- Australia

- /

- Commercial Services

- /

- ASX:MAD

Three Undiscovered Gems in Australia with Promising Potential

Reviewed by Simply Wall St

As the Australian market navigates through mixed signals from global inflation data and sector-specific challenges, small-cap stocks continue to capture investor interest with IT leading gains amidst broader market declines. In this dynamic environment, identifying promising opportunities requires a keen eye for innovation and resilience, qualities that define the three undiscovered gems in Australia we're exploring today.

Top 10 Undiscovered Gems With Strong Fundamentals In Australia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Sugar Terminals | NA | 3.78% | 4.30% | ★★★★★★ |

| Schaffer | 25.47% | 6.03% | -5.20% | ★★★★★★ |

| Fiducian Group | NA | 9.97% | 7.85% | ★★★★★★ |

| Euroz Hartleys Group | NA | 5.92% | -17.96% | ★★★★★★ |

| Hearts and Minds Investments | NA | 47.09% | 49.82% | ★★★★★★ |

| Tribune Resources | NA | -10.33% | -48.18% | ★★★★★★ |

| Djerriwarrh Investments | 1.14% | 8.17% | 7.54% | ★★★★★★ |

| Red Hill Minerals | NA | 95.16% | 40.06% | ★★★★★★ |

| Lycopodium | 6.89% | 16.56% | 32.73% | ★★★★★☆ |

| K&S | 20.24% | 1.58% | 25.54% | ★★★★☆☆ |

We'll examine a selection from our screener results.

Cobram Estate Olives (ASX:CBO)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Cobram Estate Olives Limited is involved in olive farming and the production and marketing of olive oil across Australia, the United States, and internationally, with a market capitalization of A$1.02 billion.

Operations: Cobram Estate Olives generates revenue primarily from its US operations, contributing A$67.16 million, with a segment adjustment of A$177.91 million.

Cobram Estate Olives, a burgeoning player in the olive oil industry, is poised for significant growth with strategic expansions in the U.S. and Australia. The company plans to double its planted area in the U.S., enhancing production without hefty costs, while infrastructure projects like Boort mill upgrades promise increased capacity. Despite a high net debt to equity ratio of 78.3%, earnings surged by 104.8% last year, outpacing industry growth rates significantly. Analysts anticipate revenue growth of 18.8% annually over three years and profit margins rising from 8.9% to 10.4%, though financial losses and tax liabilities remain concerns for future profitability.

Mader Group (ASX:MAD)

Simply Wall St Value Rating: ★★★★★★

Overview: Mader Group Limited is a contracting company that offers specialist technical services across the mining, energy, and industrial sectors both in Australia and internationally, with a market capitalization of A$1.42 billion.

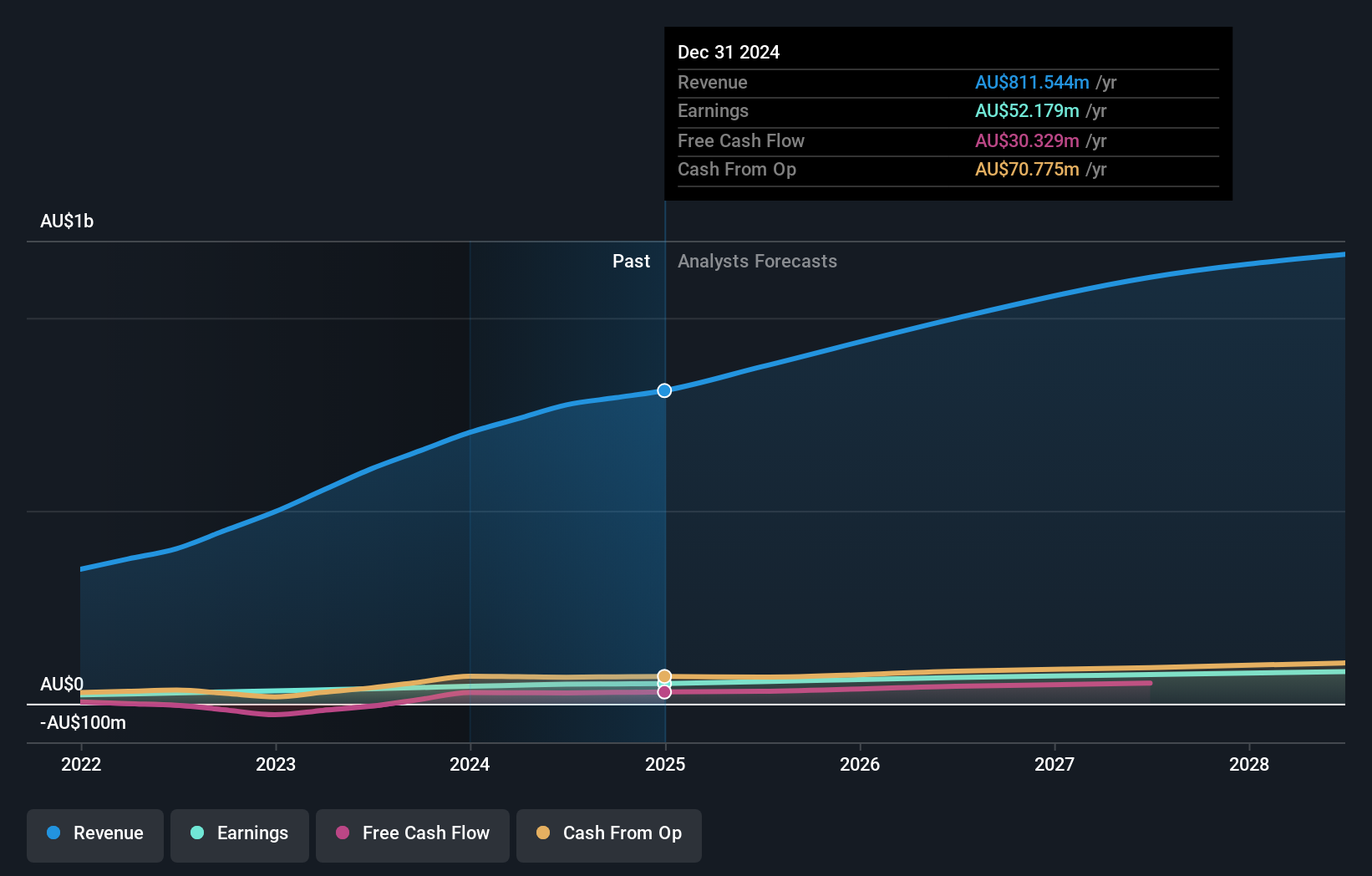

Operations: Mader Group generates revenue primarily from its Staffing & Outsourcing Services, amounting to A$811.54 million. The company's market capitalization stands at approximately A$1.42 billion.

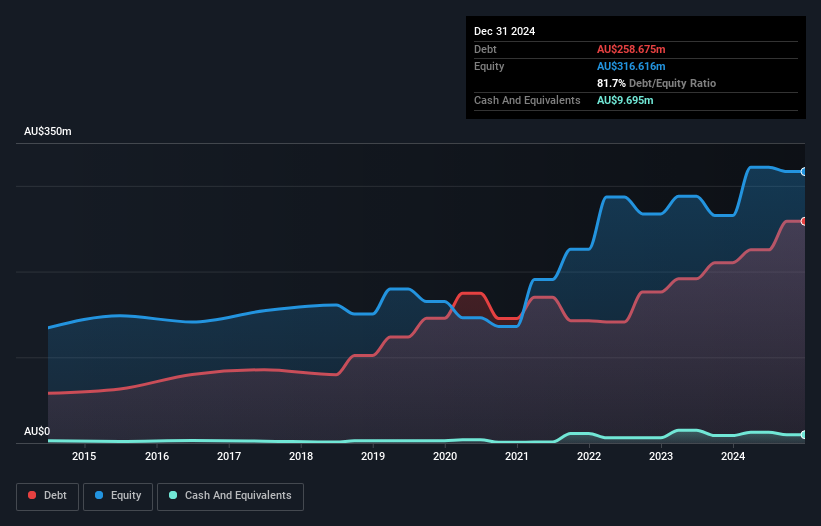

Mader Group, a nimble player in the contracting space, is making strides with its strategic expansion into energy and transport logistics. This move is likely to bolster its revenue streams beyond mining and industrial sectors. The company has high-quality earnings with a 15.5% growth last year, outpacing the industry average of 9.4%. Its debt management shines as well, reducing the debt to equity ratio from 84% to 23.5% over five years while maintaining satisfactory interest coverage at 20.5x EBIT. With shares trading at A$6.36, close to analysts' target of A$6.56, Mader's prospects appear promising amidst potential challenges like market instability and labor issues in Australia.

West African Resources (ASX:WAF)

Simply Wall St Value Rating: ★★★★★★

Overview: West African Resources Limited is involved in the mining, mineral processing, acquisition, exploration, and project development of gold projects in West Africa with a market capitalization of A$2.63 billion.

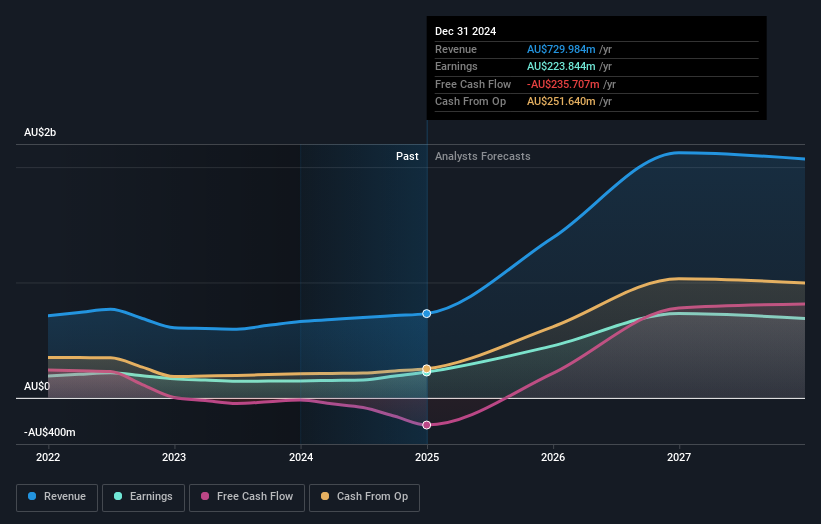

Operations: West African Resources generates revenue primarily from its mining operations, amounting to A$726.63 million. The company's financial performance is highlighted by a notable net profit margin trend, reflecting efficiency in its core activities.

West African Resources seems to be on a promising trajectory with its Kiaka project, which is over 80% complete and set to start gold production in Q3 2025. With an expected annual output of around 420,000 ounces, this development could significantly boost the company's revenue and efficiency. The firm has reduced its debt to equity ratio from 316.7% to a satisfactory 30.9% over five years, indicating improved financial health. Despite potential risks like regulatory changes in Burkina Faso and fluctuating gold prices, analysts forecast a robust annual revenue growth rate of 41.5%, with profit margins rising from 30.7% to 33.2%.

Make It Happen

- Get an in-depth perspective on all 49 ASX Undiscovered Gems With Strong Fundamentals by using our screener here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:MAD

Mader Group

A contracting company, provides specialist technical services in the mining, energy, and industrial sectors in Australia and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives