- Australia

- /

- Hospitality

- /

- ASX:BBT

A Piece Of The Puzzle Missing From BlueBet Holdings Ltd's (ASX:BBT) 33% Share Price Climb

BlueBet Holdings Ltd (ASX:BBT) shareholders have had their patience rewarded with a 33% share price jump in the last month. Unfortunately, despite the strong performance over the last month, the full year gain of 5.3% isn't as attractive.

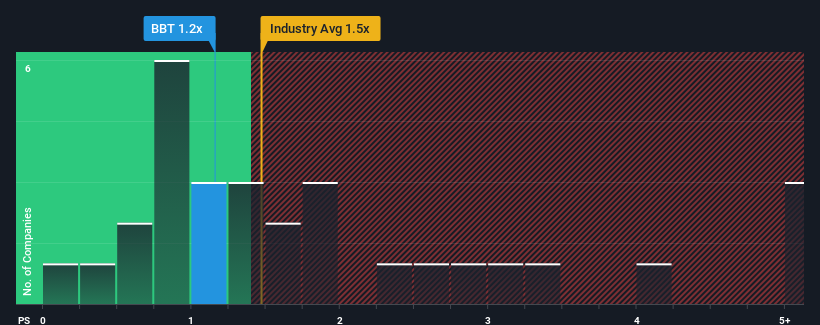

Even after such a large jump in price, you could still be forgiven for feeling indifferent about BlueBet Holdings' P/S ratio of 1.2x, since the median price-to-sales (or "P/S") ratio for the Hospitality industry in Australia is also close to 1.5x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

View our latest analysis for BlueBet Holdings

What Does BlueBet Holdings' P/S Mean For Shareholders?

Recent times haven't been great for BlueBet Holdings as its revenue has been rising slower than most other companies. It might be that many expect the uninspiring revenue performance to strengthen positively, which has kept the P/S ratio from falling. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on BlueBet Holdings.What Are Revenue Growth Metrics Telling Us About The P/S?

There's an inherent assumption that a company should be matching the industry for P/S ratios like BlueBet Holdings' to be considered reasonable.

Retrospectively, the last year delivered a decent 7.9% gain to the company's revenues. The latest three year period has also seen an excellent 101% overall rise in revenue, aided somewhat by its short-term performance. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Shifting to the future, estimates from the two analysts covering the company suggest revenue should grow by 18% over the next year. Meanwhile, the rest of the industry is forecast to only expand by 8.7%, which is noticeably less attractive.

With this information, we find it interesting that BlueBet Holdings is trading at a fairly similar P/S compared to the industry. It may be that most investors aren't convinced the company can achieve future growth expectations.

The Key Takeaway

Its shares have lifted substantially and now BlueBet Holdings' P/S is back within range of the industry median. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Looking at BlueBet Holdings' analyst forecasts revealed that its superior revenue outlook isn't giving the boost to its P/S that we would've expected. There could be some risks that the market is pricing in, which is preventing the P/S ratio from matching the positive outlook. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

Plus, you should also learn about these 4 warning signs we've spotted with BlueBet Holdings (including 1 which shouldn't be ignored).

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if BETR Entertainment might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:BBT

BETR Entertainment

Provides sports and racing betting products and services under the BlueBet and betr brands to online and telephone clients through online wagering platform and mobile applications in Australia and North America.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives