Warren Buffett famously said, 'Volatility is far from synonymous with risk.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. We can see that Breville Group Limited (ASX:BRG) does use debt in its business. But the real question is whether this debt is making the company risky.

What Risk Does Debt Bring?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. When we think about a company's use of debt, we first look at cash and debt together.

Check out our latest analysis for Breville Group

How Much Debt Does Breville Group Carry?

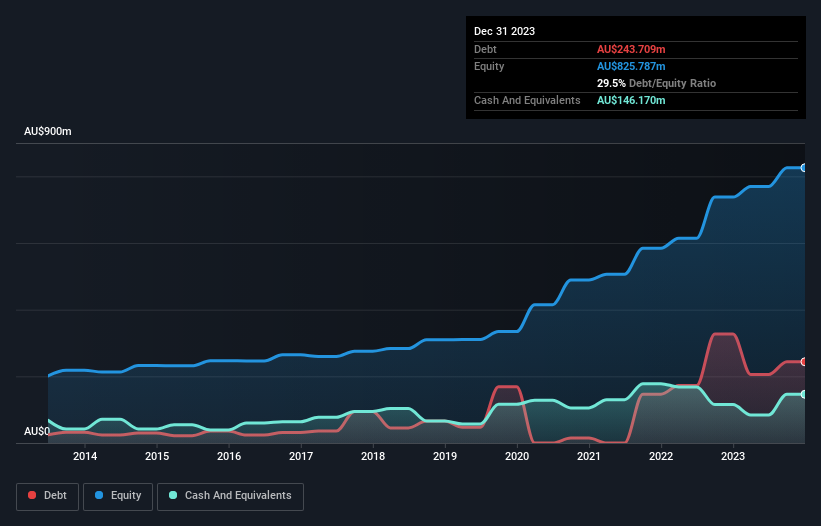

The image below, which you can click on for greater detail, shows that Breville Group had debt of AU$243.7m at the end of December 2023, a reduction from AU$327.4m over a year. However, because it has a cash reserve of AU$146.2m, its net debt is less, at about AU$97.5m.

How Strong Is Breville Group's Balance Sheet?

According to the last reported balance sheet, Breville Group had liabilities of AU$512.3m due within 12 months, and liabilities of AU$223.6m due beyond 12 months. Offsetting these obligations, it had cash of AU$146.2m as well as receivables valued at AU$456.5m due within 12 months. So its liabilities total AU$133.2m more than the combination of its cash and short-term receivables.

Since publicly traded Breville Group shares are worth a total of AU$3.89b, it seems unlikely that this level of liabilities would be a major threat. Having said that, it's clear that we should continue to monitor its balance sheet, lest it change for the worse.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

With net debt sitting at just 0.49 times EBITDA, Breville Group is arguably pretty conservatively geared. And this view is supported by the solid interest coverage, with EBIT coming in at 7.7 times the interest expense over the last year. The good news is that Breville Group has increased its EBIT by 9.7% over twelve months, which should ease any concerns about debt repayment. There's no doubt that we learn most about debt from the balance sheet. But it is future earnings, more than anything, that will determine Breville Group's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So it's worth checking how much of that EBIT is backed by free cash flow. In the last three years, Breville Group created free cash flow amounting to 13% of its EBIT, an uninspiring performance. That limp level of cash conversion undermines its ability to manage and pay down debt.

Our View

On our analysis Breville Group's net debt to EBITDA should signal that it won't have too much trouble with its debt. But the other factors we noted above weren't so encouraging. For example, its conversion of EBIT to free cash flow makes us a little nervous about its debt. When we consider all the elements mentioned above, it seems to us that Breville Group is managing its debt quite well. But a word of caution: we think debt levels are high enough to justify ongoing monitoring. We'd be motivated to research the stock further if we found out that Breville Group insiders have bought shares recently. If you would too, then you're in luck, since today we're sharing our list of reported insider transactions for free.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

Valuation is complex, but we're here to simplify it.

Discover if Breville Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:BRG

Breville Group

Designs, develops, markets, and distributes small electrical kitchen appliances in the consumer products industry in the Americas, Europe, the Middle East, Africa, and the Asia Pacific.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives