- Australia

- /

- Metals and Mining

- /

- ASX:FHS

ASX Penny Stocks To Watch In December 2024

Reviewed by Simply Wall St

The Australian market has been facing challenges, with the ASX200 down 0.5% and annual GDP growth slowing to 0.8% in Q3, prompting speculation about potential rate cuts by the RBA. Amidst these broader economic shifts, investors are increasingly looking for opportunities that can offer growth potential despite market volatility. Penny stocks, often associated with smaller or newer companies, continue to present intriguing possibilities for those seeking value at lower price points; when backed by strong financial health and fundamentals, they can offer upside potential without many of the typical risks associated with this investment category.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| Embark Early Education (ASX:EVO) | A$0.795 | A$145.87M | ★★★★☆☆ |

| LaserBond (ASX:LBL) | A$0.59 | A$69.16M | ★★★★★★ |

| Helloworld Travel (ASX:HLO) | A$2.02 | A$328.89M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.55 | A$341.08M | ★★★★★☆ |

| MaxiPARTS (ASX:MXI) | A$1.77 | A$97.91M | ★★★★★★ |

| EZZ Life Science Holdings (ASX:EZZ) | A$2.37 | A$109.39M | ★★★★★★ |

| SHAPE Australia (ASX:SHA) | A$2.75 | A$228.01M | ★★★★★★ |

| Navigator Global Investments (ASX:NGI) | A$1.63 | A$798.83M | ★★★★★☆ |

| Vita Life Sciences (ASX:VLS) | A$2.03 | A$114.16M | ★★★★★★ |

| Servcorp (ASX:SRV) | A$4.96 | A$489.38M | ★★★★☆☆ |

Click here to see the full list of 1,044 stocks from our ASX Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

BrainChip Holdings (ASX:BRN)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: BrainChip Holdings Ltd develops software and hardware solutions for artificial intelligence and machine learning applications across multiple regions, with a market cap of A$483.35 million.

Operations: The company's revenue primarily comes from the segment "The Technological Development of Designs," generating $0.22 million.

Market Cap: A$483.35M

BrainChip Holdings is a pre-revenue company with a market cap of A$483.35 million, focusing on innovative AI and machine learning solutions. Despite its unprofitability and high volatility, it has no debt and covers both short- and long-term liabilities with assets totaling $16.5M. The company recently unveiled the Akida Pico, an ultra-low power co-processor for AI applications in various sectors like healthcare and IoT, highlighting its commitment to cutting-edge technology. However, shareholders have faced dilution over the past year as BrainChip raised additional capital to extend its cash runway beyond 8 months.

- Click here and access our complete financial health analysis report to understand the dynamics of BrainChip Holdings.

- Assess BrainChip Holdings' previous results with our detailed historical performance reports.

Coast Entertainment Holdings (ASX:CEH)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Coast Entertainment Holdings Limited is involved in the investment, ownership, and operation of leisure and entertainment businesses in Australia with a market cap of A$200.66 million.

Operations: The company's revenue is derived from its Theme Parks & Attractions segment, which generated A$87.03 million.

Market Cap: A$200.66M

Coast Entertainment Holdings, with a market cap of A$200.66 million, operates in the leisure and entertainment sector, generating A$87.03 million from its Theme Parks & Attractions segment. Despite being unprofitable, it has reduced losses by 32.7% annually over five years and maintains a debt-free position with short-term assets of A$97.3M covering liabilities comfortably. The company recently initiated a significant share buyback program to repurchase up to 10% of its shares by November 2025, signaling confidence in its valuation which is currently trading below estimated fair value by 34.8%.

- Click here to discover the nuances of Coast Entertainment Holdings with our detailed analytical financial health report.

- Explore Coast Entertainment Holdings' analyst forecasts in our growth report.

Freehill Mining (ASX:FHS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Freehill Mining Limited, along with its subsidiaries, focuses on mining and exploring mineral resources in Chile and has a market capitalization of A$15.39 million.

Operations: The company generates revenue from its Chilean mining operations, amounting to A$0.69 million.

Market Cap: A$15.39M

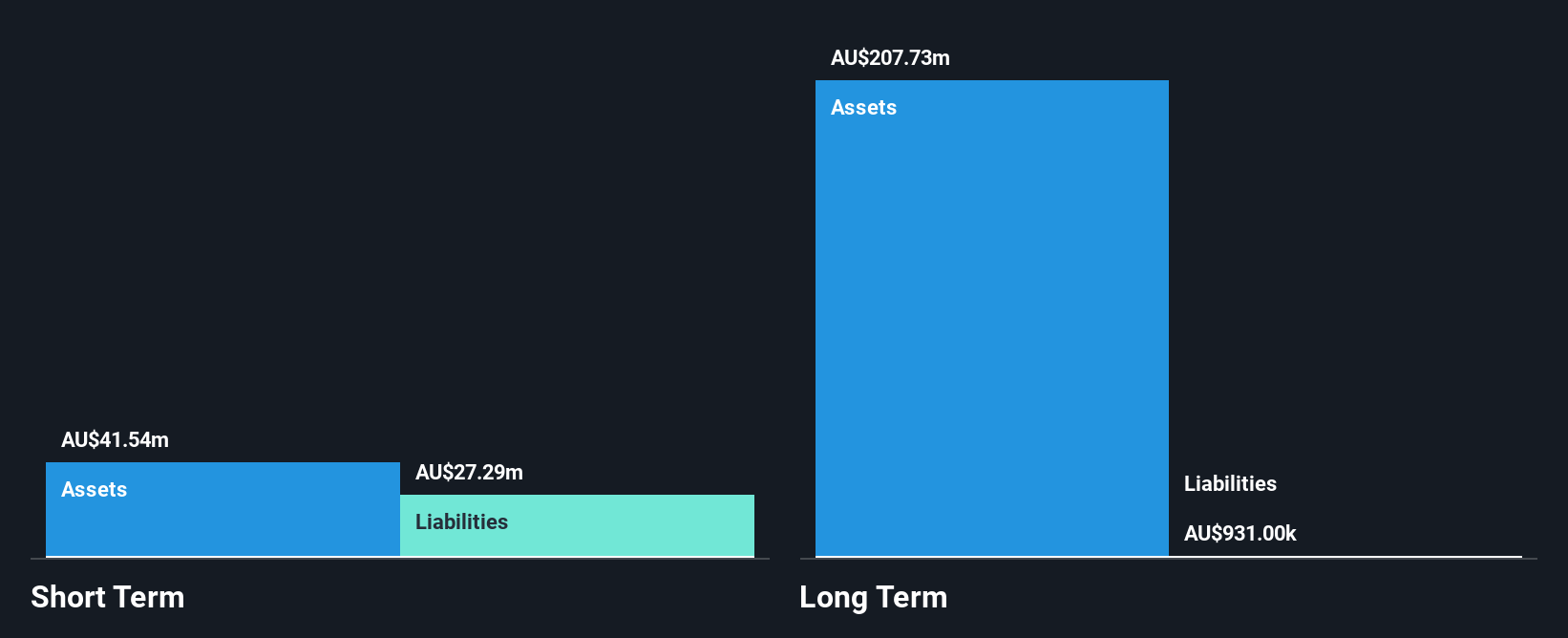

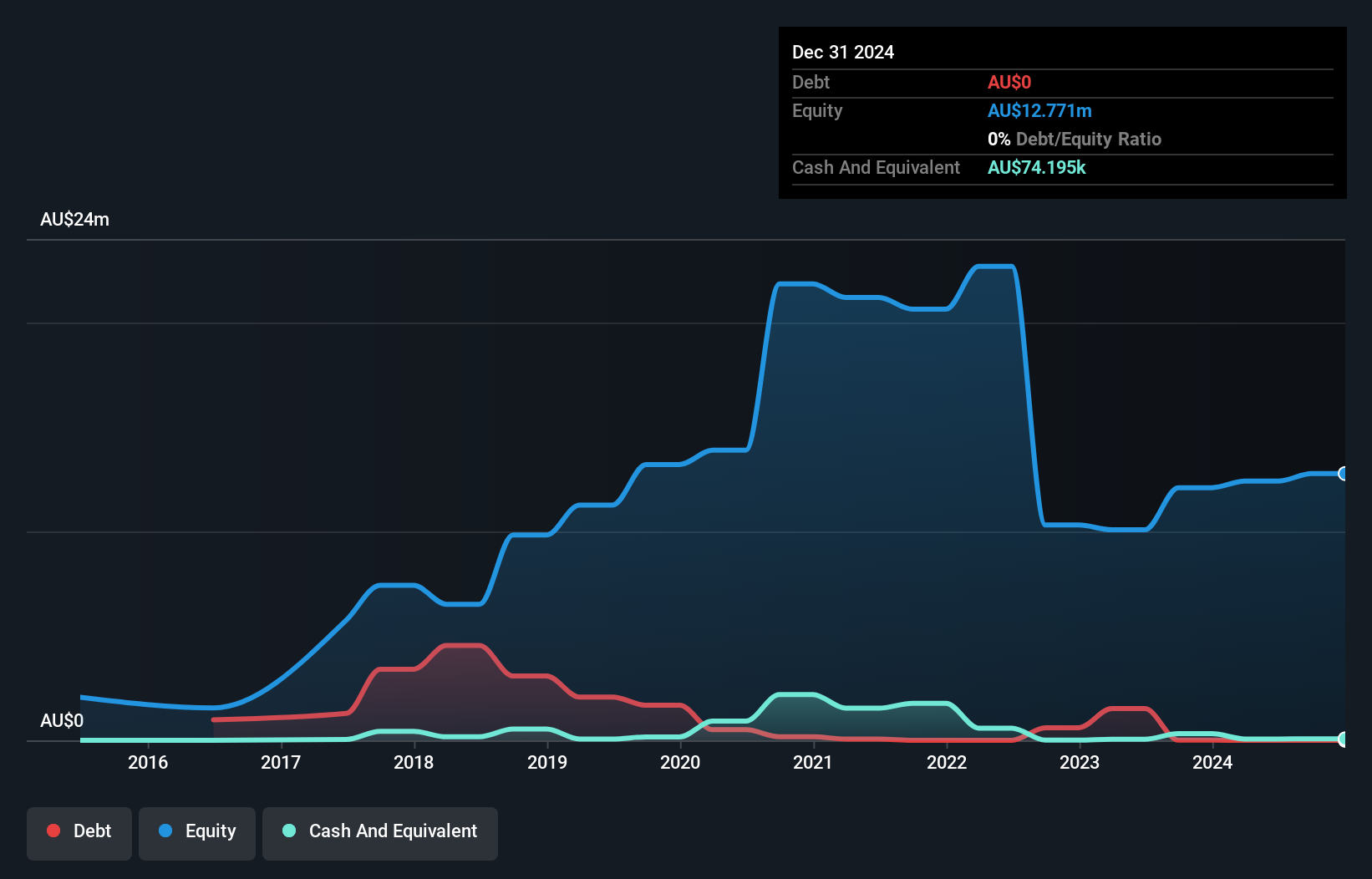

Freehill Mining Limited, with a market cap of A$15.39 million, operates as a pre-revenue entity with sales under US$1 million from its Chilean operations. Despite being debt-free and having short-term assets exceeding liabilities, the company faces significant challenges. It reported a net loss of A$1.51 million for the year ending June 2024 and has experienced shareholder dilution with an 8% increase in shares outstanding over the past year. The auditor expressed doubts about its ability to continue as a going concern, highlighting financial instability amidst high share price volatility and negative return on equity.

- Unlock comprehensive insights into our analysis of Freehill Mining stock in this financial health report.

- Gain insights into Freehill Mining's historical outcomes by reviewing our past performance report.

Seize The Opportunity

- Click this link to deep-dive into the 1,044 companies within our ASX Penny Stocks screener.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:FHS

Freehill Mining

Engages in the mining and exploration of mineral resources in Chile.

Moderate with adequate balance sheet.

Market Insights

Community Narratives