- Australia

- /

- Capital Markets

- /

- ASX:RPL

3 Promising ASX Penny Stocks With Under A$2B Market Cap

Reviewed by Simply Wall St

As Australian shares prepare for a mid-week rise, the market remains attentive to interest rate decisions both locally and in the U.S., with investors weighing their options amidst economic uncertainties. In this context, penny stocks—though often seen as relics of past market trends—still capture attention for their potential to unlock growth in lesser-known corners of the market. By focusing on companies with strong financial health, investors can find opportunities that balance stability with potential upside, making these smaller-cap stocks an intriguing area to explore.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| Alfabs Australia (ASX:AAL) | A$0.385 | A$110.34M | ✅ 4 ⚠️ 4 View Analysis > |

| Dusk Group (ASX:DSK) | A$0.79 | A$49.19M | ✅ 4 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$2.89 | A$444.16M | ✅ 4 ⚠️ 2 View Analysis > |

| MotorCycle Holdings (ASX:MTO) | A$3.21 | A$237.1M | ✅ 4 ⚠️ 1 View Analysis > |

| Veris (ASX:VRS) | A$0.074 | A$38.98M | ✅ 3 ⚠️ 2 View Analysis > |

| West African Resources (ASX:WAF) | A$2.74 | A$3.13B | ✅ 4 ⚠️ 2 View Analysis > |

| Service Stream (ASX:SSM) | A$2.23 | A$1.37B | ✅ 3 ⚠️ 2 View Analysis > |

| EDU Holdings (ASX:EDU) | A$0.90 | A$129.54M | ✅ 4 ⚠️ 2 View Analysis > |

| Fleetwood (ASX:FWD) | A$2.63 | A$243.49M | ✅ 3 ⚠️ 2 View Analysis > |

| GWA Group (ASX:GWA) | A$2.44 | A$639.96M | ✅ 5 ⚠️ 1 View Analysis > |

Click here to see the full list of 421 stocks from our ASX Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Coast Entertainment Holdings (ASX:CEH)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Coast Entertainment Holdings Limited invests in, owns, and operates leisure and entertainment businesses in Australia with a market capitalization of A$192.34 million.

Operations: The company generates revenue from its Theme Parks & Attractions segment, amounting to A$96.40 million.

Market Cap: A$192.34M

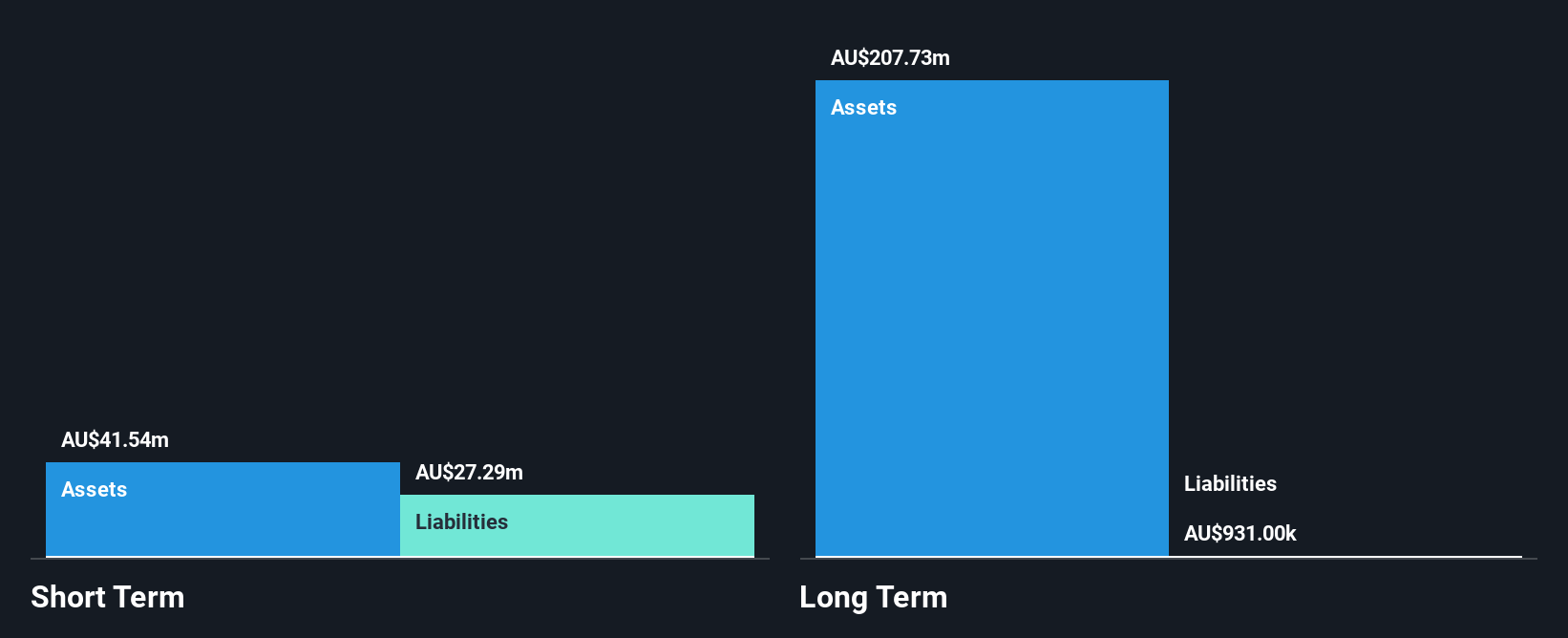

Coast Entertainment Holdings, with a market cap of A$192.34 million, operates in the leisure sector and generates A$96.40 million from its Theme Parks & Attractions segment. Despite being unprofitable, it has reduced losses by 57.9% annually over five years and is forecasted to grow earnings by 62.74% per year. The company is debt-free and maintains stable weekly volatility at 6%. It covers both short-term (A$27.3M) and long-term liabilities (A$931K) with short-term assets of A$41.5M but faces challenges with less than a year of cash runway based on current free cash flow trends.

- Unlock comprehensive insights into our analysis of Coast Entertainment Holdings stock in this financial health report.

- Review our growth performance report to gain insights into Coast Entertainment Holdings' future.

Cogstate (ASX:CGS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Cogstate Limited is a neuroscience solutions company focused on the creation, validation, and commercialization of digital brain health assessments globally, with a market cap of A$430.78 million.

Operations: Cogstate generates revenue from two primary segments: Healthcare, including sports-related applications, contributing $2.51 million, and Clinical Trials, which encompasses precision recruitment tools and research services, accounting for $50.58 million.

Market Cap: A$430.78M

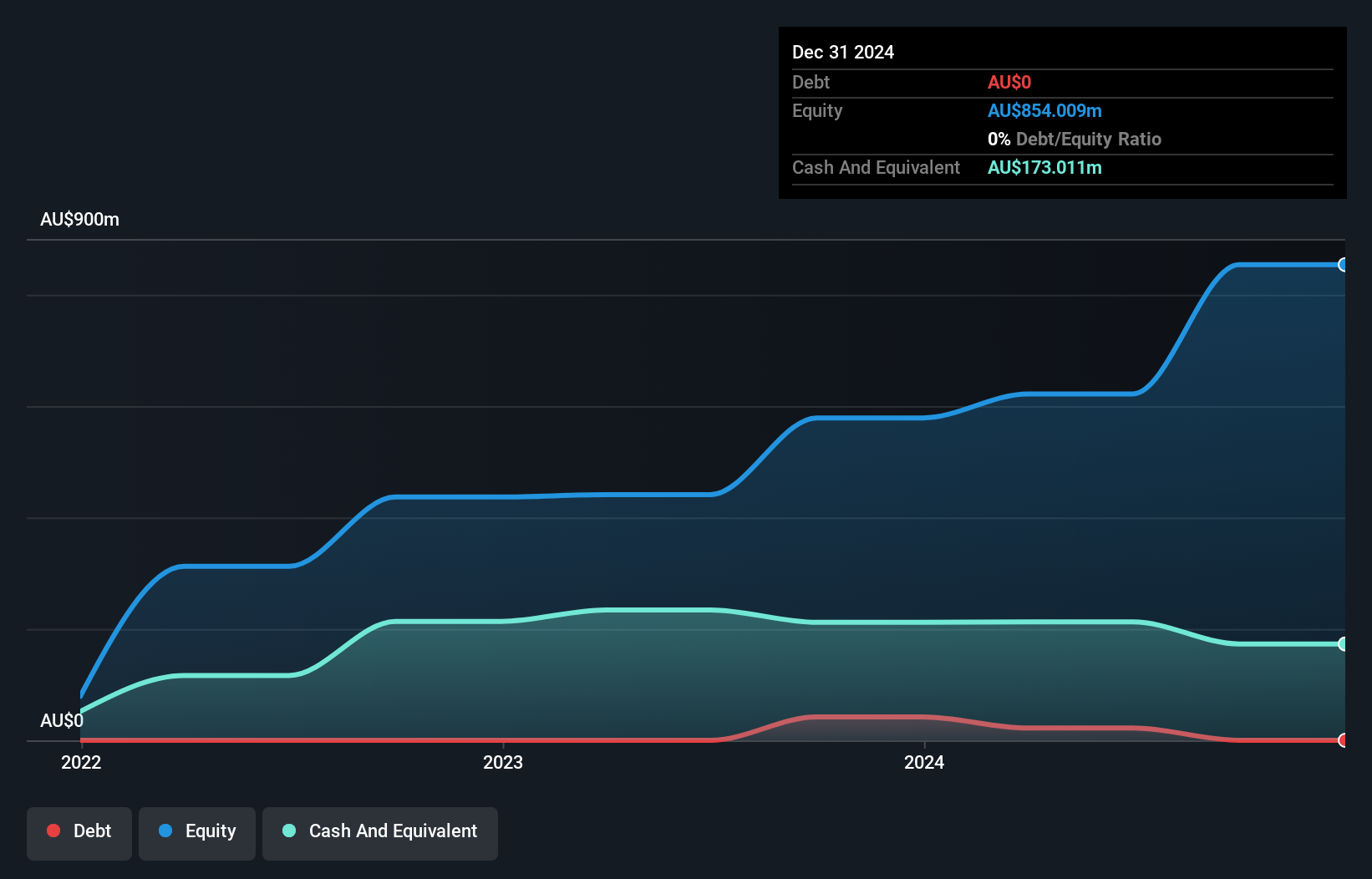

Cogstate Limited, with a market cap of A$430.78 million, has shown strong financial health and growth potential. The company is debt-free and maintains high-quality earnings with a net profit margin increase to 19.1%. Its earnings grew significantly by 86.1% over the past year, outpacing the industry average, while its Price-To-Earnings ratio of 28.2x suggests good relative value compared to peers. Cogstate's management team is experienced, with an average tenure of 4.8 years, and it has initiated a share buyback program representing up to 10% of its issued capital through November 2026, enhancing shareholder value prospects.

- Click here and access our complete financial health analysis report to understand the dynamics of Cogstate.

- Gain insights into Cogstate's outlook and expected performance with our report on the company's earnings estimates.

Regal Partners (ASX:RPL)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Regal Partners Limited is a privately owned hedge fund sponsor with a market cap of A$1.13 billion.

Operations: The company generates revenue primarily through the provision of investment management services, amounting to A$245.45 million.

Market Cap: A$1.13B

Regal Partners Limited, with a market cap of A$1.13 billion, demonstrates financial stability through its short-term assets (A$256.8M) exceeding both short-term and long-term liabilities. Despite recent negative earnings growth of -24.1%, the company maintains high-quality earnings and forecasts a significant annual earnings growth of 31.51%. However, its profit margins have decreased from 28.1% to 17.2%, and insider selling has been significant recently. The dividend yield of 5.21% is not well covered by current earnings or free cash flow, indicating potential sustainability concerns despite being added to the S&P/ASX Small Ordinaries and ASX 300 Indexes recently.

- Jump into the full analysis health report here for a deeper understanding of Regal Partners.

- Assess Regal Partners' future earnings estimates with our detailed growth reports.

Summing It All Up

- Navigate through the entire inventory of 421 ASX Penny Stocks here.

- Contemplating Other Strategies? The end of cancer? These 29 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:RPL

Reasonable growth potential with adequate balance sheet.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

SLI is share to watch next 5 years

The "Molecular Pencil": Why Beam's Technology is Built to Win

PRME remains a long shot but publication in the New England Journal of Medicine helps.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026