- Australia

- /

- Hospitality

- /

- ASX:FLT

Flight Centre (ASX:FLT): Valuation Insights Following Buy-Back Program and Change in Major Shareholder

Reviewed by Kshitija Bhandaru

Flight Centre Travel Group (ASX:FLT) has drawn attention after announcing ongoing on-market share buy-backs, along with the recent withdrawal of Citigroup as a substantial holder. These actions shine a spotlight on the company’s capital management and investor landscape.

See our latest analysis for Flight Centre Travel Group.

Despite management’s buy-back program and a notable change in major shareholdings, Flight Centre Travel Group’s 1-year total shareholder return is down 45.5%. Momentum faded across the year as the share price slid more than 30% year-to-date. Investors are watching for signs of renewed growth or stability.

If you’re weighing your next move, this is a smart time to broaden your approach and discover fast growing stocks with high insider ownership

With shares trading at a significant discount to analyst price targets and the company pursuing buy-backs, investors are left to wonder: is Flight Centre now undervalued, or is the market accurately reflecting its growth prospects?

Most Popular Narrative: 26% Undervalued

Flight Centre Travel Group’s last close at A$11.58 sits well below the most popular narrative’s fair value estimate of A$15.64. This gap suggests strong market skepticism compared to more optimistic forward-looking projections, setting the stage for key catalysts that could shift sentiment.

Ongoing investment in proprietary digital platforms (for example, Melon for Corporate Traveler, a revitalized SAM app, and the Echo platform in Leisure) and AI integration is expected to enhance productivity, drive operational efficiency, enable higher self-service rates, and unlock meaningful cost reductions over time. This should strengthen net margins and support long-term earnings growth.

What if digital transformation and corporate expansion are the missing factors behind that fair value? The narrative is built on a mix of future efficiency gains and ambitious earnings projections. Want to know which assumptions have the boldest influence? Unpack the drivers behind this valuation call.

Result: Fair Value of $15.64 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing macroeconomic volatility and underperformance in key regions could quickly challenge bullish expectations for Flight Centre’s recovery and future growth.

Find out about the key risks to this Flight Centre Travel Group narrative.

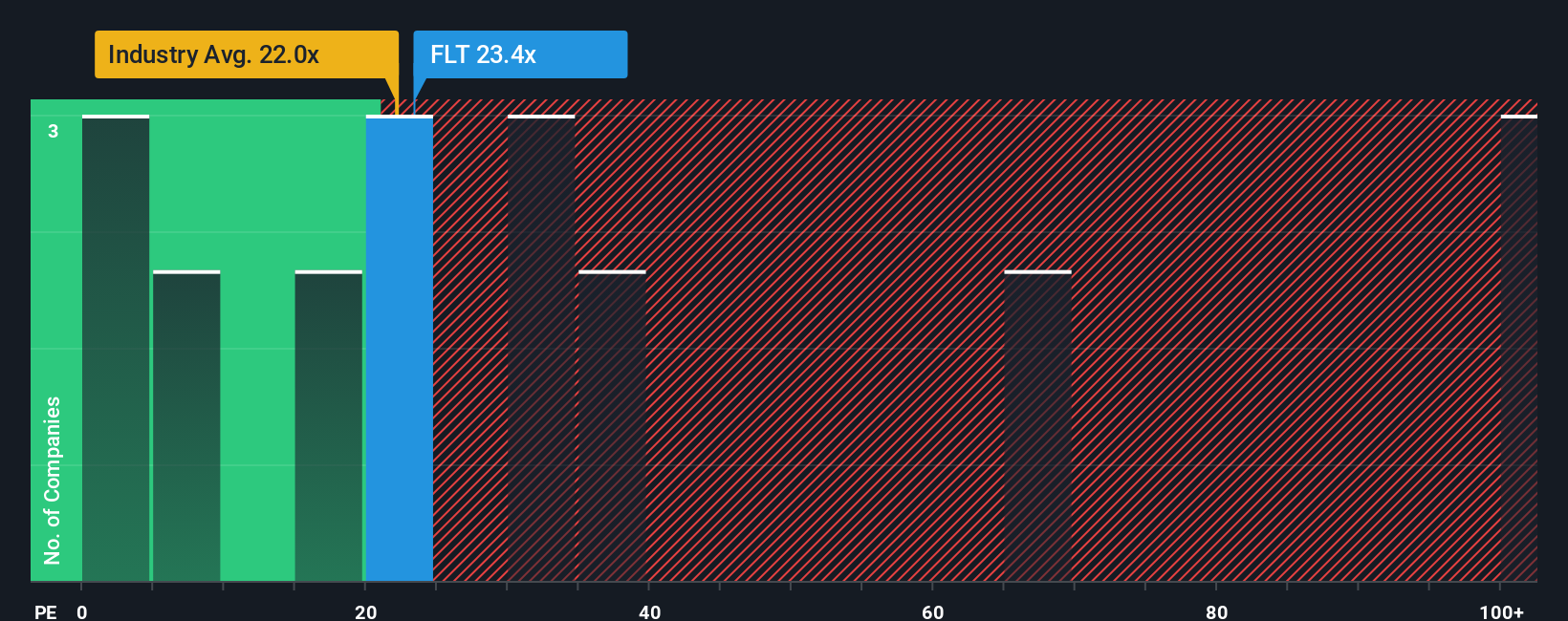

Another View: Price-to-Earnings Perspective

Looking through the lens of the price-to-earnings ratio, Flight Centre trades at 22.5 times earnings, slightly above the global hospitality industry average of 22 times. While this suggests shares are somewhat expensive against the broader sector, they remain well below the peer average of 61.8 times and under the fair ratio of 30.2 times. This contrast points to both valuation risk and possible opportunity as market sentiment could shift to reflect greater optimism.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Flight Centre Travel Group Narrative

If you want a different perspective or would rather dig into the numbers yourself, take a few minutes to build your own interpretation from the data. Do it your way

A great starting point for your Flight Centre Travel Group research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Ideas?

Unlock even more market opportunities by seeking out hidden value, big trends, and future growth stories most investors overlook. Take action today with these distinctive strategies:

- Tap into high-potential stocks flying under the radar by starting with these 887 undervalued stocks based on cash flows. Explore quality companies trading at sharp discounts to their intrinsic worth.

- Capture compounding income and stability by checking out these 19 dividend stocks with yields > 3%. Discover options delivering attractive yields well above market averages.

- Ride the AI revolution as it reshapes healthcare by exploring these 32 healthcare AI stocks. Find companies fueling innovation across medical technology and digital health solutions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:FLT

Flight Centre Travel Group

Provides travel retailing services for the leisure and corporate sectors in Australia, New Zealand, the Americas, Europe, the Middle East, Africa, Asia, and internationally.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives