- Australia

- /

- Metals and Mining

- /

- ASX:OMH

Euroz Hartleys Group And 2 Other ASX Penny Stocks To Watch

Reviewed by Simply Wall St

Australian shares have seen a slight dip in futures, reflecting a cautious market as investors await key economic developments and geopolitical talks. Amidst this backdrop, penny stocks present an intriguing opportunity for those looking to explore beyond established names. Although the term 'penny stocks' might seem outdated, these smaller or newer companies can offer a blend of affordability and growth potential when backed by strong financials.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| EZZ Life Science Holdings (ASX:EZZ) | A$2.66 | A$125.48M | ✅ 2 ⚠️ 2 View Analysis > |

| Dusk Group (ASX:DSK) | A$0.905 | A$56.35M | ✅ 4 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$2.67 | A$410.95M | ✅ 4 ⚠️ 3 View Analysis > |

| MotorCycle Holdings (ASX:MTO) | A$3.32 | A$245.04M | ✅ 4 ⚠️ 2 View Analysis > |

| Pureprofile (ASX:PPL) | A$0.041 | A$47.96M | ✅ 3 ⚠️ 1 View Analysis > |

| Veris (ASX:VRS) | A$0.073 | A$38.45M | ✅ 4 ⚠️ 2 View Analysis > |

| West African Resources (ASX:WAF) | A$3.04 | A$3.47B | ✅ 4 ⚠️ 1 View Analysis > |

| LaserBond (ASX:LBL) | A$0.50 | A$59.04M | ✅ 4 ⚠️ 1 View Analysis > |

| Praemium (ASX:PPS) | A$0.83 | A$397.09M | ✅ 5 ⚠️ 2 View Analysis > |

| Clover (ASX:CLV) | A$0.70 | A$116.9M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 420 stocks from our ASX Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Euroz Hartleys Group (ASX:EZL)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Euroz Hartleys Group Limited is a diversified financial services company offering stockbroking, wealth and funds management, and investing services in Australia with a market cap of A$157.73 million.

Operations: The company's revenue is primarily derived from its Private Wealth segment, contributing A$54.17 million, followed by the Wholesale segment at A$44.16 million.

Market Cap: A$157.73M

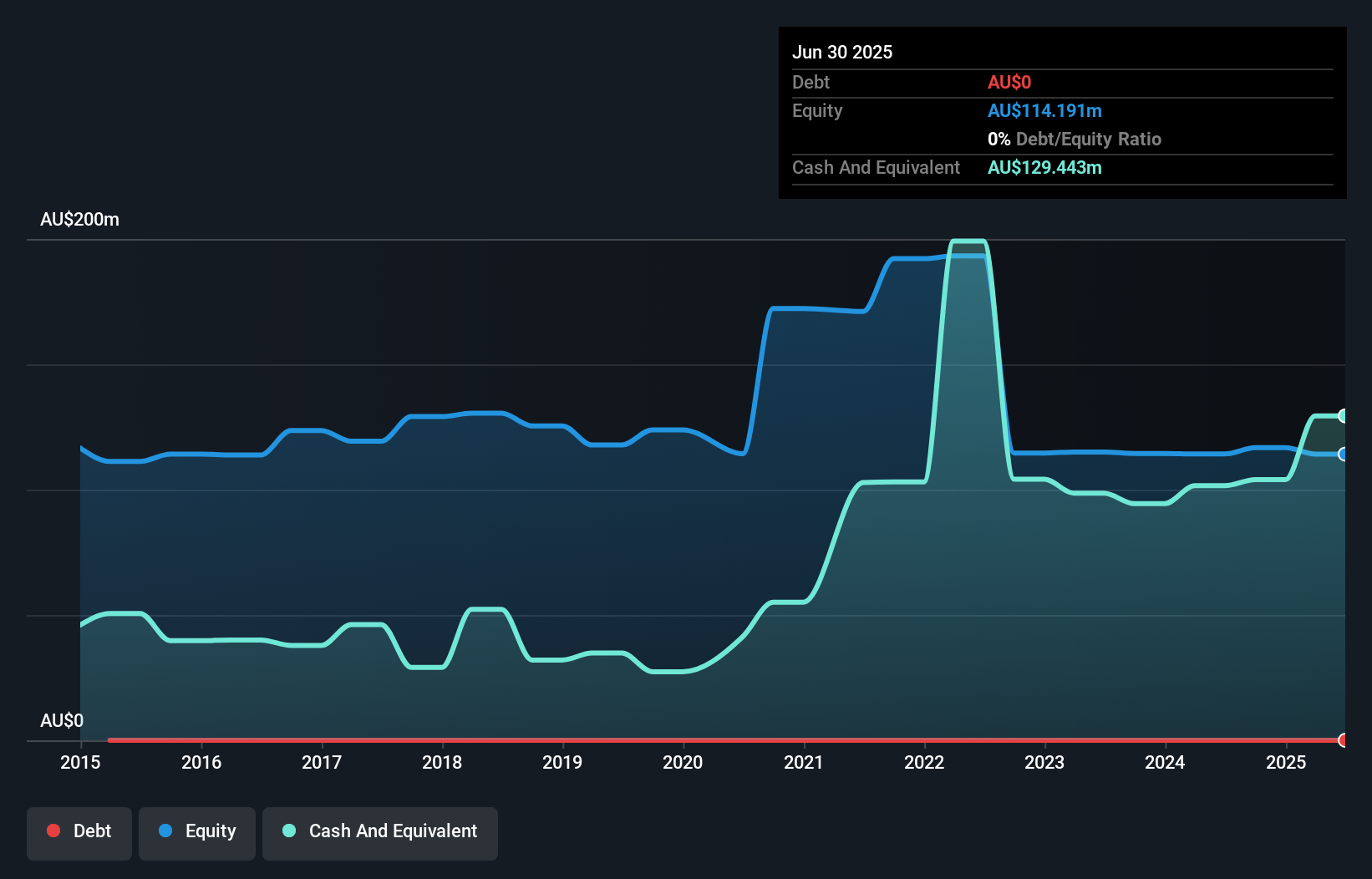

Euroz Hartleys Group Limited, with a market cap of A$157.73 million, demonstrates financial stability in the penny stock realm by maintaining no debt and covering both short-term and long-term liabilities with its assets. The company's recent earnings growth of 87.7% over the past year surpasses industry averages, though it contrasts with a five-year decline of 25.3% annually. Despite an unstable dividend history, Euroz Hartleys recently increased its ordinary dividend to A$0.035 per share for the period ending June 2025. Its Price-To-Earnings ratio (15.4x) suggests potential undervaluation compared to the broader Australian market (21.7x).

- Navigate through the intricacies of Euroz Hartleys Group with our comprehensive balance sheet health report here.

- Evaluate Euroz Hartleys Group's historical performance by accessing our past performance report.

OM Holdings (ASX:OMH)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: OM Holdings Limited is an investment holding company involved in the mining, smelting, trading, and marketing of manganese ores and ferroalloys globally, with a market cap of A$206.37 million.

Operations: The company's revenue is primarily derived from its Smelting segment, which generated $498.11 million, and its Marketing and Trading segment, contributing $680.80 million.

Market Cap: A$206.37M

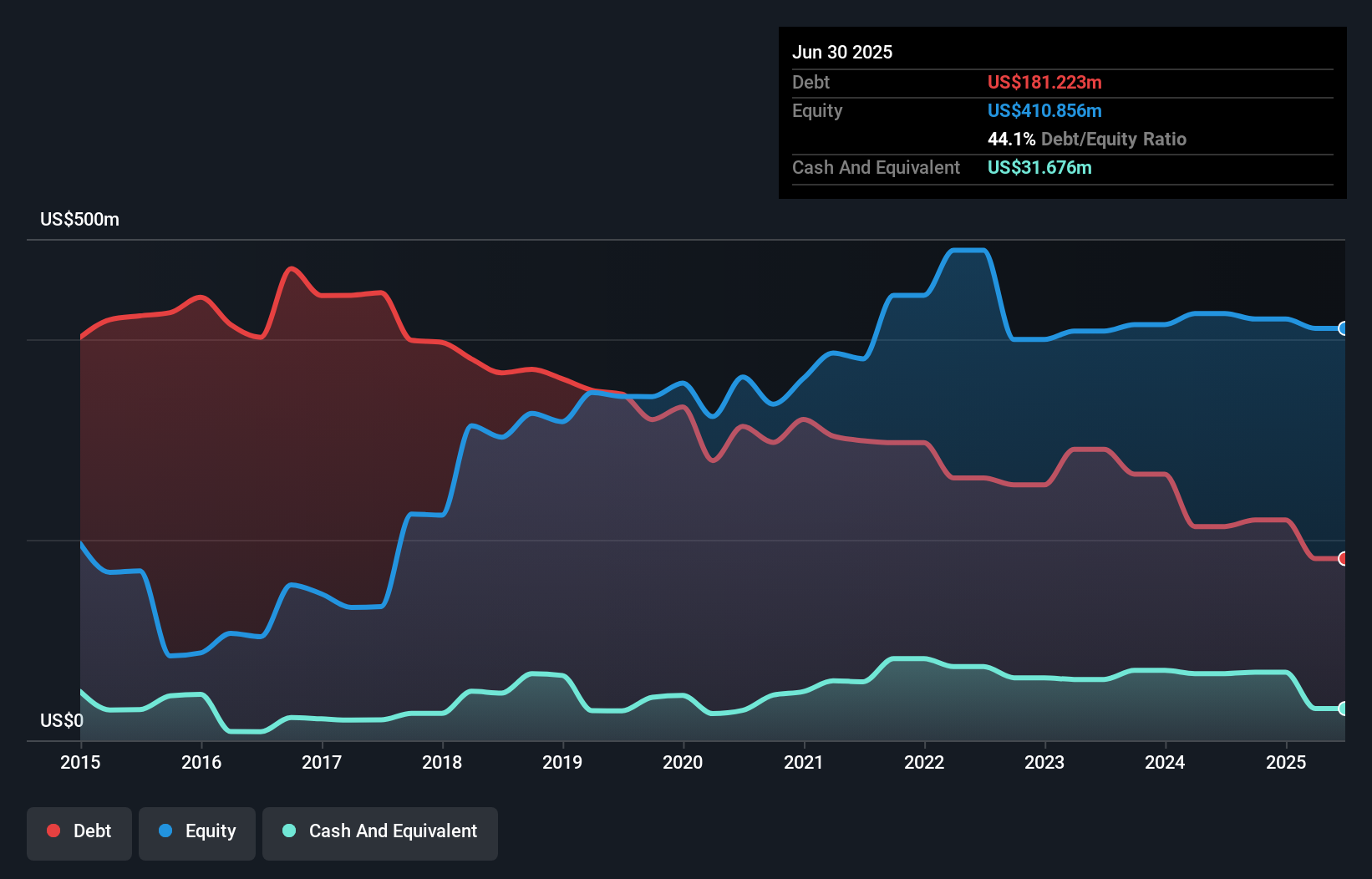

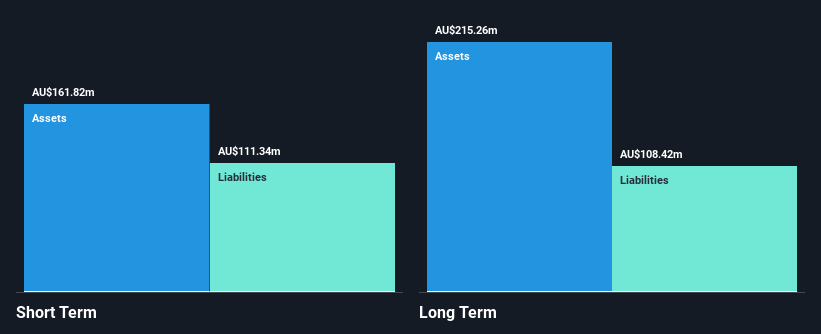

OM Holdings Limited, with a market cap of A$206.37 million, faces challenges typical of penny stocks. Despite generating significant revenue from its Smelting and Marketing segments, the company reported a net loss of US$9.57 million for the half-year ending June 2025. While OM Holdings' short-term assets comfortably cover both short- and long-term liabilities, its debt interest payments are not well covered by EBIT. The board's extensive experience contrasts with management's less clear tenure data. Although unprofitable currently, earnings are forecast to grow significantly at 101% annually, indicating potential future improvement in financial performance.

- Dive into the specifics of OM Holdings here with our thorough balance sheet health report.

- Explore OM Holdings' analyst forecasts in our growth report.

Peoplein (ASX:PPE)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Peoplein Limited, with a market cap of A$100.76 million, offers staffing, business, and operational services across Australia, New Zealand, and Singapore.

Operations: The company's revenue is derived from three main segments: Health and Community (A$125.28 million), Professional Services (A$106.74 million), and Industrial and Specialist Services (A$866.10 million).

Market Cap: A$100.76M

Peoplein Limited, with a market cap of A$100.76 million, reflects the complexities often seen in penny stocks. Despite generating significant revenue across its segments, it reported a net loss of A$12.76 million for the year ending June 2025, transitioning from profitability the previous year. The debt situation is mixed; while operating cash flow covers 39.1% of its debt and short-term assets exceed liabilities, interest coverage remains weak at 1.9x EBIT. The company’s recent share buyback program aims to enhance shareholder value but highlights financial challenges as losses have expanded over five years at an annual rate of 35.4%.

- Jump into the full analysis health report here for a deeper understanding of Peoplein.

- Learn about Peoplein's future growth trajectory here.

Next Steps

- Access the full spectrum of 420 ASX Penny Stocks by clicking on this link.

- Want To Explore Some Alternatives? Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:OMH

OM Holdings

An investment holding company, engages in mining, smelting, trading, and marketing manganese ores and ferroalloys worldwide.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives