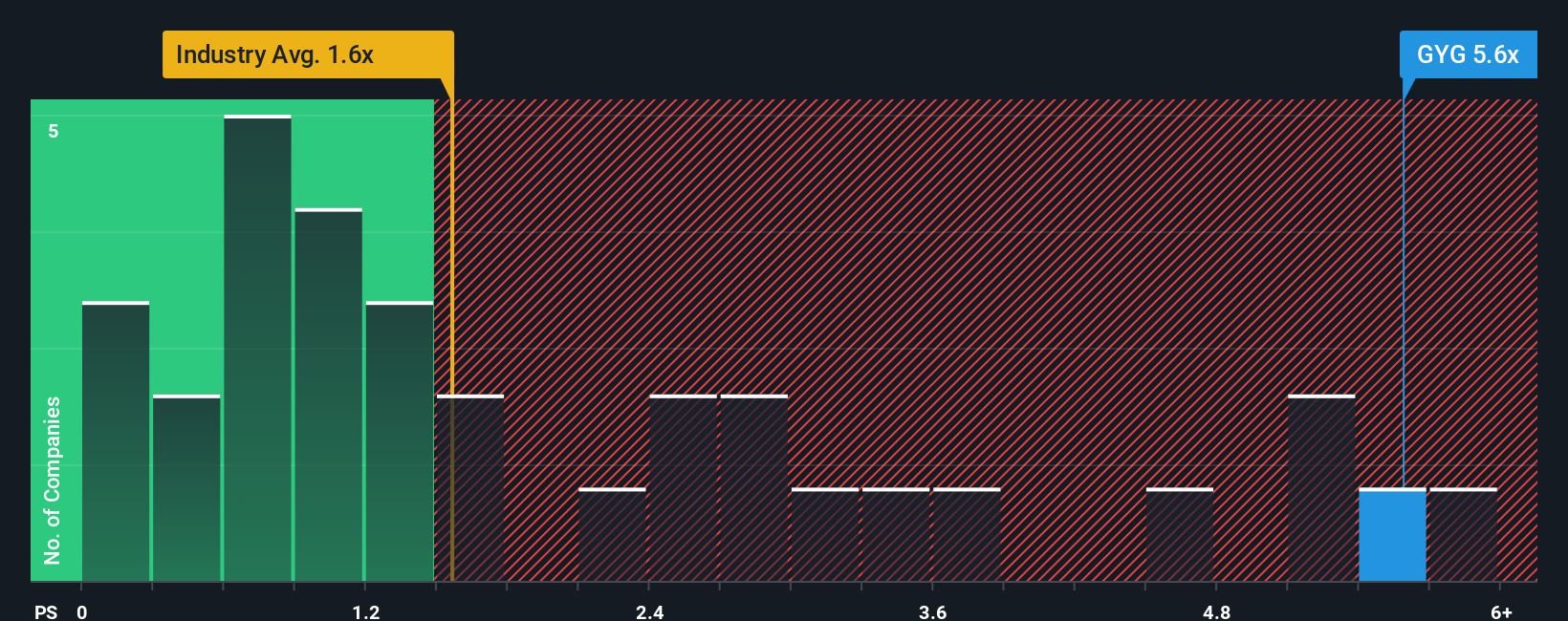

Another View: Comparing Sales Ratios

Looking at another angle, Guzman y Gomez trades at a price-to-sales ratio of 5.7 times. This is notably higher than its Australian Hospitality peers, which average just 1.6 times, and it is also above its fair ratio of 2.7 times. This suggests investors are paying a strong premium for growth. Could the market adjust if results disappoint?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Guzman y Gomez Narrative

If you see things differently or want to dig into the numbers on your own terms, it takes just a few minutes to chart your own path. Do it your way

A great starting point for your Guzman y Gomez research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Stay ahead by checking out compelling investment opportunities selected to match different strategies and sectors. You could find your next winner. Do not let these slip past you.

- Target generous income streams by scanning these 19 dividend stocks with yields > 3% with yields above 3% and strong payout records.

- Catch the momentum behind breakthrough technology with these 26 quantum computing stocks shaping the future of computing and innovation.

- Capitalize on growth potential by identifying these 899 undervalued stocks based on cash flows that the market may be overlooking right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:GYG

Guzman y Gomez

Operates and manages quick service restaurants in Australia, Singapore, Japan, and the United States.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives