- Australia

- /

- Specialized REITs

- /

- ASX:NSR

ASX Stocks Estimated Below Intrinsic Value In April 2025

Reviewed by Simply Wall St

As the Australian market continues to show resilience, with the ASX200 closing up 0.36% at 7,997 points, investors are keenly observing sector performances that drive growth and stability. With sectors like Energy and IT leading gains, identifying stocks trading below their intrinsic value becomes crucial in capitalizing on potential opportunities amidst fluctuating market conditions.

Top 10 Undervalued Stocks Based On Cash Flows In Australia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| LaserBond (ASX:LBL) | A$0.375 | A$0.66 | 43.1% |

| Acrow (ASX:ACF) | A$1.075 | A$2.04 | 47.3% |

| Domino's Pizza Enterprises (ASX:DMP) | A$25.85 | A$51.48 | 49.8% |

| GenusPlus Group (ASX:GNP) | A$2.72 | A$5.12 | 46.9% |

| Medical Developments International (ASX:MVP) | A$0.465 | A$0.89 | 47.8% |

| PolyNovo (ASX:PNV) | A$1.155 | A$1.93 | 40.2% |

| Integral Diagnostics (ASX:IDX) | A$2.29 | A$4.08 | 43.9% |

| Nuix (ASX:NXL) | A$2.42 | A$4.23 | 42.8% |

| Electro Optic Systems Holdings (ASX:EOS) | A$1.25 | A$2.35 | 46.9% |

| Superloop (ASX:SLC) | A$2.39 | A$4.58 | 47.8% |

We'll examine a selection from our screener results.

Domino's Pizza Enterprises (ASX:DMP)

Overview: Domino's Pizza Enterprises Limited operates retail food outlets and has a market cap of A$2.44 billion.

Operations: The company generates revenue primarily from its restaurants segment, which accounts for A$2.30 billion.

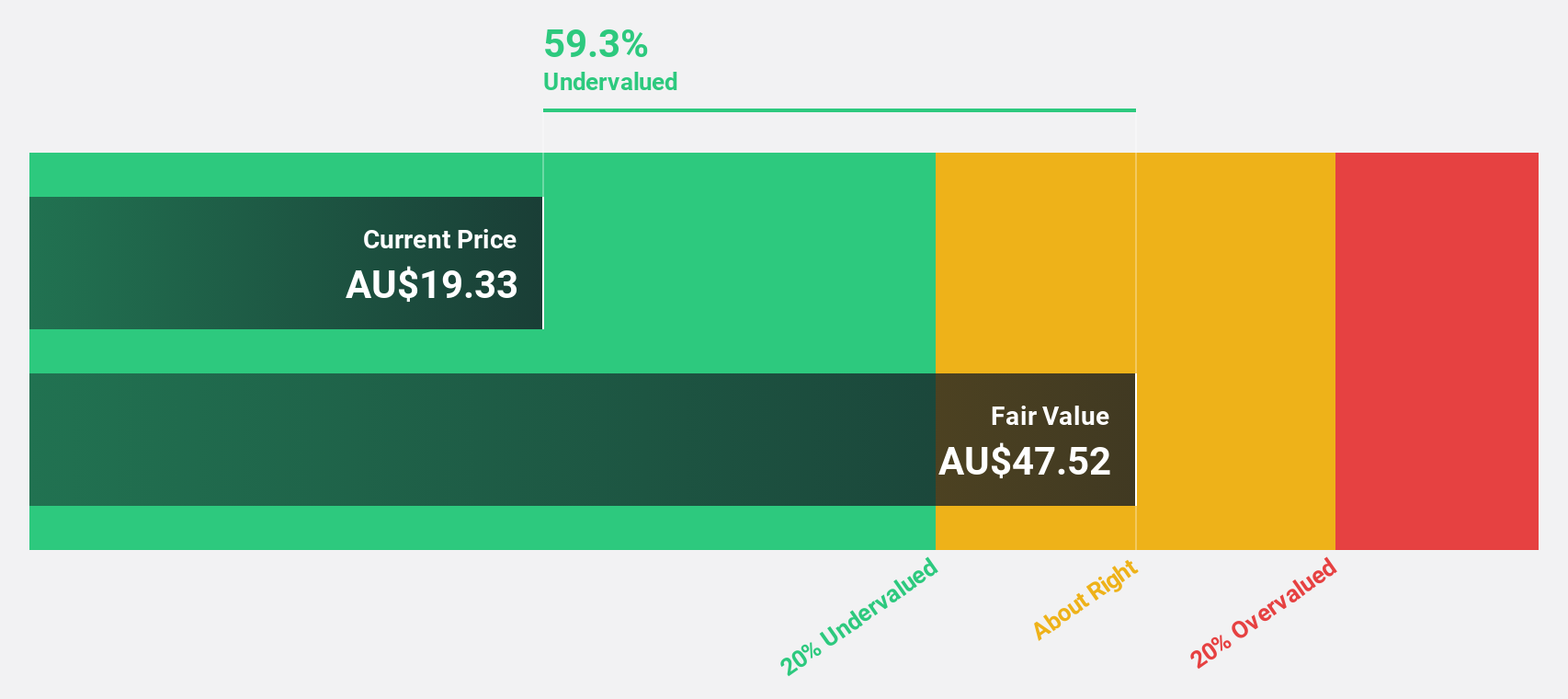

Estimated Discount To Fair Value: 49.8%

Domino's Pizza Enterprises is trading at A$25.85, significantly below its estimated fair value of A$51.48, indicating potential undervaluation based on cash flows. Despite a high debt level and recent net loss of A$22.17 million for H1 FY2025, earnings are forecast to grow 43.3% annually, outpacing the Australian market average growth rate. However, revenue growth projections lag behind the market average, and profit margins have declined from last year’s figures.

- Our comprehensive growth report raises the possibility that Domino's Pizza Enterprises is poised for substantial financial growth.

- Unlock comprehensive insights into our analysis of Domino's Pizza Enterprises stock in this financial health report.

National Storage REIT (ASX:NSR)

Overview: National Storage REIT is the largest self-storage provider in Australia and New Zealand, operating over 225 centers for more than 90,000 residential and commercial customers, with a market cap of A$3.12 billion.

Operations: The company's revenue segment is primarily derived from the operation and management of storage centers, generating A$369.99 million.

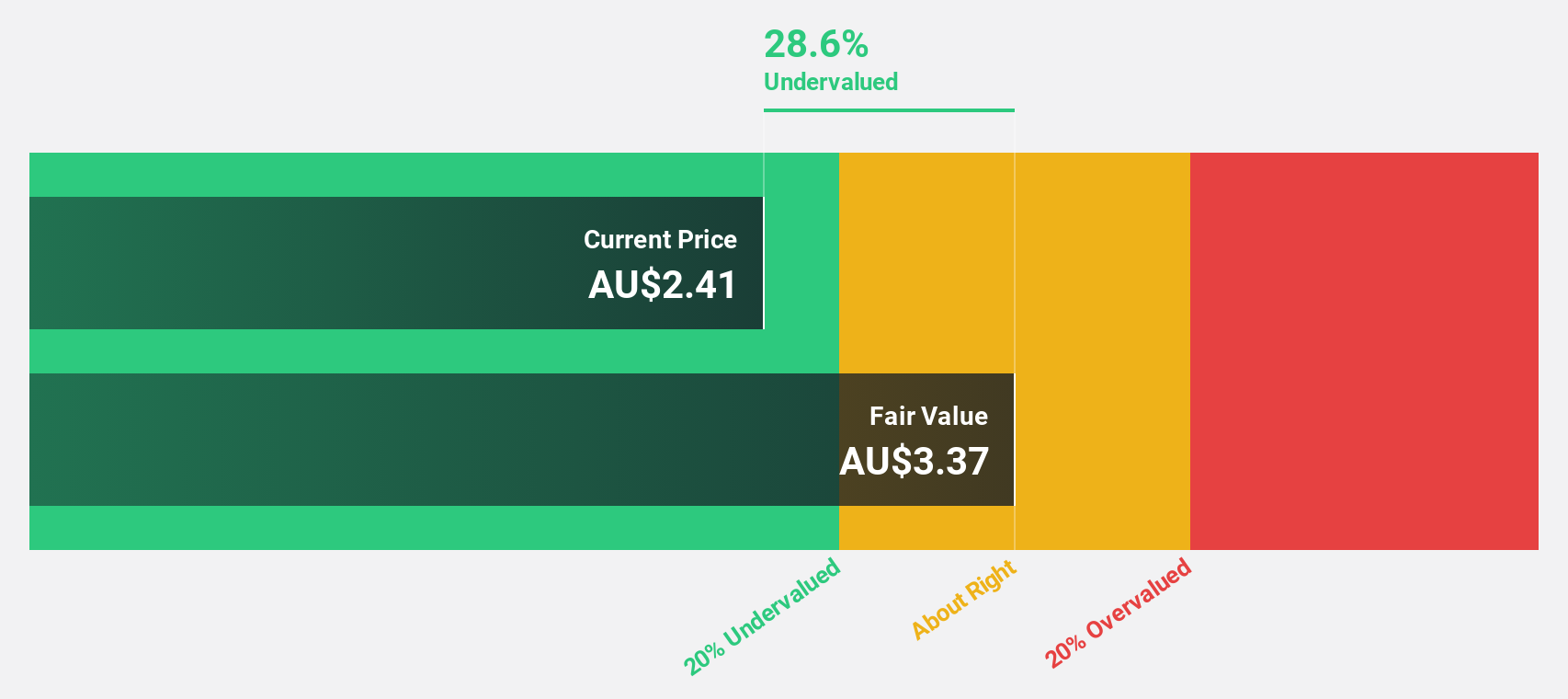

Estimated Discount To Fair Value: 35.4%

National Storage REIT, trading at A$2.24, is valued 35.4% below its estimated fair value of A$3.47, suggesting potential undervaluation based on cash flows. Earnings are projected to grow at 21.2% annually, surpassing the Australian market average growth rate; however, profit margins have decreased from last year’s figures and debt coverage by operating cash flow is weak. Recent earnings show increased revenue but a decline in net income compared to the previous year.

- Our earnings growth report unveils the potential for significant increases in National Storage REIT's future results.

- Get an in-depth perspective on National Storage REIT's balance sheet by reading our health report here.

PWR Holdings (ASX:PWH)

Overview: PWR Holdings Limited specializes in designing, prototyping, producing, testing, validating, and selling cooling products and solutions across various international markets with a market cap of A$642.60 million.

Operations: The company's revenue is primarily derived from its PWR Performance Products segment, contributing A$109.04 million, and its PWR C&R segment, adding A$46.48 million.

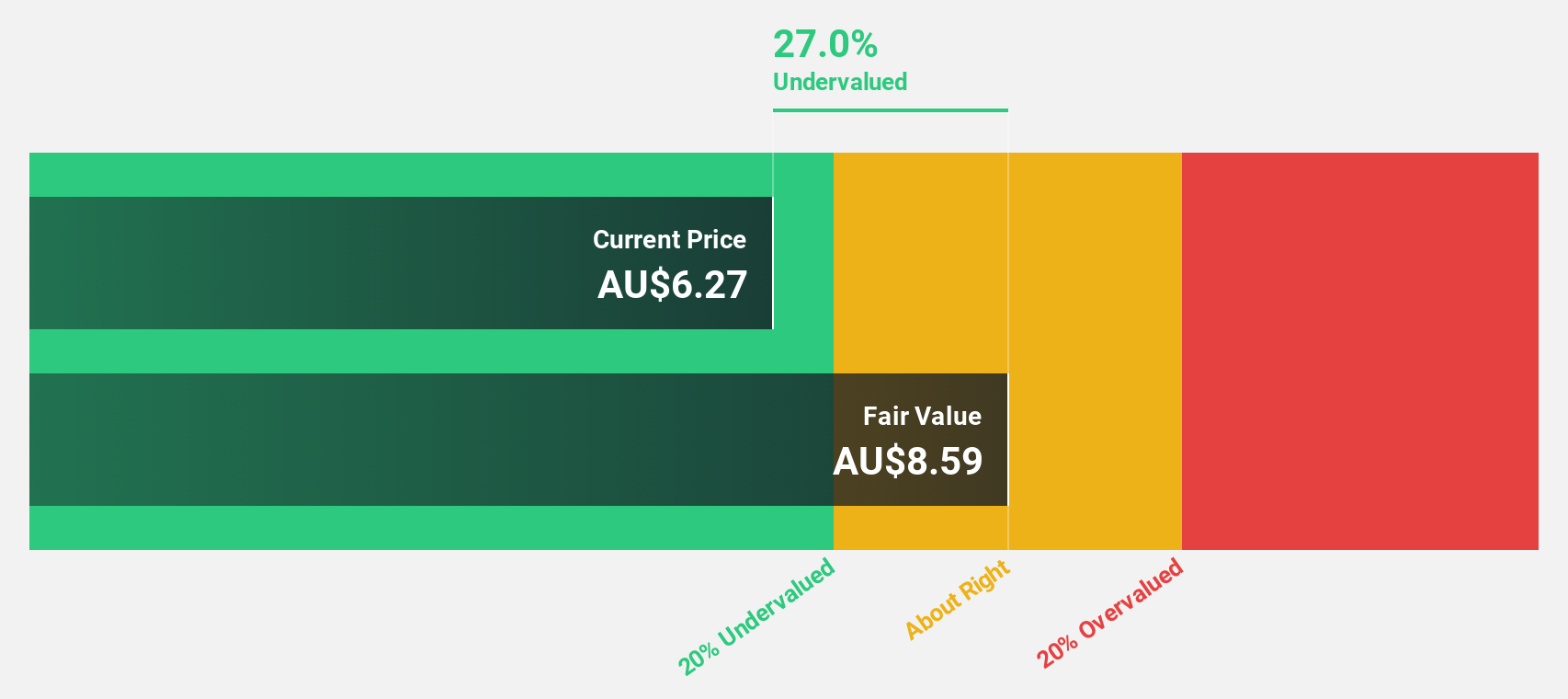

Estimated Discount To Fair Value: 26.5%

PWR Holdings is trading at A$6.39, over 26% below its estimated fair value of A$8.69, indicating potential undervaluation based on cash flows. Despite a recent decline in net income to A$4.08 million from A$9.78 million the previous year, earnings are forecast to grow significantly at 24.66% annually, outpacing the Australian market average growth rate of 11.7%. The company also anticipates robust revenue growth and a high return on equity in three years' time.

- Insights from our recent growth report point to a promising forecast for PWR Holdings' business outlook.

- Dive into the specifics of PWR Holdings here with our thorough financial health report.

Where To Now?

- Explore the 33 names from our Undervalued ASX Stocks Based On Cash Flows screener here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if National Storage REIT might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:NSR

National Storage REIT

National Storage is the largest self-storage provider in Australia and New Zealand, with over 260 centres providing tailored storage solutions to over 97,000 residential and commercial customers.

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives