- Australia

- /

- Specialty Stores

- /

- ASX:AX1

ASX Value Stock Estimates For November 2024

Reviewed by Simply Wall St

The Australian stock market has recently seen mixed performance, with the ASX200 closing slightly down at 8,436 points and sectors like Materials leading the gains. In this fluctuating environment, identifying undervalued stocks can offer potential opportunities for investors seeking value in a market where certain sectors are outperforming others.

Top 10 Undervalued Stocks Based On Cash Flows In Australia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| SKS Technologies Group (ASX:SKS) | A$2.00 | A$3.88 | 48.5% |

| Accent Group (ASX:AX1) | A$2.47 | A$4.94 | 50% |

| Atlas Arteria (ASX:ALX) | A$4.80 | A$9.50 | 49.5% |

| Charter Hall Group (ASX:CHC) | A$15.72 | A$31.34 | 49.8% |

| Gold Road Resources (ASX:GOR) | A$1.865 | A$3.58 | 48% |

| Millennium Services Group (ASX:MIL) | A$1.145 | A$2.24 | 48.9% |

| Genesis Minerals (ASX:GMD) | A$2.53 | A$4.74 | 46.6% |

| Audinate Group (ASX:AD8) | A$8.83 | A$17.54 | 49.7% |

| Energy One (ASX:EOL) | A$5.40 | A$10.66 | 49.3% |

| FINEOS Corporation Holdings (ASX:FCL) | A$1.96 | A$3.80 | 48.4% |

Let's dive into some prime choices out of the screener.

Accent Group (ASX:AX1)

Overview: Accent Group Limited operates in the retail, distribution, and franchise sectors for lifestyle footwear, apparel, and accessories across Australia and New Zealand with a market capitalization of A$1.35 billion.

Operations: The company's revenue is primarily derived from its retail segment, which generated A$1.27 billion, and its wholesale segment, contributing A$463.20 million.

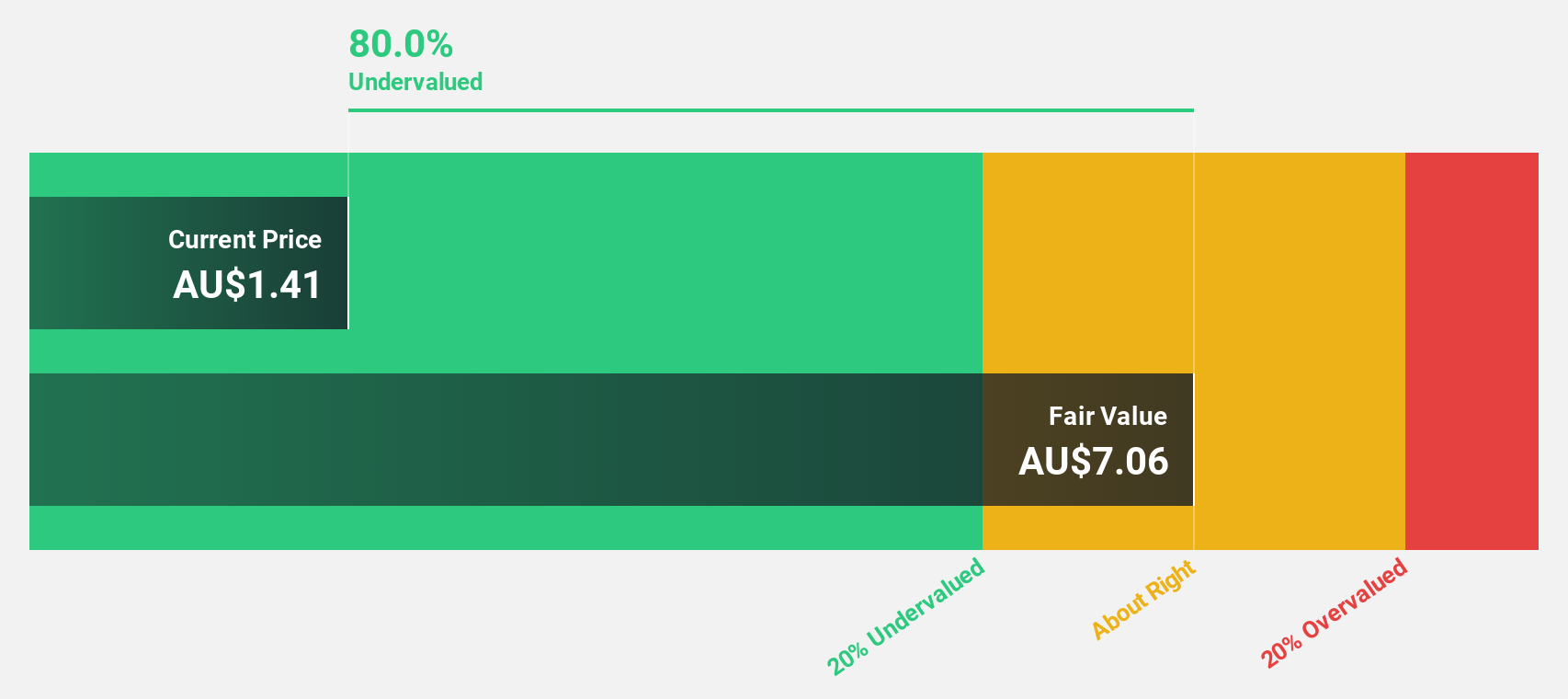

Estimated Discount To Fair Value: 50%

Accent Group is trading at A$2.47, significantly below its estimated fair value of A$4.94, suggesting it may be undervalued based on cash flows. The company's earnings are projected to grow 14.73% annually, outpacing the broader Australian market's forecasted growth of 12.6%. However, profit margins have declined from 6.2% to 4.1%, and recent insider selling could be a concern for potential investors despite promising revenue growth forecasts and strategic board appointments enhancing governance expertise.

- The growth report we've compiled suggests that Accent Group's future prospects could be on the up.

- Click here and access our complete balance sheet health report to understand the dynamics of Accent Group.

Flight Centre Travel Group (ASX:FLT)

Overview: Flight Centre Travel Group Limited operates as a travel retailer offering services for both leisure and corporate sectors across various regions including Australia, New Zealand, the Americas, Europe, the Middle East, Africa, Asia, and globally; it has a market cap of A$3.84 billion.

Operations: The company's revenue is derived from its leisure segment, which accounts for A$1.35 billion, and its corporate segment, contributing A$1.11 billion.

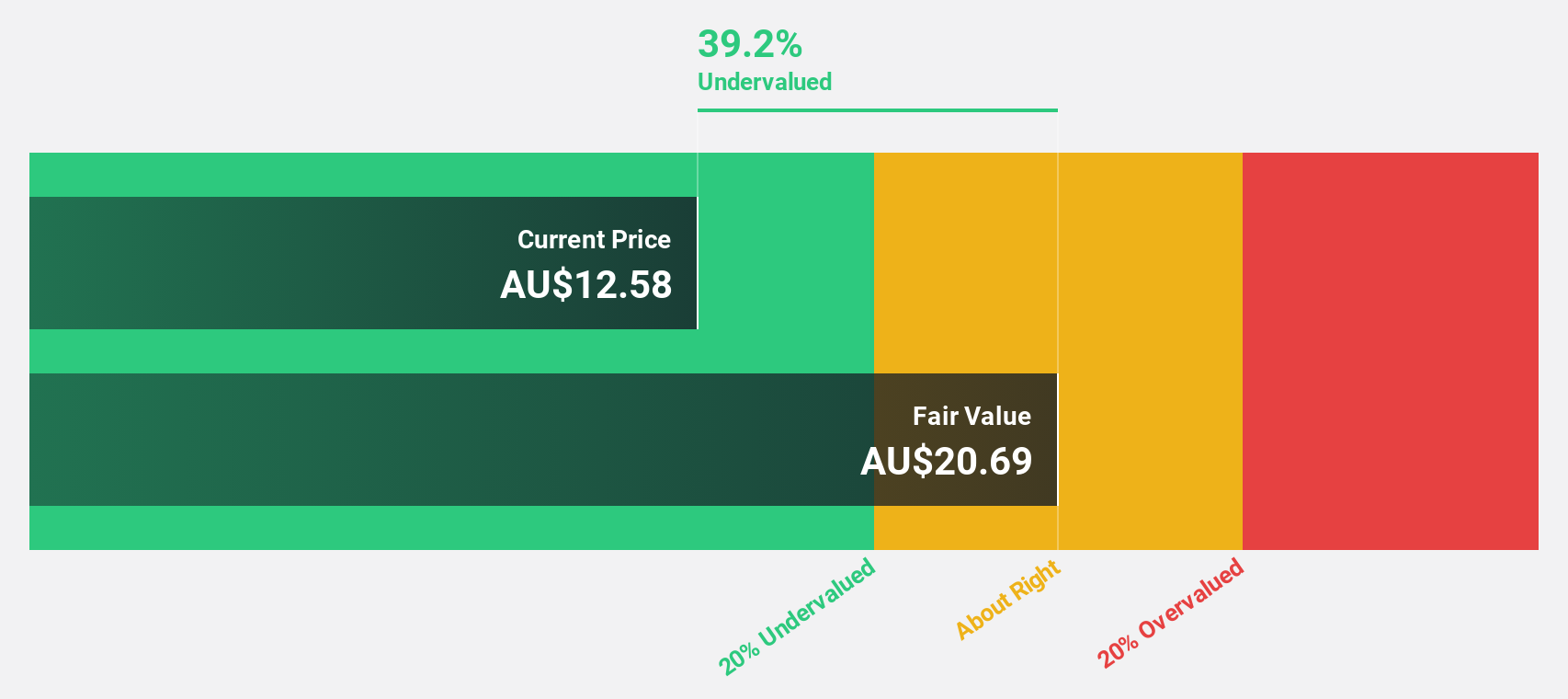

Estimated Discount To Fair Value: 32.6%

Flight Centre Travel Group is trading at A$17.51, well below its estimated fair value of A$26, indicating potential undervaluation based on cash flows. Earnings are projected to grow 19% annually, surpassing the Australian market's 12.6% growth forecast. Recent issuance of A$140 million in convertible notes may bolster financial flexibility but raises questions about future dilution risks. Despite an unstable dividend history, robust revenue growth forecasts and high return on equity projections remain positive factors.

- Our growth report here indicates Flight Centre Travel Group may be poised for an improving outlook.

- Unlock comprehensive insights into our analysis of Flight Centre Travel Group stock in this financial health report.

Megaport (ASX:MP1)

Overview: Megaport Limited offers on-demand interconnection and internet exchange services to enterprises and service providers across various regions including Australia, New Zealand, Asia, North America, and Europe, with a market cap of A$1.22 billion.

Operations: The company's revenue segments are comprised of A$31.88 million from Europe, A$52.58 million from Asia-Pacific, and A$110.81 million from North America.

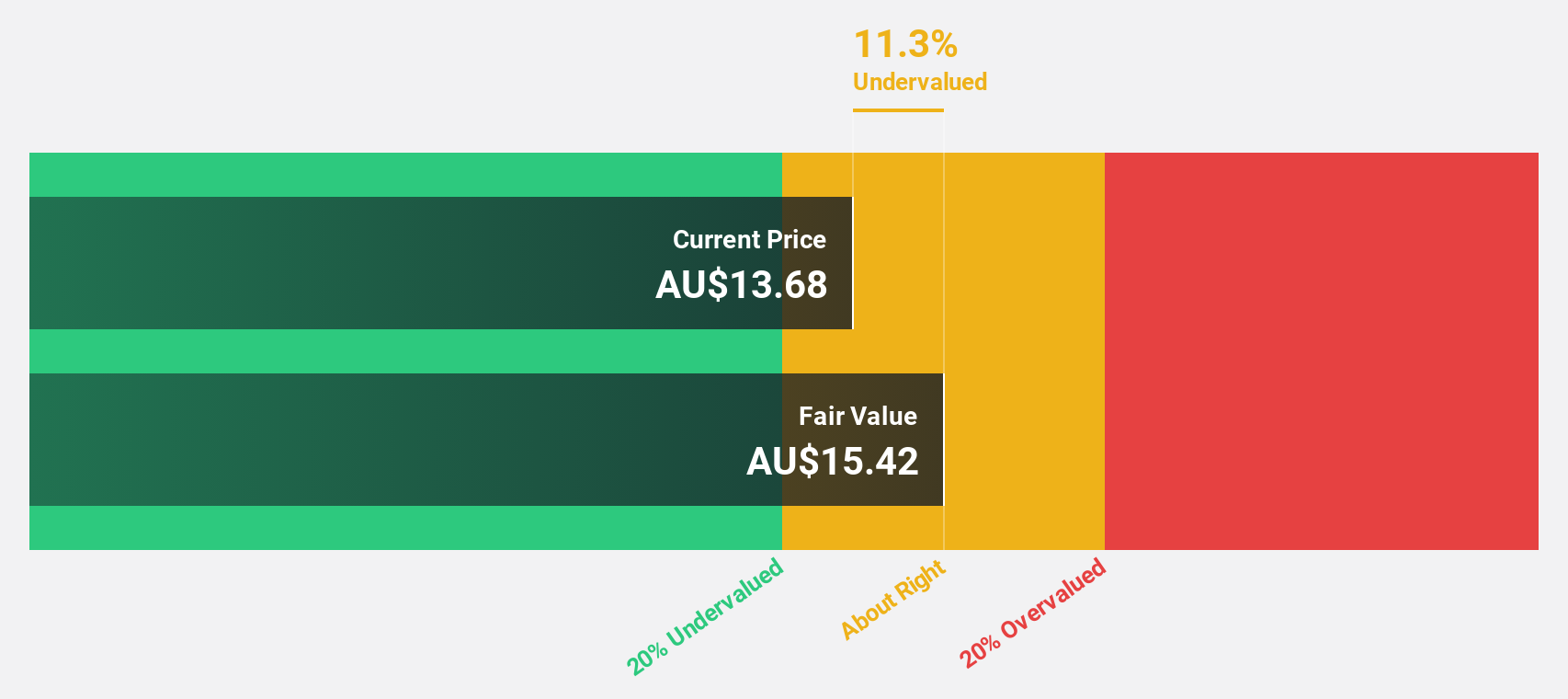

Estimated Discount To Fair Value: 35.6%

Megaport is trading at A$7.89, significantly below its estimated fair value of A$12.25, highlighting potential undervaluation based on cash flows. Earnings are expected to grow 27.9% annually, outpacing the broader Australian market's growth forecast. Recent expansions into Brazil and Europe enhance Megaport's global reach and connectivity offerings, potentially driving future revenue growth despite slower projected revenue increases compared to earnings. These strategic moves could strengthen its competitive position in the network-as-a-service sector.

- According our earnings growth report, there's an indication that Megaport might be ready to expand.

- Get an in-depth perspective on Megaport's balance sheet by reading our health report here.

Where To Now?

- Get an in-depth perspective on all 41 Undervalued ASX Stocks Based On Cash Flows by using our screener here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:AX1

Accent Group

Engages in the retail, distribution, and franchise of lifestyle footwear, apparel, and accessories in Australia and New Zealand.

Very undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives