- Australia

- /

- Food and Staples Retail

- /

- ASX:COL

Pinning Down Coles Group Limited's (ASX:COL) P/E Is Difficult Right Now

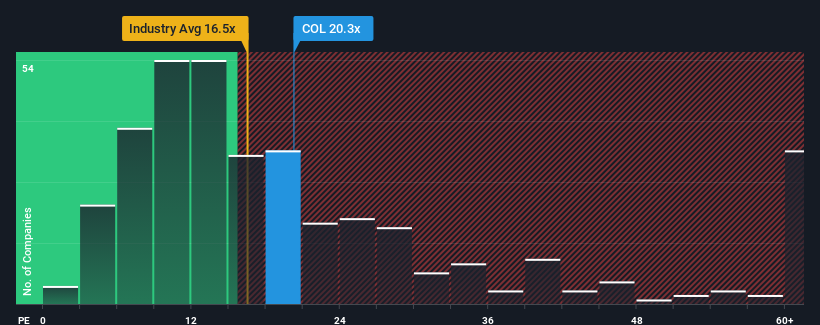

With a median price-to-earnings (or "P/E") ratio of close to 19x in Australia, you could be forgiven for feeling indifferent about Coles Group Limited's (ASX:COL) P/E ratio of 20.3x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

There hasn't been much to differentiate Coles Group's and the market's retreating earnings lately. It seems that few are expecting the company's earnings performance to deviate much from most other companies, which has held the P/E back. If you still like the company, you'd want its earnings trajectory to turn around before making any decisions. At the very least, you'd be hoping that earnings don't accelerate downwards if your plan is to pick up some stock while it's not in favour.

See our latest analysis for Coles Group

Does Growth Match The P/E?

There's an inherent assumption that a company should be matching the market for P/E ratios like Coles Group's to be considered reasonable.

If we review the last year of earnings, the company posted a result that saw barely any deviation from a year ago. Regardless, EPS has managed to lift by a handy 6.6% in aggregate from three years ago, thanks to the earlier period of growth. So it appears to us that the company has had a mixed result in terms of growing earnings over that time.

Turning to the outlook, the next three years should generate growth of 5.3% each year as estimated by the analysts watching the company. Meanwhile, the rest of the market is forecast to expand by 17% each year, which is noticeably more attractive.

With this information, we find it interesting that Coles Group is trading at a fairly similar P/E to the market. Apparently many investors in the company are less bearish than analysts indicate and aren't willing to let go of their stock right now. Maintaining these prices will be difficult to achieve as this level of earnings growth is likely to weigh down the shares eventually.

The Bottom Line On Coles Group's P/E

Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of Coles Group's analyst forecasts revealed that its inferior earnings outlook isn't impacting its P/E as much as we would have predicted. When we see a weak earnings outlook with slower than market growth, we suspect the share price is at risk of declining, sending the moderate P/E lower. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

Plus, you should also learn about this 1 warning sign we've spotted with Coles Group.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:COL

Solid track record with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives