Key Takeaways

- U.S. expansion and automation are set to drive significant production growth, strengthened profitability, and substantial free cash flow improvements for Cobram Estate Olives.

- Health trends, climate resilience, and sustainability focus position Cobram Estate as a premium, high-margin leader in global olive oil markets.

- Sustained demand, completed major investments, organic growth potential, premium brand strength, and operational efficiencies position the company for ongoing margin expansion and volume-driven earnings growth.

Catalysts

About Cobram Estate Olives- Engages in olive farming and the production and marketing of olive oil in Australia, the United States, and internationally.

- Analysts broadly agree U.S. land acquisition and plantings will double production, but current planting schedules and ongoing property acquisitions could lead to more than an 11x increase in U.S. supply within the decade, potentially allowing Cobram Estate to become the top-selling olive oil brand produced in the U.S. and fueling sustained, above-consensus revenue growth.

- Analyst consensus expects a lift in margins as groves mature, yet the transition to a sustaining CapEx regime in Australia and the highly automated, efficiency-driven processing infrastructure signal an even more substantial, long-term step change in profitability and free cash flow as higher yields flow through at minimal incremental cost, dramatically expanding net margins.

- Global health trends are accelerating consumption of extra virgin olive oil at a faster pace than forecast, and Cobram's healthcare professional programs and focus on health-based marketing position the firm to disproportionately capture share in premium and mainstream segments, delivering robust branded sales and margin expansion.

- Cobram's vertically integrated structure and sustainability leadership are likely to be increasingly rewarded with premium shelf space and pricing power as key retailers and consumers demand traceability and low-carbon supply, supporting premium revenue streams and industry-leading profit margins.

- With climate volatility curbing Mediterranean supply and Cobram's Australian groves demonstrating greater climate and water resilience, Cobram is positioned to be the supply-of-last-resort for global and Asian buyers, underpinning superior long-term volume growth, pricing power, and earnings visibility.

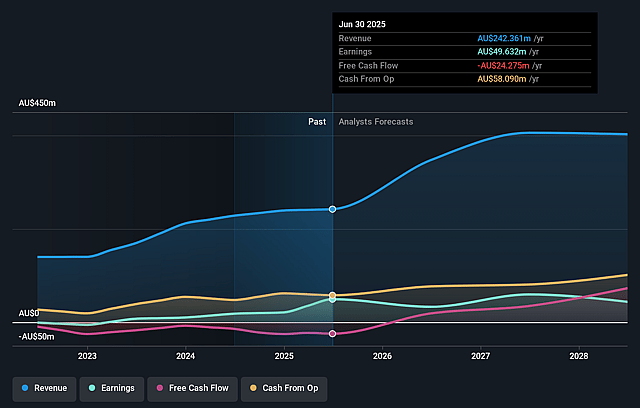

Cobram Estate Olives Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Cobram Estate Olives compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Cobram Estate Olives's revenue will grow by 22.1% annually over the next 3 years.

- The bullish analysts assume that profit margins will shrink from 20.5% today to 10.0% in 3 years time.

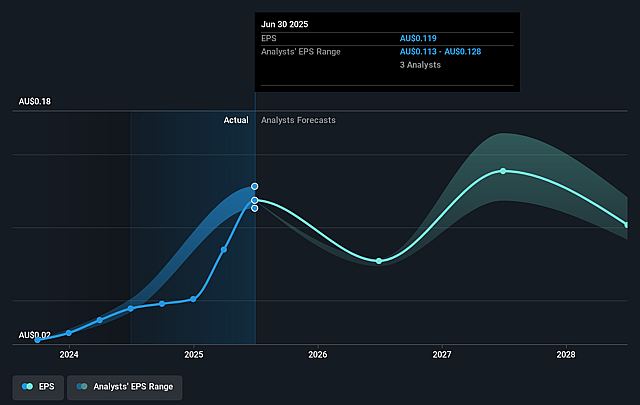

- The bullish analysts expect earnings to reach A$44.0 million (and earnings per share of A$0.09) by about September 2028, down from A$49.6 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 39.4x on those 2028 earnings, up from 28.2x today. This future PE is greater than the current PE for the AU Food industry at 13.6x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.48%, as per the Simply Wall St company report.

Cobram Estate Olives Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Persistent strong demand for premium, locally produced extra virgin olive oil continues in both Australia and the USA, which has driven double-digit sales growth and record operating cash flow, making long-term revenue decline less likely.

- Major production and capital investments are largely complete in Australia, shifting to a lower, sustaining capital expenditure program from fiscal year 2026, which is likely to improve free cash flow and reduce pressure on net margins compared to prior years of heavy development spend.

- The company's olive groves in both Australia and the USA have significant embedded organic growth, with a large proportion of younger trees set to mature over the next 5 to 8 years, which will expand production capacity and drive volume growth, positively impacting earnings.

- Cobram Estate has strengthened its position as a differentiated premium brand, with growing supermarket distribution in the USA and strong brand loyalty in both key markets, which may support higher average selling prices, protect margins, and limit the impact of price-based competition.

- Recent upgrades in bottling, automation, and milling infrastructure are designed to deliver greater economies of scale and operational efficiencies as volumes increase, further supporting cost management and future net profit margin expansion.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Cobram Estate Olives is A$3.44, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Cobram Estate Olives's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of A$3.44, and the most bearish reporting a price target of just A$2.9.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be A$441.3 million, earnings will come to A$44.0 million, and it would be trading on a PE ratio of 39.4x, assuming you use a discount rate of 6.5%.

- Given the current share price of A$3.34, the bullish analyst price target of A$3.44 is 2.9% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.