- Australia

- /

- Food and Staples Retail

- /

- ASX:WOW

Valuing Woolworths Group (ASX:WOW) After New Pricing Rules, DoorDash Deal and Moorebank Overhaul

Reviewed by Simply Wall St

The latest move in Woolworths Group (ASX:WOW) comes as Canberra targets excessive supermarket pricing from 2026, while the company focuses on a new DoorDash partnership and its Moorebank logistics overhaul to defend margins.

See our latest analysis for Woolworths Group.

Despite the regulatory overhang, Woolworths has quietly posted a 4.7% 1 month share price return and a flat 1 year total shareholder return. This suggests momentum is stabilising rather than breaking out.

If this kind of defensive story appeals, it might be worth seeing what else is out there and exploring fast growing stocks with high insider ownership as a contrast.

With earnings still growing, a modest discount to analyst targets and fresh regulatory clouds on the horizon, is Woolworths quietly undervalued here, or is the market already pricing in every dollar of future growth?

Most Popular Narrative Narrative: 3.1% Undervalued

With the narrative fair value sitting just above Woolworths Group's A$29.56 last close, expectations hinge on whether earnings can compound steadily from here.

The ongoing investment and upgrades in Woolworths' supply chain automation and distribution centers are expected to drive significant operational efficiencies and margin improvement over the next few years, as dual running and commissioning costs roll off and new facilities like Moorebank and Auburn CFCs deliver returns that are likely to support higher future EBIT and ROIC.

Curious how modest looking top line growth and a step change in margins can still back a multi year earnings ramp and premium multiple contraction story? The most followed narrative joins the dots between these moving parts, its chosen discount rate, and a surprisingly punchy 2028 profit ambition. Want to see exactly how those assumptions stack up into today’s fair value?

Result: Fair Value of $30.51 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent BIG W weakness and intensifying supermarket price competition could pressure margins and stall the multi year earnings and valuation rerating that investors are banking on.

Find out about the key risks to this Woolworths Group narrative.

Another Take on Value

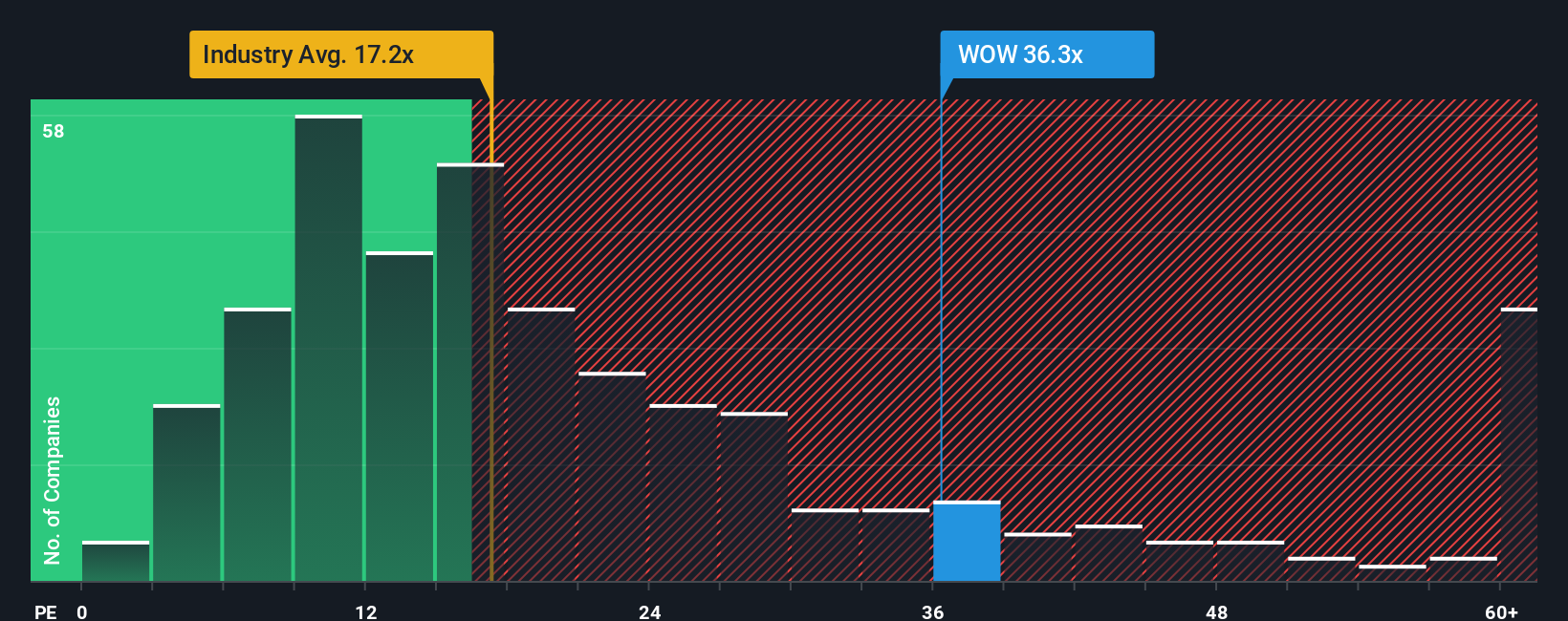

While the narrative view sees Woolworths as only 3.1% undervalued, its price to earnings ratio of 37.5x looks steep compared with both global consumer retail at 17.2x and a fair ratio of 34.6x. This suggests far less margin of safety if growth disappoints.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Woolworths Group Narrative

If you see Woolworths differently, or simply prefer to test every assumption yourself, you can build a custom view in minutes: Do it your way.

A great starting point for your Woolworths Group research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Ready for more high conviction ideas?

Before you move on, lock in an edge by scanning hand picked stock ideas that match your strategy, so the next opportunity does not slip by.

- Target robust cash generators trading below intrinsic value with these 908 undervalued stocks based on cash flows, tailored for investors who want quality at a meaningful discount.

- Harness the power of automation and machine learning trends through these 26 AI penny stocks, capturing companies at the forefront of intelligent technology.

- Strengthen your income stream by reviewing these 13 dividend stocks with yields > 3%, built for investors who want reliable yields without sacrificing balance sheet quality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Woolworths Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:WOW

Moderate growth potential with acceptable track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)