- Australia

- /

- Food and Staples Retail

- /

- ASX:WOW

Will Woolworths (ASX:WOW) Board Refresh and Dividend Underscore Evolving Priorities for Shareholders?

Reviewed by Simply Wall St

- Woolworths Group Limited recently reported full-year earnings for the period ended June 30, 2025, with net income rising to A$963 million and announced a fully franked cash dividend of A$0.45 per share, payable in late September 2025, alongside upcoming board changes including the addition of Ken Meyer as a non-executive director pending approvals and the retirement of Holly Kramer after nine years of service.

- The appointment of Ken Meyer, who brings 24 years of experience from Whole Foods Market, marks a shift towards deeper international food retail expertise on Woolworths’ Board.

- We’ll now explore how Woolworths’ strong earnings result and board refresh shape the company’s future investment narrative.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Woolworths Group Investment Narrative Recap

Woolworths shareholders generally need to believe in the group’s ability to drive operational efficiencies, maintain a strong footprint in essential retail, and defend market share in the face of fierce competition. The latest earnings result reinforces short-term confidence but does not materially shift the most important near-term catalyst, increasing margins through supply chain automation. The main risk remains intense competition and elevated costs in areas like loss prevention and price investment, and these are unchanged by recent announcements.

The appointment of Ken Meyer to the board stands out as highly relevant given Woolworths’ renewal focus and efforts to enhance food retail expertise. His arrival signals a continued commitment to operational innovation, yet margin pressures from rivals and cost inflation remain the primary catalyst shaping investor expectations for future performance.

But while recent leadership changes attract attention, investors should be especially mindful of how ongoing margin pressure from competition and cost control might quietly undermine Woolworths’...

Read the full narrative on Woolworths Group (it's free!)

Woolworths Group is projected to reach A$77.3 billion in revenue and A$1.9 billion in earnings by 2028. This outlook assumes annual revenue growth of 3.8% and an earnings increase of A$937 million from current earnings of A$963 million.

Uncover how Woolworths Group's forecasts yield a A$30.51 fair value, a 10% upside to its current price.

Exploring Other Perspectives

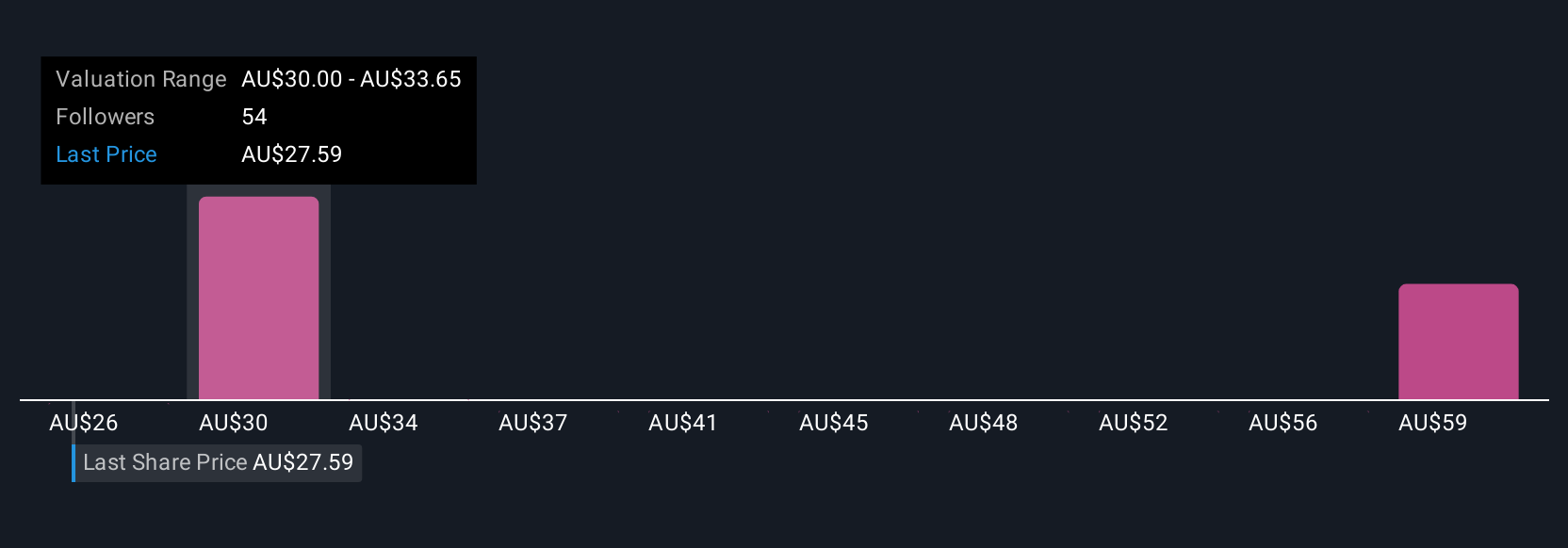

Eight members of the Simply Wall St Community estimate Woolworths’ fair value between A$26.35 and A$62.61 per share. Opinions about margin pressures from price competition and elevated costs show why investor outlooks on profitability can vary so much.

Explore 8 other fair value estimates on Woolworths Group - why the stock might be worth 5% less than the current price!

Build Your Own Woolworths Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Woolworths Group research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Woolworths Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Woolworths Group's overall financial health at a glance.

Searching For A Fresh Perspective?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- AI is about to change healthcare. These 29 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Woolworths Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:WOW

Moderate growth potential with acceptable track record.

Similar Companies

Market Insights

Community Narratives