Last Update 23 Aug 25

Fair value Increased 20%Rising Water Costs Will Burden Australia And US Operations

The increase in Cobram Estate Olives’ net profit margin, while revenue growth forecasts remained stable, supports a higher consensus analyst price target, now raised from A$2.62 to A$2.77.

What's in the News

- Cobram Estate Olives' Board anticipates paying a fully franked dividend of 4.5 cents per share in late November 2025, up from 3.3 cents per share in the prior year.

Valuation Changes

Summary of Valuation Changes for Cobram Estate Olives

- The Consensus Analyst Price Target has risen from A$2.62 to A$2.77.

- The Net Profit Margin for Cobram Estate Olives has risen slightly from 11.60% to 12.12%.

- The Consensus Revenue Growth forecasts for Cobram Estate Olives remained effectively unchanged, moving only marginally from 20.4% per annum to 20.6% per annum.

Key Takeaways

- Near-term revenue growth may disappoint due to supply constraints and agricultural yield cycles, despite high market expectations driven by recent profit performance.

- Rising operational costs and heavy US expansion funding could pressure margins and cash flow, especially if global demand growth or product appeal falls short.

- Operational leverage from grove maturation, supply diversification, and automation upgrades position Cobram Estate for margin, earnings, and market share growth amid rising global demand for premium olive oil.

Catalysts

About Cobram Estate Olives- Engages in olive farming and the production and marketing of olive oil in Australia, the United States, and internationally.

- The market appears to be factoring in outsized, uninterrupted long-term revenue growth based on rising global demand for healthy oils and increased adoption of olive oil in the US and Asia-Pacific; however, current operational constraints (notably limited short-term supply growth in both Australia and the US while new groves mature) mean near-term revenues are likely to be flat or only modestly higher, creating a disconnect between expectations and upcoming sales results.

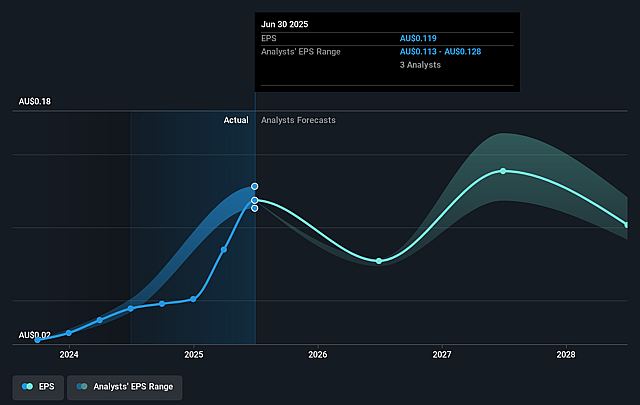

- Share price strength appears linked to the company's recent record profit and operating cash flow, but these were driven in large part by a cyclical high harvest year (on-year) in Australia, which isn't expected to repeat in FY26; over-optimism in the current valuation risks underestimating revenue and earnings volatility from agricultural yield cycles and seasonality.

- Operational cost headwinds from rising water prices-especially in Australia, where temporary water costs are already tracking above last year and every $100/ML increase means ~$4 million in extra expenses-threaten to erode net margins if price increases or cost efficiencies can't fully offset these pressures as climatic variability continues.

- The transition from aggressive Australian growth CapEx to heavy US capital deployment, with persistent high capital requirements for land, planting, and mill expansion, could pressure free cash flow and increase leverage over the next several years, potentially limiting earnings growth if US scaling or demand does not materialize as optimistically projected.

- The valuation might also be reflecting an assumption that Cobram Estate is largely insulated from broader shifts in consumer preferences towards novel plant-based fats and superfoods; should these secular headwinds accelerate, product differentiation and premium pricing power could erode, impacting both revenue growth and long-term margin trajectory.

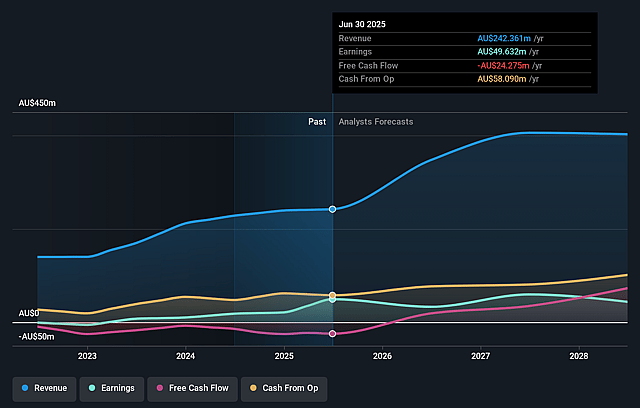

Cobram Estate Olives Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Cobram Estate Olives's revenue will grow by 18.4% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 20.5% today to 10.9% in 3 years time.

- Analysts expect earnings to reach A$43.9 million (and earnings per share of A$0.1) by about September 2028, down from A$49.6 million today. However, there is some disagreement amongst the analysts with the more bullish ones expecting earnings as high as A$50.5 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 36.1x on those 2028 earnings, up from 27.0x today. This future PE is greater than the current PE for the AU Food industry at 14.6x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.48%, as per the Simply Wall St company report.

Cobram Estate Olives Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Ongoing maturation of Cobram Estate's Australian and U.S. groves is set to significantly increase production capacity over the next 5–7 years, leveraging largely fixed production costs; this drives strong operating leverage and has the potential to materially expand gross margins and long-term earnings.

- The company's proven ability to achieve double-digit branded sales growth in both Australia and the U.S.-with U.S. branded sales more than doubling year-over-year and further U.S. market share gains possible-suggests resilient topline growth and revenue expansion even in the face of short-term supply constraints.

- Substantial investments in vertically integrated infrastructure and automation (e.g., mill and bottling upgrades, warehouse robotics) have already translated into record operating cash flow growth (39% CAGR over 5 years), enhancing operational efficiency and supporting free cash flow and sustainable dividend payments.

- Global secular trends favoring premium, natural, and health-focused food products-alongside heightened demand for transparent and sustainably produced olive oil-strongly align with Cobram Estate's brand positioning and integrated supply chain, underpinning future revenue resilience and pricing power.

- Diversification of olive oil supply away from climate-challenged Mediterranean regions-coupled with supply constraints in Spain and continued high global olive oil prices-positions Cobram's Australian and U.S. operations to capture market share and premium pricing, further supporting revenue, margin, and earnings stability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of A$3.14 for Cobram Estate Olives based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be A$402.7 million, earnings will come to A$43.9 million, and it would be trading on a PE ratio of 36.1x, assuming you use a discount rate of 6.5%.

- Given the current share price of A$3.2, the analyst price target of A$3.14 is 1.9% lower. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.