- Australia

- /

- Commercial Services

- /

- ASX:MAD

Undervalued Asian Small Caps With Insider Buying In May 2025

Reviewed by Simply Wall St

As global markets face volatility amid renewed tariff threats and fluctuating economic indicators, small-cap stocks in Asia present intriguing opportunities for investors seeking diversification. In this environment, identifying companies with strong fundamentals and insider buying can offer valuable insights into potential growth prospects despite broader market challenges.

Top 10 Undervalued Small Caps With Insider Buying In Asia

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Security Bank | 4.1x | 0.9x | 42.32% | ★★★★★★ |

| Puregold Price Club | 8.1x | 0.4x | 26.02% | ★★★★★☆ |

| East West Banking | 3.1x | 0.7x | 34.64% | ★★★★★☆ |

| Atturra | 29.4x | 1.2x | 34.64% | ★★★★★☆ |

| Viva Energy Group | NA | 0.1x | 46.17% | ★★★★★☆ |

| Lion Rock Group | 4.9x | 0.4x | 49.52% | ★★★★☆☆ |

| Dicker Data | 18.9x | 0.7x | -14.46% | ★★★★☆☆ |

| Smart Parking | 68.0x | 6.0x | 49.01% | ★★★☆☆☆ |

| PWR Holdings | 35.5x | 4.9x | 23.38% | ★★★☆☆☆ |

| Integral Diagnostics | 156.5x | 1.8x | 43.69% | ★★★☆☆☆ |

We're going to check out a few of the best picks from our screener tool.

Dicker Data (ASX:DDR)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Dicker Data is a wholesale distributor specializing in computer peripherals, with a market capitalization of A$2.57 billion.

Operations: The company generates revenue primarily through wholesale distribution of computer peripherals, with a recent quarterly revenue of A$2.28 billion. Cost of Goods Sold (COGS) significantly impacts the financials, amounting to A$1.95 billion in the latest period. Operating expenses and non-operating expenses further influence net income, which stands at A$78.69 million for the same period. Notably, the gross profit margin has shown an upward trend, reaching 14.56% in recent quarters.

PE: 18.9x

Dicker Data, a small-cap in the tech distribution sector, is gaining attention for its strategic moves and insider confidence. Recent insider purchases signal belief in its potential. The company recently partnered with CrowdStrike to enhance cybersecurity offerings across Australia and New Zealand, tapping into rising demand. Despite high debt levels from external borrowing, earnings are forecasted to grow by 9% annually. This growth potential positions Dicker Data as an intriguing option among undervalued stocks in Asia.

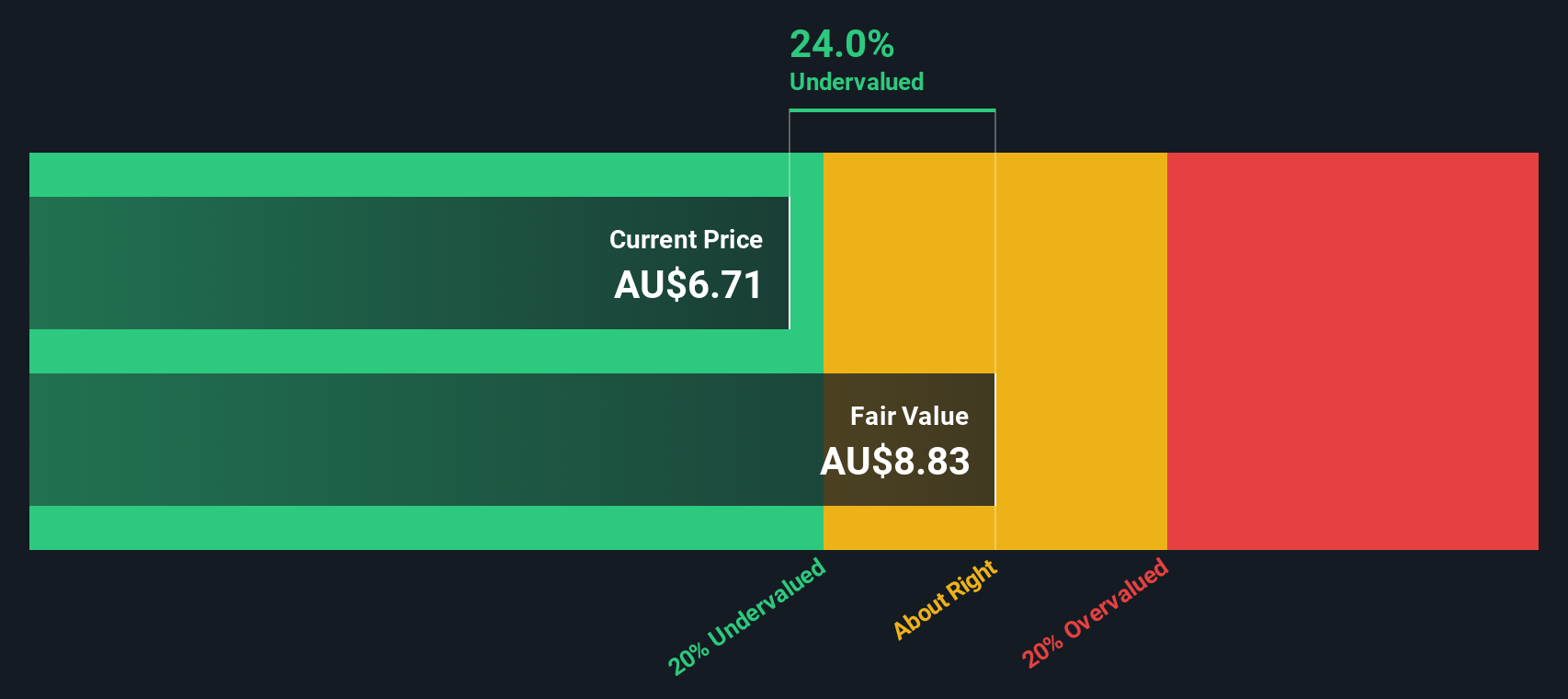

Mader Group (ASX:MAD)

Simply Wall St Value Rating: ★★★☆☆☆

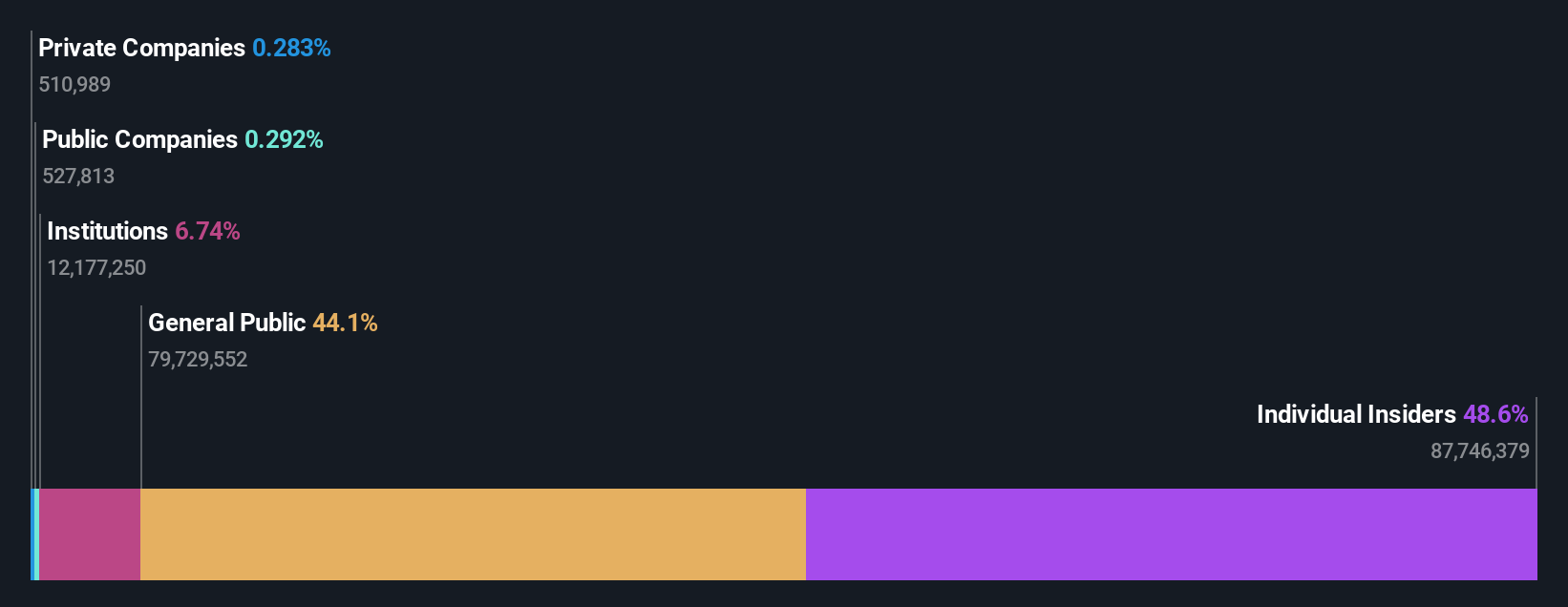

Overview: Mader Group specializes in providing staffing and outsourcing services, with a focus on the mining and civil industries, and has a market cap of A$1.16 billion.

Operations: Mader Group's primary revenue stream is from Staffing & Outsourcing Services, generating A$811.54 million. The company's gross profit margin has recently shown a decline to 19.11%. Operating expenses stand at A$81.25 million, with non-operating expenses recorded at A$21.68 million as of the latest period ending December 31, 2024.

PE: 23.6x

Mader Group, a prominent player in its industry, demonstrates potential for growth with earnings expected to rise by 13.48% annually. The company's reliance on external borrowing presents a higher risk profile, yet insider confidence is evident as they purchased 83,500 shares worth A$498,495 recently. This purchase indicates trust in the company's future prospects despite the funding risks. Mader's position in Asia's market highlights its potential for investors seeking opportunities within this segment.

- Unlock comprehensive insights into our analysis of Mader Group stock in this valuation report.

Understand Mader Group's track record by examining our Past report.

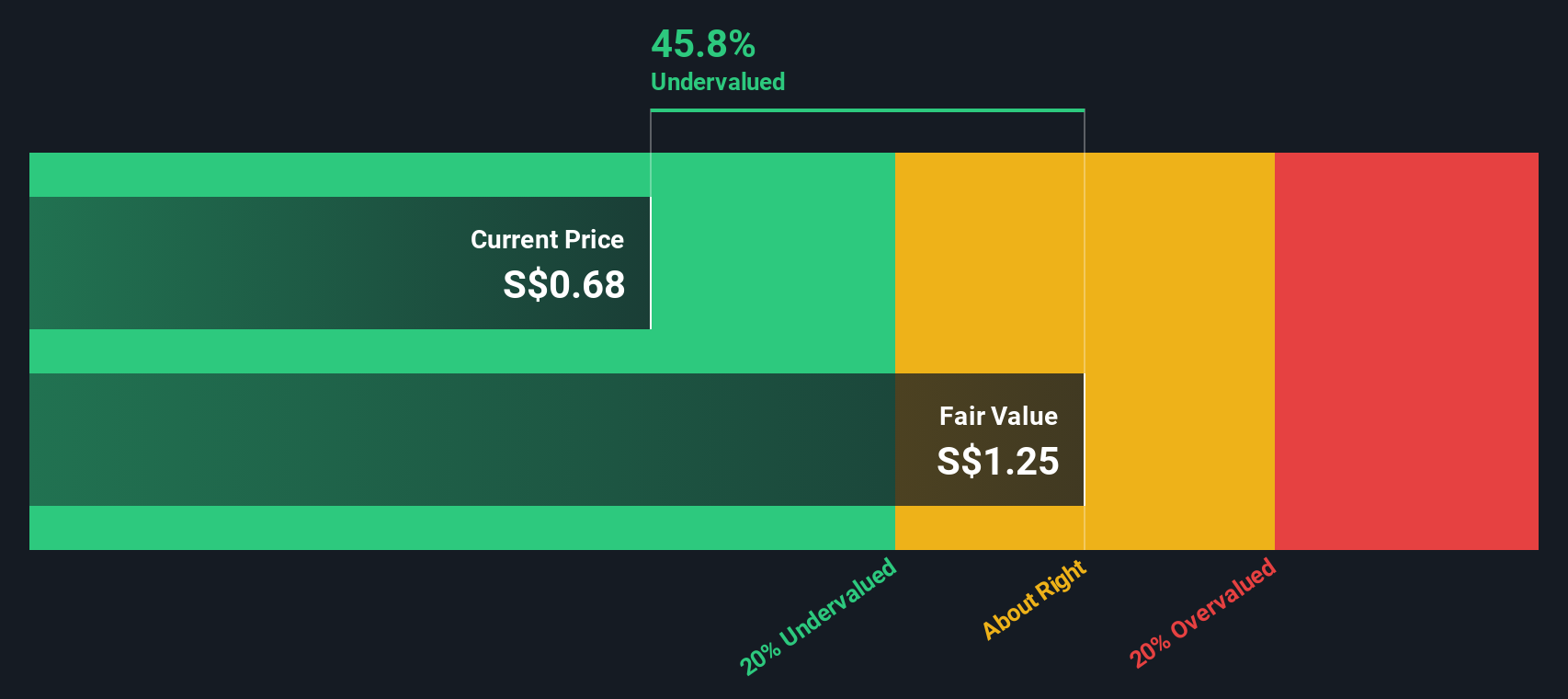

Riverstone Holdings (SGX:AP4)

Simply Wall St Value Rating: ★★★★★★

Overview: Riverstone Holdings is a company primarily engaged in the manufacturing of gloves, with additional operations in other sectors, and has a market capitalization of S$1.07 billion.

Operations: The primary revenue stream is derived from gloves, which accounts for MYR 1.06 billion. The gross profit margin has shown fluctuations, with a notable increase to 65.01% in June 2021 before declining to 34.84% by March 2025. Operating expenses have varied over the periods, impacting net income margins as they range from approximately 13% to nearly 48%.

PE: 12.3x

Riverstone Holdings, a smaller company in Asia's market landscape, has shown insider confidence with recent share purchases. Despite a dip in net income to MYR 56.43 million from MYR 72.19 million year-on-year for Q1 2025, sales rose slightly to MYR 252.27 million. The company declared an increased final dividend of RM0.08 per share for FY2024, reflecting a commitment to shareholder returns amidst steady revenue growth forecasts of 4.49% annually.

Seize The Opportunity

- Discover the full array of 67 Undervalued Asian Small Caps With Insider Buying right here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:MAD

Mader Group

A contracting company, provides specialist technical services in the mining, energy, and industrial sectors in Australia and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives