- Australia

- /

- Specialty Stores

- /

- ASX:CTT

3 ASX Stocks Estimated To Be Trading Up To 39.8% Below Intrinsic Value

Reviewed by Simply Wall St

The Australian market has remained flat over the last week but is up 16% over the past year, with earnings expected to grow by 12% annually in the coming years. In this context, identifying stocks that are trading below their intrinsic value can present attractive opportunities for investors seeking to capitalize on potential future growth.

Top 10 Undervalued Stocks Based On Cash Flows In Australia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Mader Group (ASX:MAD) | A$5.37 | A$10.43 | 48.5% |

| MLG Oz (ASX:MLG) | A$0.64 | A$1.16 | 44.8% |

| Charter Hall Group (ASX:CHC) | A$15.74 | A$31.43 | 49.9% |

| Ingenia Communities Group (ASX:INA) | A$4.99 | A$9.43 | 47.1% |

| MedAdvisor (ASX:MDR) | A$0.43 | A$0.85 | 49.4% |

| IperionX (ASX:IPX) | A$3.45 | A$6.80 | 49.3% |

| Millennium Services Group (ASX:MIL) | A$1.145 | A$2.24 | 48.9% |

| IDP Education (ASX:IEL) | A$15.03 | A$27.70 | 45.7% |

| Superloop (ASX:SLC) | A$1.78 | A$3.31 | 46.3% |

| Mineral Resources (ASX:MIN) | A$47.94 | A$94.51 | 49.3% |

Below we spotlight a couple of our favorites from our exclusive screener.

Cettire (ASX:CTT)

Overview: Cettire Limited operates as an online luxury goods retailer in Australia, the United States, and internationally, with a market cap of A$762.48 million.

Operations: The company's revenue is primarily generated from online retail sales, amounting to A$742.26 million.

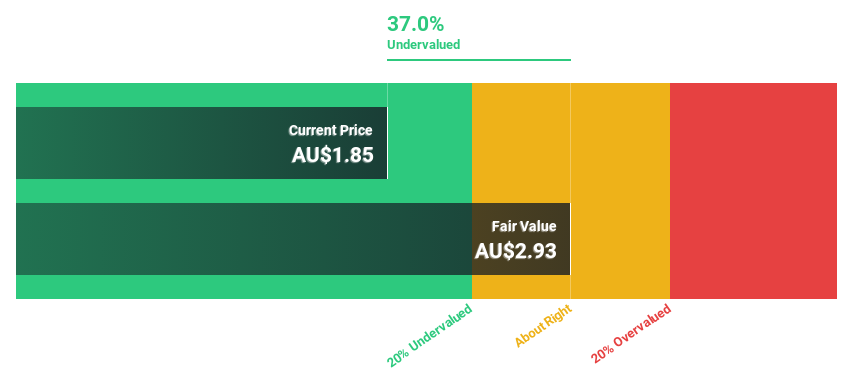

Estimated Discount To Fair Value: 32%

Cettire is trading at A$2, significantly below its estimated fair value of A$2.94, suggesting potential undervaluation based on cash flows. Although earnings are expected to grow 29% annually, profit margins have declined from 3.8% to 1.4%. Recent board appointments bring experienced leadership amid revenue growth forecasts surpassing the Australian market average. However, Cettire's share price remains highly volatile, and net income has decreased year-on-year despite strong sales growth.

- Our growth report here indicates Cettire may be poised for an improving outlook.

- Click to explore a detailed breakdown of our findings in Cettire's balance sheet health report.

Flight Centre Travel Group (ASX:FLT)

Overview: Flight Centre Travel Group Limited offers travel retailing services to both leisure and corporate clients across various regions including Australia, New Zealand, the Americas, Europe, the Middle East, Africa, Asia, and globally; it has a market cap of A$4.84 billion.

Operations: The company's revenue is derived from two main segments: Leisure, contributing A$1.35 billion, and Corporate, generating A$1.11 billion.

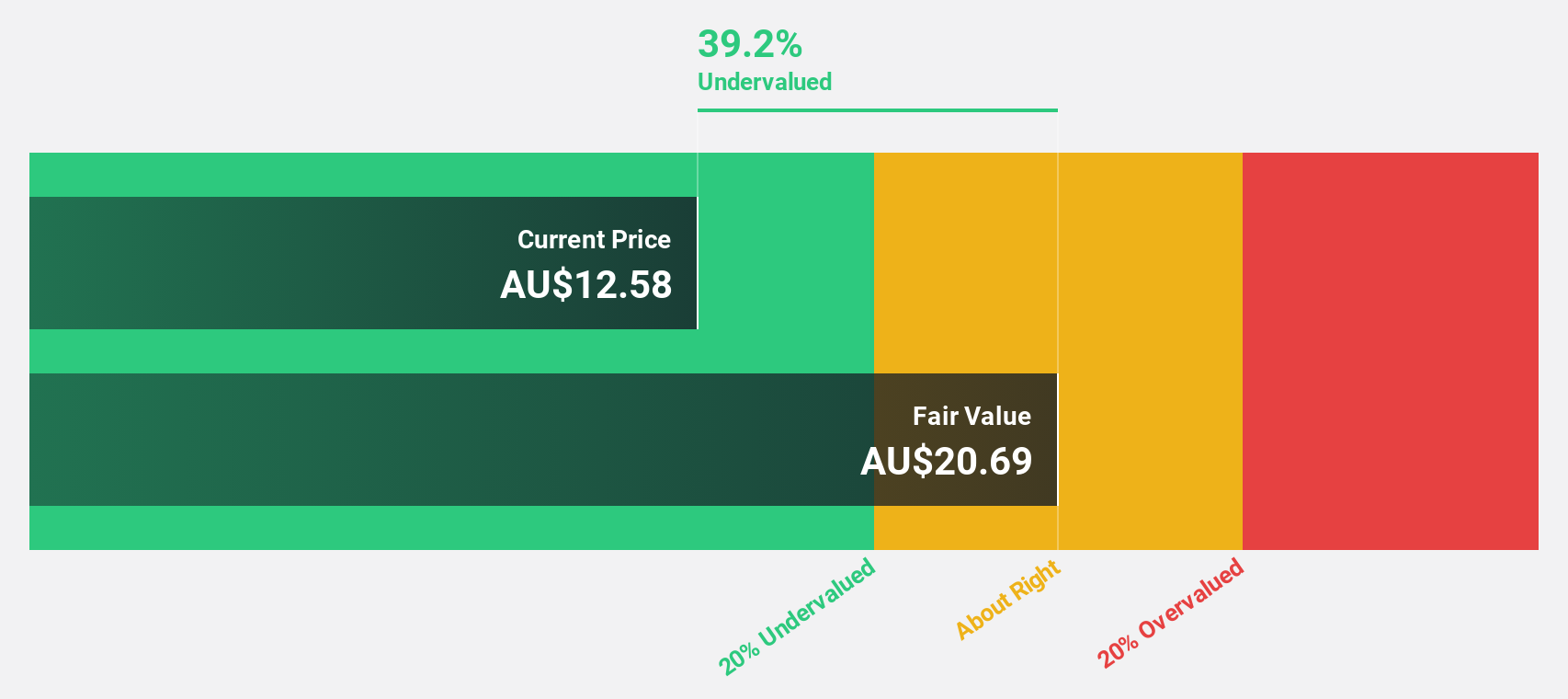

Estimated Discount To Fair Value: 14.9%

Flight Centre Travel Group is trading at A$21.92, below its fair value estimate of A$25.74, indicating potential undervaluation based on cash flows. The company reported a significant increase in net income to A$139 million, supported by a strong cash position and ongoing growth strategies including acquisitions. While earnings are projected to grow 19.6% annually, outpacing the Australian market average, revenue growth is slower at 8%. Dividend sustainability remains uncertain due to an unstable track record.

- Upon reviewing our latest growth report, Flight Centre Travel Group's projected financial performance appears quite optimistic.

- Click here to discover the nuances of Flight Centre Travel Group with our detailed financial health report.

Regal Partners (ASX:RPL)

Overview: Regal Partners Limited is a privately owned hedge fund sponsor with a market capitalization of A$1.21 billion.

Operations: Regal Partners Limited generates revenue of A$198.50 million from providing investment management services.

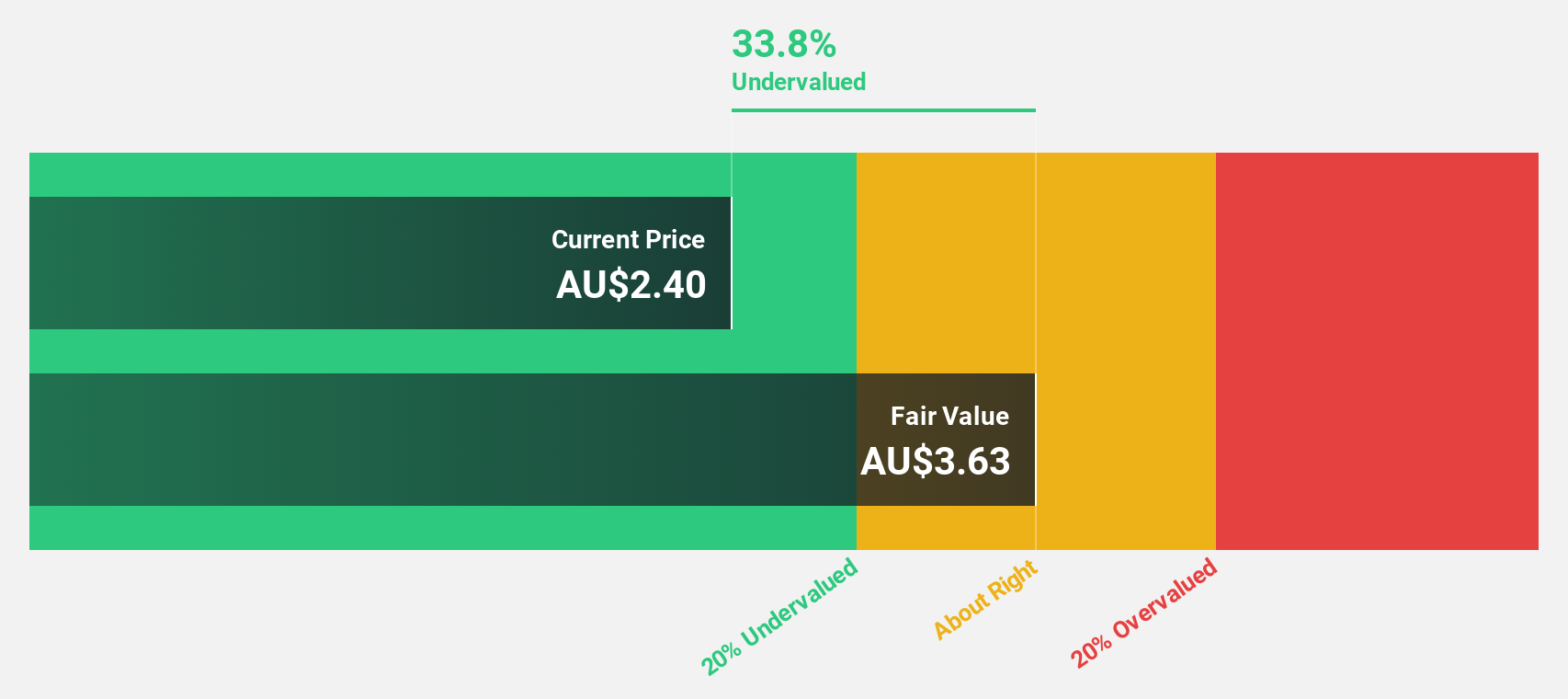

Estimated Discount To Fair Value: 39.8%

Regal Partners is trading at A$3.61, significantly below its fair value estimate of A$6, highlighting potential undervaluation based on cash flows. The company reported a substantial increase in net income to A$50.23 million for the half-year ended June 2024 from a loss the previous year, despite shareholder dilution concerns. Earnings are forecast to grow over 20% annually, outpacing the Australian market, though dividend coverage by free cash flow remains inadequate.

- In light of our recent growth report, it seems possible that Regal Partners' financial performance will exceed current levels.

- Click here and access our complete balance sheet health report to understand the dynamics of Regal Partners.

Taking Advantage

- Discover the full array of 47 Undervalued ASX Stocks Based On Cash Flows right here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:CTT

Cettire

Engages in the online luxury goods retailing business in Australia, the United States, and internationally.

Flawless balance sheet slight.

Similar Companies

Market Insights

Community Narratives