- Australia

- /

- Specialty Stores

- /

- ASX:APE

Insider Buying Highlights 3 Top Undervalued Small Caps In Australia

Reviewed by Simply Wall St

The Australian market has seen a flat performance over the past week, yet it has achieved a notable 15% rise over the last year, with earnings projected to grow by 12% annually. In this context, identifying stocks that are potentially undervalued and have insider buying can be key indicators of promising opportunities for investors seeking to navigate these market conditions.

Top 10 Undervalued Small Caps With Insider Buying In Australia

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| GWA Group | 16.9x | 1.6x | 40.20% | ★★★★★☆ |

| SHAPE Australia | 14.3x | 0.3x | 33.88% | ★★★★☆☆ |

| Collins Foods | 18.1x | 0.7x | 7.76% | ★★★★☆☆ |

| Centuria Capital Group | 22.9x | 5.1x | 42.65% | ★★★★☆☆ |

| Bapcor | NA | 0.9x | 43.77% | ★★★★☆☆ |

| Eagers Automotive | 11.2x | 0.3x | 36.66% | ★★★★☆☆ |

| Tabcorp Holdings | NA | 0.5x | 18.59% | ★★★★☆☆ |

| Dicker Data | 21.2x | 0.8x | -74.36% | ★★★☆☆☆ |

| Coventry Group | 237.0x | 0.4x | -17.06% | ★★★☆☆☆ |

| Corporate Travel Management | 21.7x | 2.6x | -1.99% | ★★★☆☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Eagers Automotive (ASX:APE)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Eagers Automotive is a leading automotive retail group in Australia, primarily engaged in car retailing operations, with a market cap of A$3.69 billion.

Operations: Car Retailing generates the majority of revenue at A$10.50 billion, with gross profit margins showing a varied trend, peaking at 19.13% in mid-2022 before declining to 18.17% by mid-2024. Operating expenses have consistently increased over time, impacting net income margins which reached as high as 3.75% in late 2021 but later decreased to around 2.47% by mid-2024. The company experienced a significant turnaround in net income from negative figures during early 2019 and into early 2020, moving to positive earnings thereafter despite fluctuations in non-operating expenses and depreciation costs over the years.

PE: 11.2x

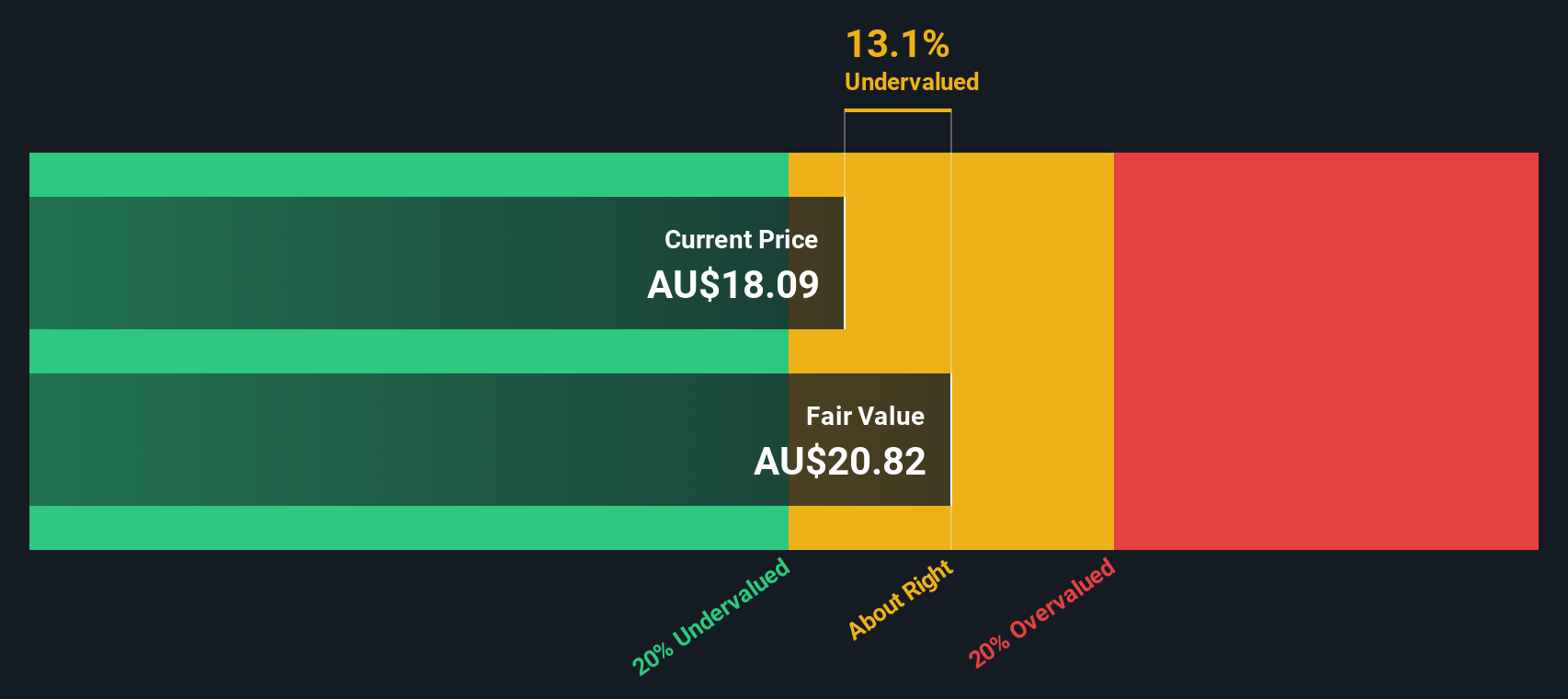

Eagers Automotive, a prominent player in Australia's automotive industry, showcases potential as an undervalued investment. Despite a dip in net income to A$116 million for the first half of 2024, sales rose to A$5.46 billion from the previous year. Insider confidence is evident with Nicholas Politis acquiring 200,000 shares worth approximately A$2.09 million recently. While debt coverage by operating cash flow remains challenging due to reliance on external borrowing, ongoing dividend payouts reflect financial stability and commitment to shareholders.

- Unlock comprehensive insights into our analysis of Eagers Automotive stock in this valuation report.

Mader Group (ASX:MAD)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Mader Group provides staffing and outsourcing services, with a market capitalization of A$1.03 billion.

Operations: The company generates revenue primarily from Staffing & Outsourcing Services, with the most recent figure at A$774.47 million. Gross profit margin has shown an interesting trend, peaking at 22.91% in December 2023 before decreasing to 20.92% by June 2024 and remaining consistent through October 2024. Operating expenses have been significant, with general and administrative expenses being a major component, reaching A$87.06 million in June and October 2024 respectively.

PE: 21.4x

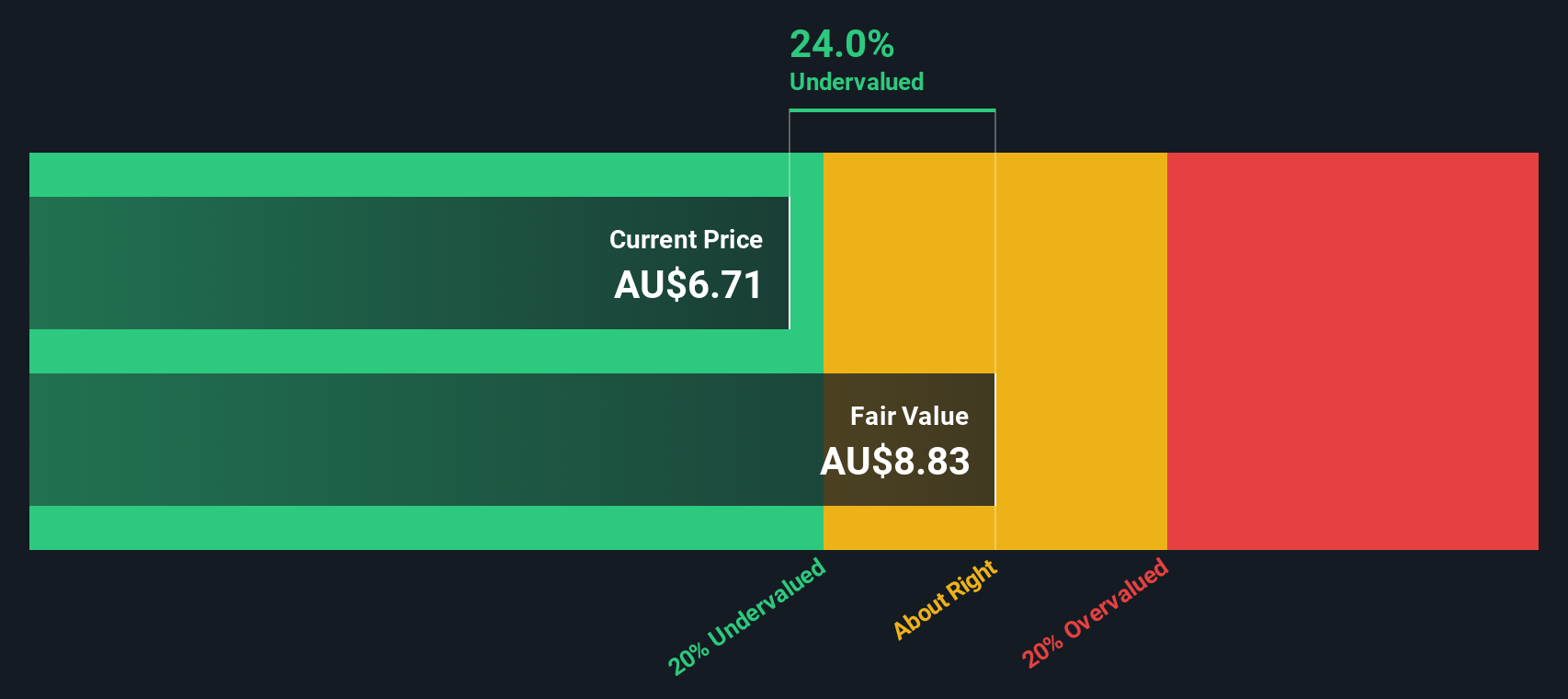

Mader Group, recently added to the S&P Global BMI Index, showcases insider confidence with share purchases over the past year. Reporting A$774 million in fiscal 2024 sales and a net income of A$50 million, they anticipate revenue growth to at least A$870 million in fiscal 2025. Despite relying on external borrowing for funding, Mader's earnings are set to grow by 13% annually. The company increased dividends by 34%, reflecting strong financial health and potential for future expansion.

- Dive into the specifics of Mader Group here with our thorough valuation report.

Explore historical data to track Mader Group's performance over time in our Past section.

Magellan Financial Group (ASX:MFG)

Simply Wall St Value Rating: ★★★★★☆

Overview: Magellan Financial Group is an Australian-based investment management firm specializing in global equities and infrastructure strategies, with a market capitalization of approximately A$4.5 billion.

Operations: Magellan Financial Group generates revenue primarily from investment management services, fund investments, and corporate activities. The company's cost of goods sold (COGS) significantly impacts its gross profit, with a recent gross profit margin at 80.78%. Operating expenses include general and administrative costs and sales & marketing expenses. Net income margins have shown variability over time, reflecting changes in non-operating expenses and other financial factors.

PE: 7.8x

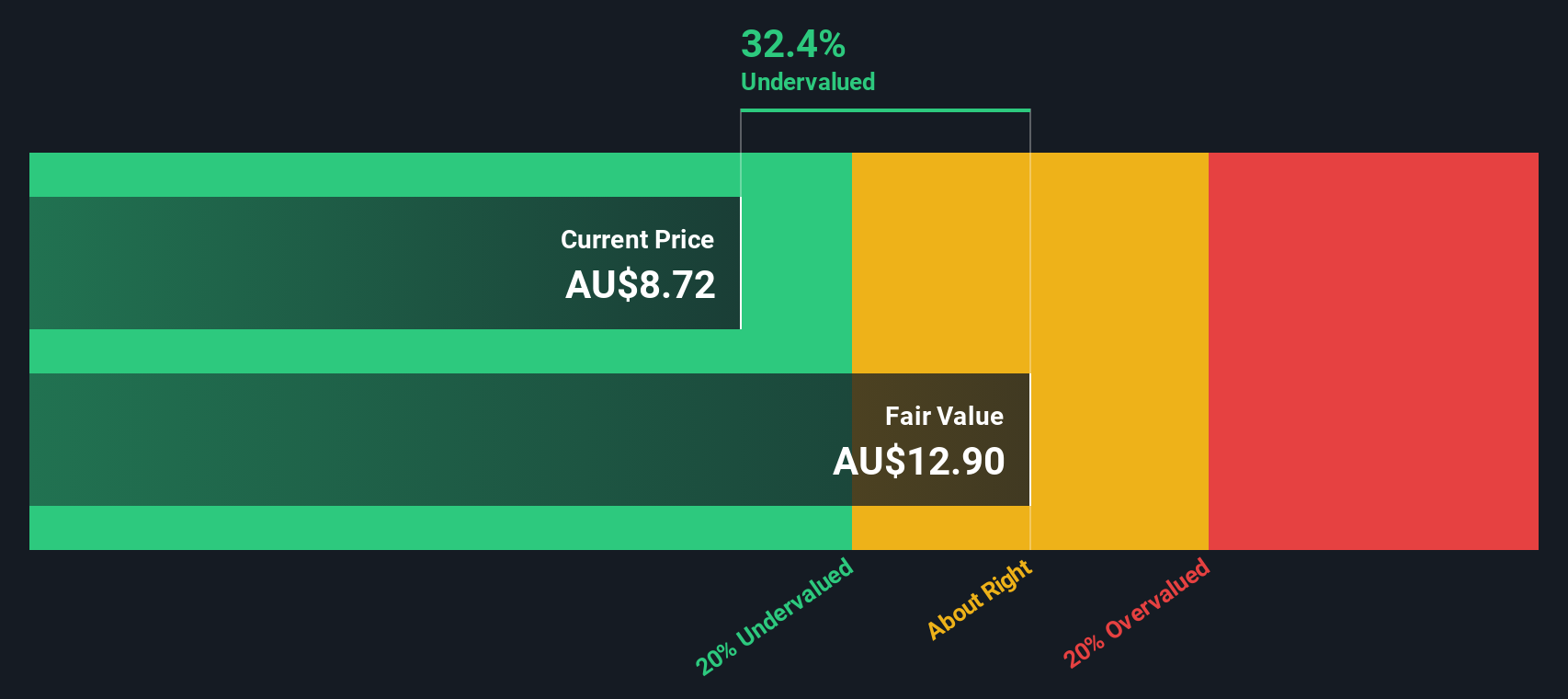

Magellan Financial Group, a smaller player in Australia's financial sector, has shown mixed signals recently. The company reported A$378.63 million in revenue for the year ending June 2024, down from A$431.65 million previously, yet net income rose to A$238.76 million from A$182.66 million due to increased operational efficiency. They completed a share repurchase of 2.69%, spending A$52.47 million since March 2022, indicating strategic confidence despite forecasts of declining earnings by 9% annually over three years and reliance on higher-risk external borrowing for funding needs.

Taking Advantage

- Click this link to deep-dive into the 24 companies within our Undervalued ASX Small Caps With Insider Buying screener.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Eagers Automotive might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:APE

Eagers Automotive

Owns and operates motor vehicle dealerships in Australia and New Zealand.

Reasonable growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives