- Australia

- /

- Metals and Mining

- /

- ASX:RNU

3 ASX Penny Stocks With Market Caps Under A$200M

Reviewed by Simply Wall St

The Australian market has shown resilience, with the ASX 200 rising by 0.47% amid global economic shifts, including new tariffs announced by President Donald Trump and falling U.S. bond yields impacting currency values. In this context, identifying stocks that combine affordability with growth potential is crucial for investors seeking to capitalize on current trends. Penny stocks, often associated with smaller or newer companies, continue to offer intriguing opportunities for those willing to explore beyond traditional investment avenues.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| Embark Early Education (ASX:EVO) | A$0.775 | A$142.2M | ★★★★☆☆ |

| LaserBond (ASX:LBL) | A$0.575 | A$67.4M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.535 | A$331.78M | ★★★★★☆ |

| SHAPE Australia (ASX:SHA) | A$2.91 | A$241.27M | ★★★★★★ |

| GTN (ASX:GTN) | A$0.555 | A$108.99M | ★★★★★★ |

| MaxiPARTS (ASX:MXI) | A$1.95 | A$107.87M | ★★★★★★ |

| Helloworld Travel (ASX:HLO) | A$1.975 | A$321.56M | ★★★★★★ |

| Vita Life Sciences (ASX:VLS) | A$2.00 | A$111.85M | ★★★★★★ |

| Centrepoint Alliance (ASX:CAF) | A$0.315 | A$62.65M | ★★★★★☆ |

| IVE Group (ASX:IGL) | A$2.12 | A$328.36M | ★★★★☆☆ |

Click here to see the full list of 1,027 stocks from our ASX Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Donaco International (ASX:DNA)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Donaco International Limited operates in the hotel accommodation, gaming, and leisure sectors across Australia, Cambodia, Vietnam, Singapore, Malaysia, and Hong Kong with a market cap of A$39.49 million.

Operations: The company's revenue is primarily derived from its casino operations, with A$13.86 million generated in Vietnam and A$25.67 million in Cambodia.

Market Cap: A$39.49M

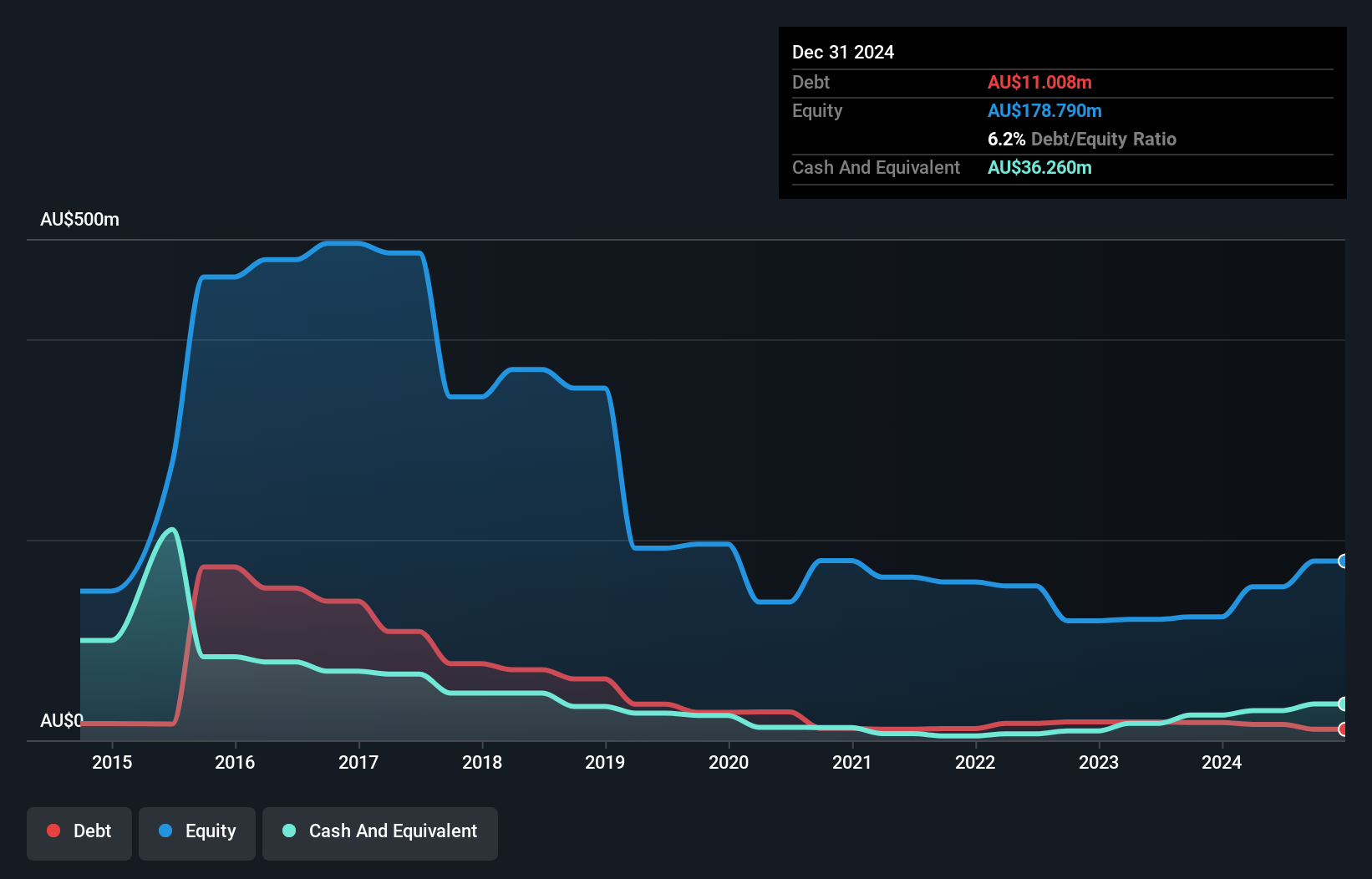

Donaco International Limited has shown significant progress by becoming profitable over the past year, with earnings growing at an impressive rate. The company's return on equity stands high at 25%, and its debt is well-covered by operating cash flow. Despite this, short-term assets of A$31.2 million do not fully cover its short-term liabilities of A$40.3 million, indicating some liquidity challenges. Additionally, a large one-off gain of A$23.8 million has impacted recent financial results, which may affect the perceived quality of earnings. The company trades significantly below estimated fair value, suggesting potential undervaluation in the market.

- Unlock comprehensive insights into our analysis of Donaco International stock in this financial health report.

- Gain insights into Donaco International's past trends and performance with our report on the company's historical track record.

Renascor Resources (ASX:RNU)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Renascor Resources Limited is an Australian company focused on the exploration, development, and evaluation of mineral properties, with a market cap of A$152.51 million.

Operations: The company's revenue segment is primarily derived from the exploration of graphite, copper, gold, uranium, and other minerals, generating A$0.00054 million.

Market Cap: A$152.51M

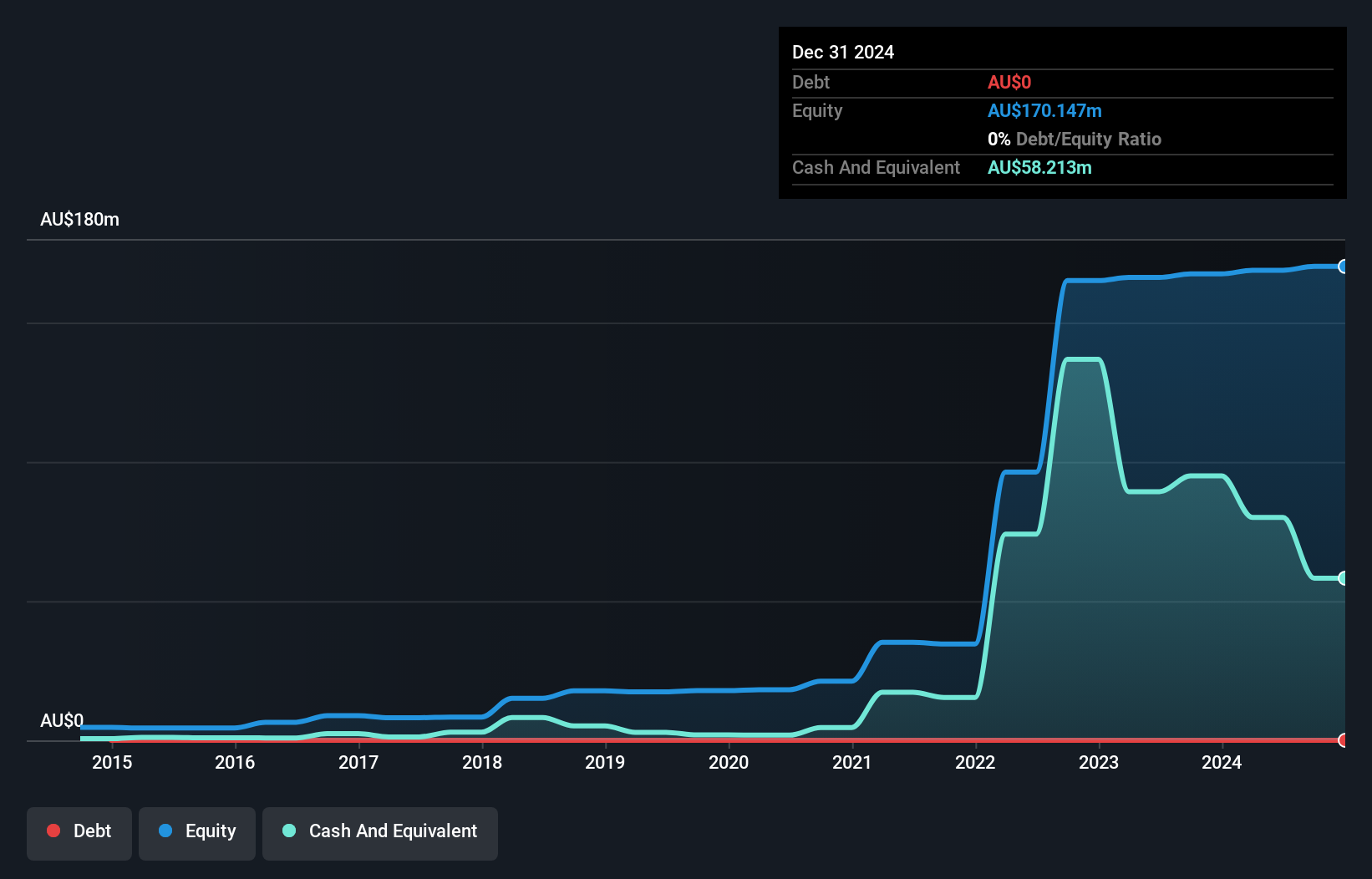

Renascor Resources Limited, with a market cap of A$152.51 million, remains pre-revenue, generating only A$540 from exploration activities. Despite this, the company has demonstrated substantial earnings growth of 302.1% over the past year and has maintained profitability over five years with an average annual growth rate of 47.8%. Renascor is debt-free and its short-term assets (A$113.2M) comfortably exceed liabilities (A$2.2M), ensuring financial stability. The seasoned management team and board contribute to strategic oversight, while recent updates on their Battery Anode Material project highlight ongoing development efforts in their mineral exploration ventures.

- Get an in-depth perspective on Renascor Resources' performance by reading our balance sheet health report here.

- Understand Renascor Resources' track record by examining our performance history report.

Tribeca Global Natural Resources (ASX:TGF)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Tribeca Global Natural Resources Limited is an investment firm focused on infrastructure investments, with a market cap of A$115.43 million.

Operations: The firm's revenue segment includes an investment in securities amounting to -A$2.40 million.

Market Cap: A$115.43M

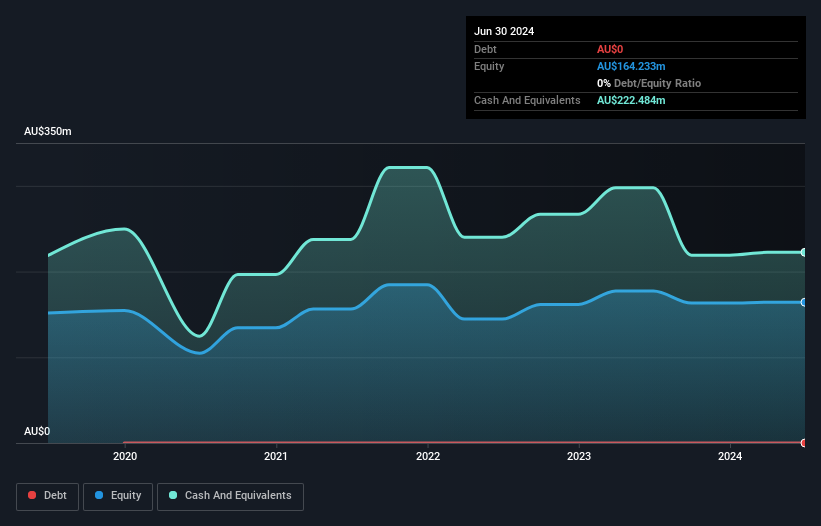

Tribeca Global Natural Resources Limited, with a market cap of A$115.43 million, is pre-revenue and currently unprofitable. Despite this, the company maintains a strong financial position with short-term assets of A$225.2 million surpassing liabilities of A$75.4 million and no debt on its balance sheet for the past five years. While earnings have declined by 6.6% annually over five years, Tribeca benefits from a positive cash flow that supports more than three years of operations without additional funding needs. The company has not diluted shareholders recently and shows stable weekly volatility at 3%.

- Dive into the specifics of Tribeca Global Natural Resources here with our thorough balance sheet health report.

- Examine Tribeca Global Natural Resources' past performance report to understand how it has performed in prior years.

Make It Happen

- Unlock more gems! Our ASX Penny Stocks screener has unearthed 1,024 more companies for you to explore.Click here to unveil our expertly curated list of 1,027 ASX Penny Stocks.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:RNU

Renascor Resources

Engages in the exploration, development, and evaluation of mineral properties in Australia.

Flawless balance sheet with proven track record.