Key Takeaways

- Rising input costs and climate-driven resource scarcity threaten margins, while aggressive U.S. expansion increases leverage and risks lower free cash flow.

- Heightened competition from alternative oils, industry disruption, and overreliance on key markets may hamper demand growth and expose Cobram to volatile earnings.

- Reduced capital spending, rising production efficiency, premium positioning, and strong supply ties are set to drive sustainable revenue and margin growth while resisting supply disruptions.

Catalysts

About Cobram Estate Olives- Engages in olive farming and the production and marketing of olive oil in Australia, the United States, and internationally.

- Intensifying resource scarcity-especially water-due to climate change is driving up input costs and disrupting olive yields, with every $100 per megaliter increase in water prices impacting Cobram Estate Olives by approximately $4 million, leading to potential long-term margin pressure and earnings volatility as climate risks increase.

- While global health trends have historically benefited olive oil, rising competition from alternative plant-based oils like avocado and consumer shifts toward diversified dietary fats threaten to decelerate demand growth for traditional olive oil, which could limit revenue expansion well below the optimistic forecasts currently baked into the valuation.

- The company's rapid U.S. expansion and aggressive orchard development involve substantial ongoing capital requirements, evidenced by over $250 million spent in recent years and new U.S. land commitments; this heavy capex and higher leverage heighten the risk of lower free cash flow, increased debt servicing, and potential earnings dilution, especially if underlying sales growth fails to meet projections.

- Cobram's increasing reliance on a few key international markets, particularly the U.S., leaves it exposed to shifts in food import policies, regulatory barriers, or consumer preference changes; such concentration may amplify revenue volatility and potentially result in disproportionately negative impacts to group sales figures.

- Ongoing industry consolidation and the risk of technological disruption from lower-cost, novel oil production methods threaten to erode Cobram Estate Olives' long-term market share and pricing power, putting downward pressure on future operating margins and return on invested capital.

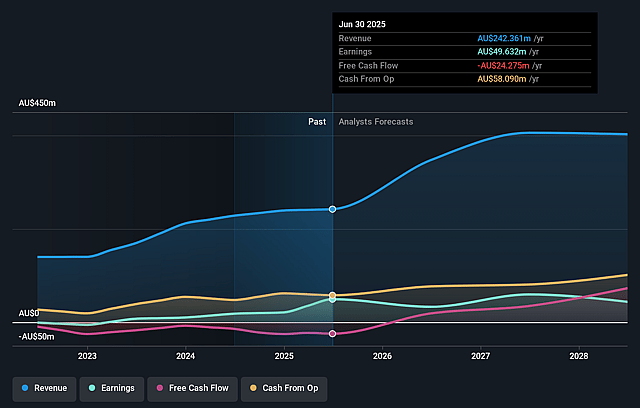

Cobram Estate Olives Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Cobram Estate Olives compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Cobram Estate Olives's revenue will grow by 15.2% annually over the next 3 years.

- The bearish analysts assume that profit margins will shrink from 20.5% today to 11.0% in 3 years time.

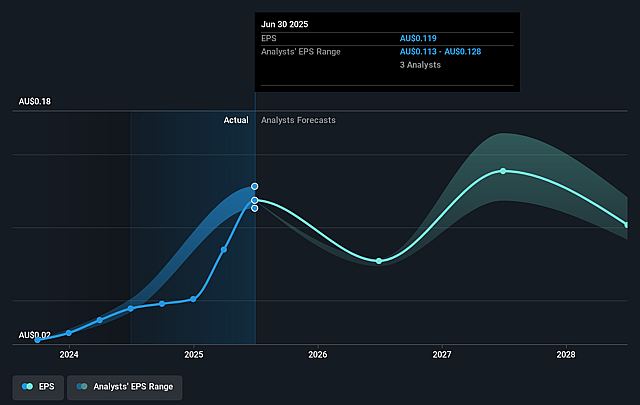

- The bearish analysts expect earnings to reach A$40.5 million (and earnings per share of A$0.09) by about September 2028, down from A$49.6 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 36.1x on those 2028 earnings, up from 27.0x today. This future PE is greater than the current PE for the AU Food industry at 14.2x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.48%, as per the Simply Wall St company report.

Cobram Estate Olives Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company is transitioning from a high growth capital expenditure phase in Australia to a sustaining CapEx model, which will significantly reduce capital outflows while production volumes are set to rise as a greater proportion of olive groves reach maturity, supporting future revenue and margin growth.

- There is a strong long-term demand trend for high-quality, locally produced extra virgin olive oil in both Australia and the US, highlighted by recent double-digit sales growth and rising brand strength, providing a solid foundation for continued revenue expansion and pricing power.

- The large pipeline of maturing and newly planted groves in both Australia and the US is expected to drive substantial organic volume growth over the coming years, enabling improved efficiency through greater economies of scale and higher profitability as fixed costs are leveraged.

- Technological investments in automation, processing, and sustainable practices are expected to drive cost efficiencies and operational margin improvements, which, coupled with a successful premiumization strategy, should support net margin enhancement.

- The company's vertical integration, robust supply chain, and strong relationships with supermarkets and third-party growers position it to capture additional market share and insulate against supply shocks, which could support resilient earnings and cash flow performance over the long term.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Cobram Estate Olives is A$2.9, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Cobram Estate Olives's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of A$3.3, and the most bearish reporting a price target of just A$2.9.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be A$370.1 million, earnings will come to A$40.5 million, and it would be trading on a PE ratio of 36.1x, assuming you use a discount rate of 6.5%.

- Given the current share price of A$3.2, the bearish analyst price target of A$2.9 is 10.3% lower.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.